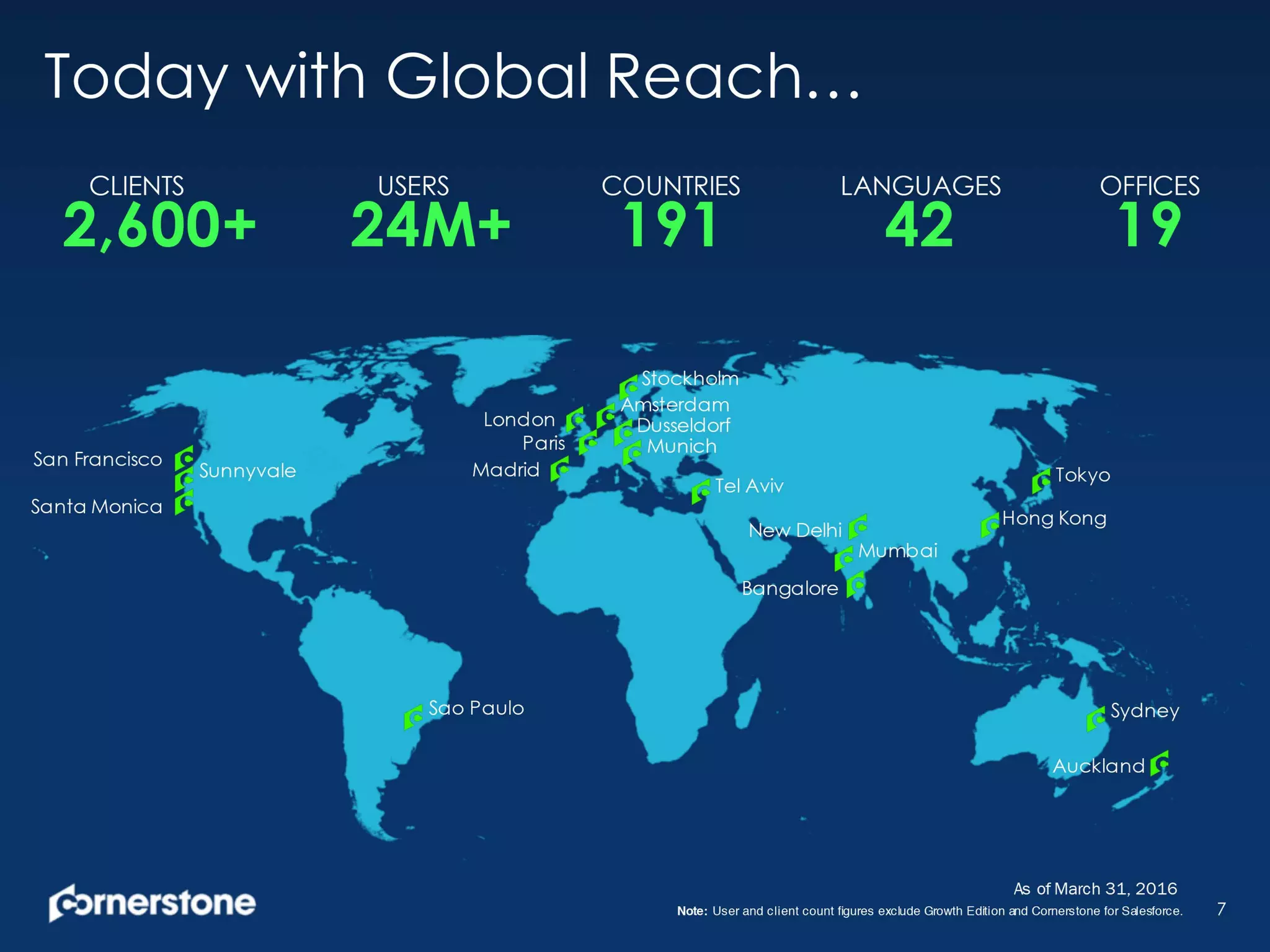

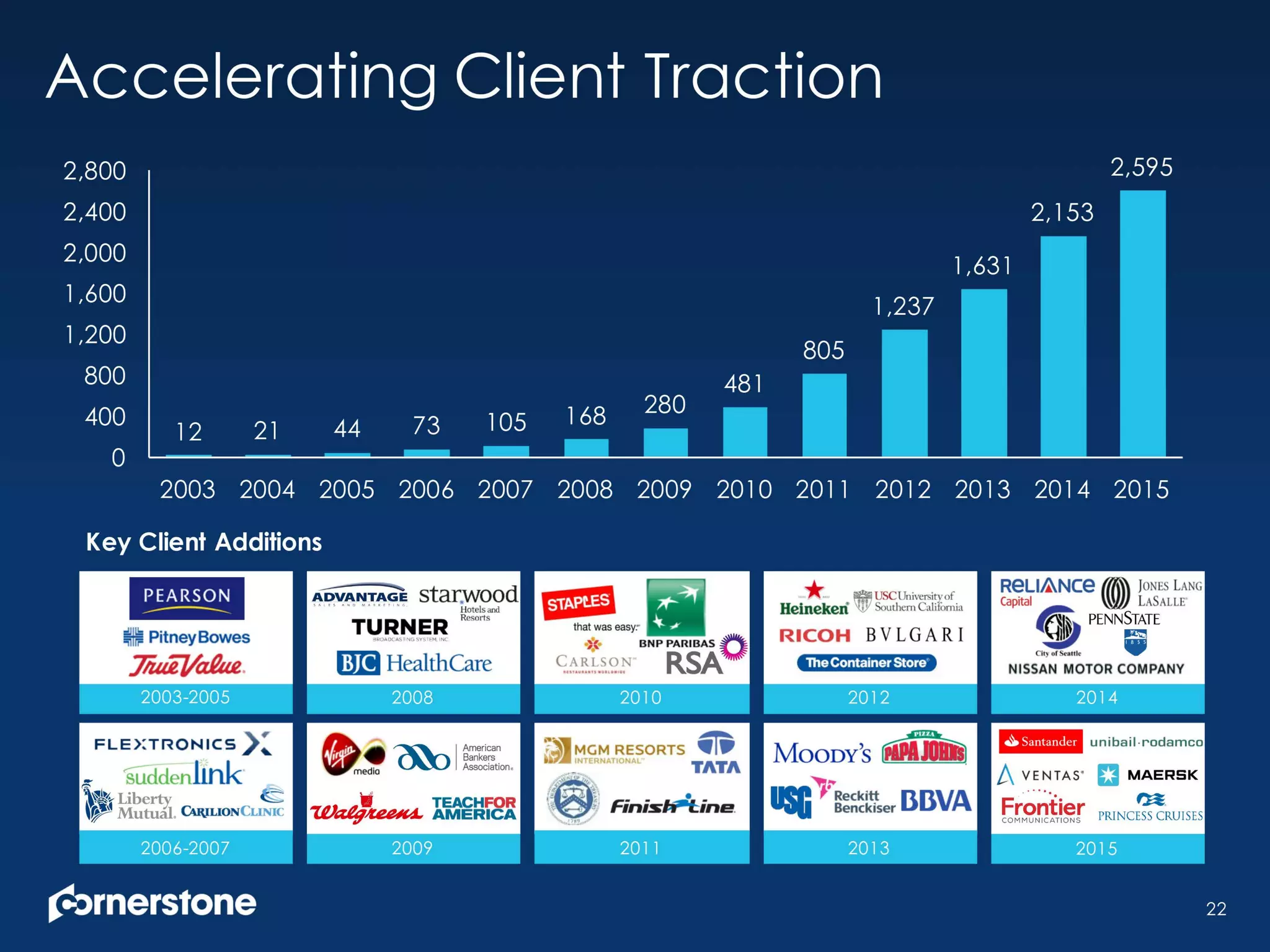

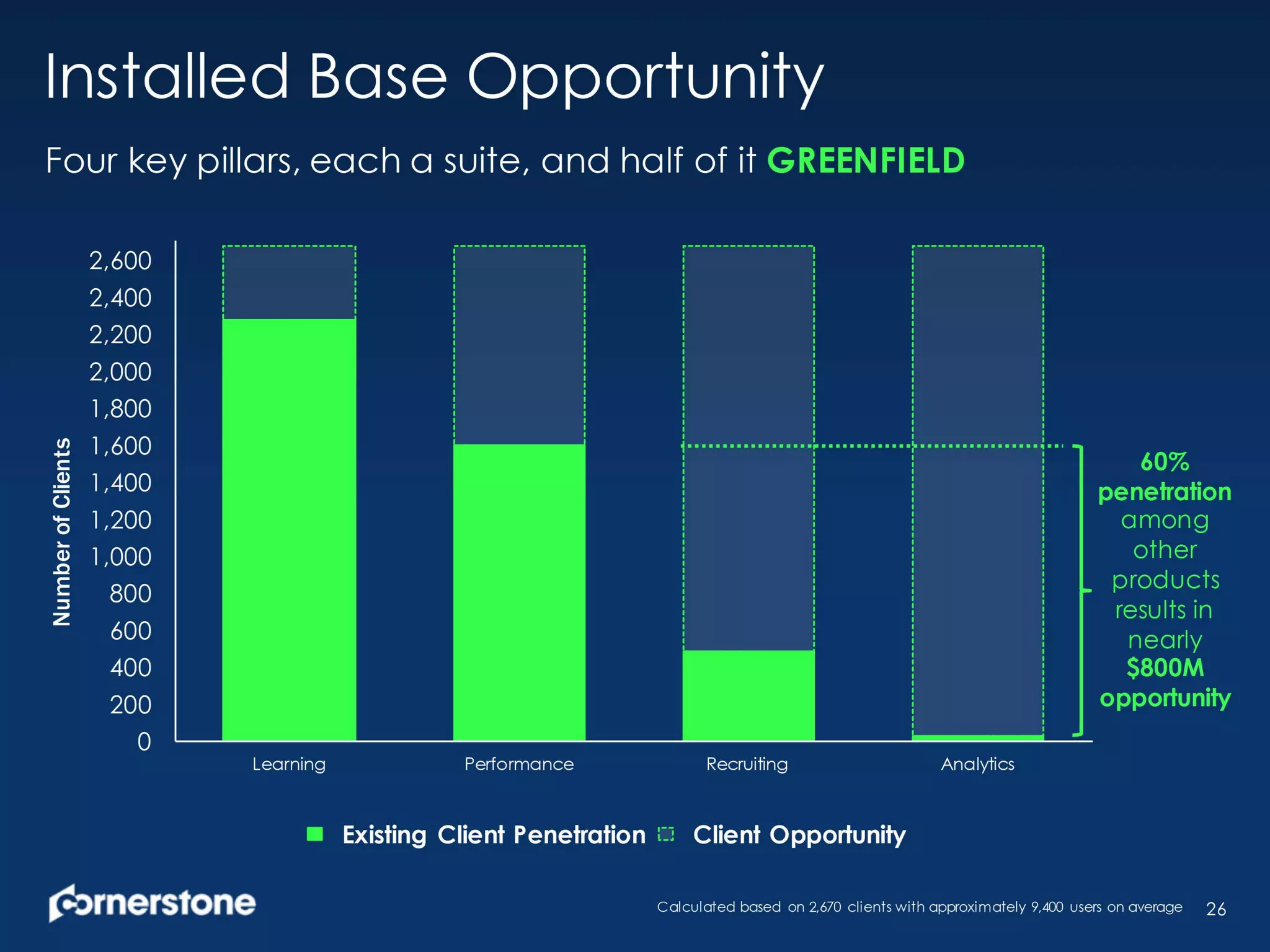

Cornerstone provides a corporate overview and highlights of its second quarter 2016 performance. It discusses its evolution over the past 16 years from 4 employees to over 2,500 clients and 25 million users today. Cornerstone also outlines its strong financial results with continued growth in revenue, bookings, clients, and users. It shares its vision and strategy to achieve $1 billion in revenue by continuing its leadership in the talent management market and pursuing opportunities in new industries, geographies, market segments, and with its large installed base.