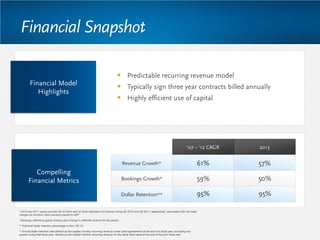

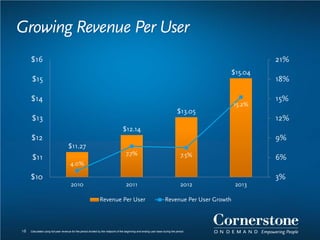

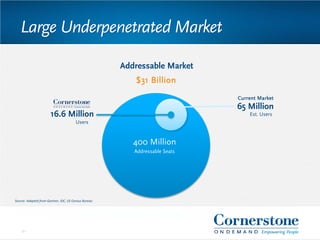

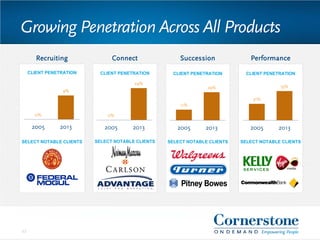

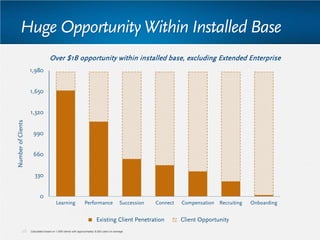

This investor presentation summarizes Cornerstone OnDemand's financial performance and growth strategy to reach $1 billion in revenue. It discusses Cornerstone's established market leadership in talent management software, strong financial results with recurring revenue and high retention rates, and two paths to reach $1 billion by either increasing their market breadth through global expansion and new clients, or increasing client penetration of their existing product suite within the large installed base. The presentation outlines Cornerstone's organic growth, competitive differentiation, and recent acquisition of Evolv to enhance analytics capabilities and accelerate their workforce planning strategy.