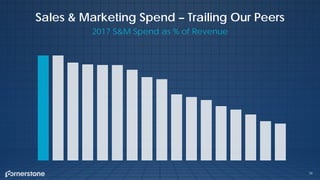

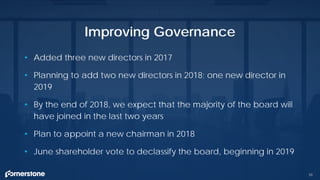

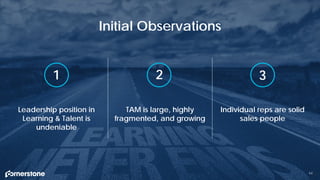

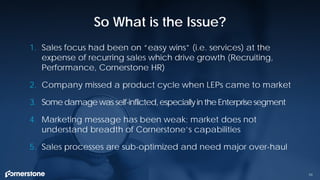

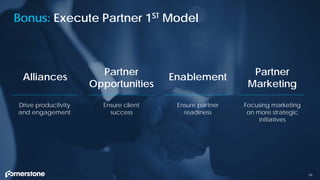

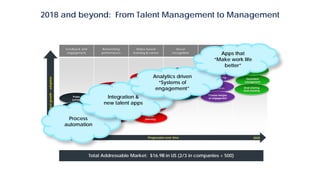

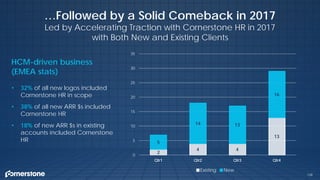

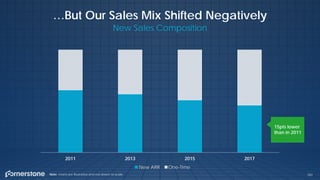

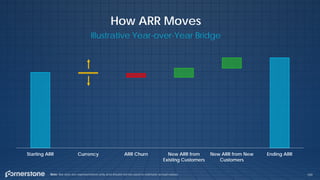

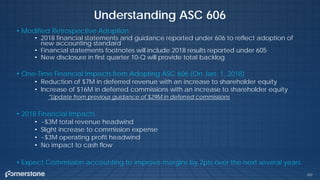

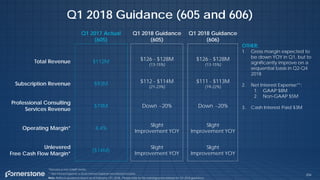

The document outlines an agenda for a Cornerstone Financial Analyst & Investor Day event. The agenda includes presentations on Cornerstone's business overview, opportunities in various markets and business units, financial review, and Q&A. It also includes forward-looking statements and risk factors. Jeff Lautenbach then summarizes Cornerstone's strategic plan to improve sales focus on recurring revenue, operating margins, new recurring revenue streams, leadership team, and governance. The plan aims to address past issues and drive growth.

![17

Using Cornerstone, we’ve since seen a 53%

increase in [employee] movement between

Hyatt brands. Employees feel like they have

even more options from a career standpoint.

“

”Randy Goldberg,

Vice President , Talent Management](https://image.slidesharecdn.com/analyst-day-deck-final-180402165832/85/Analyst-day-deck-final-17-320.jpg)