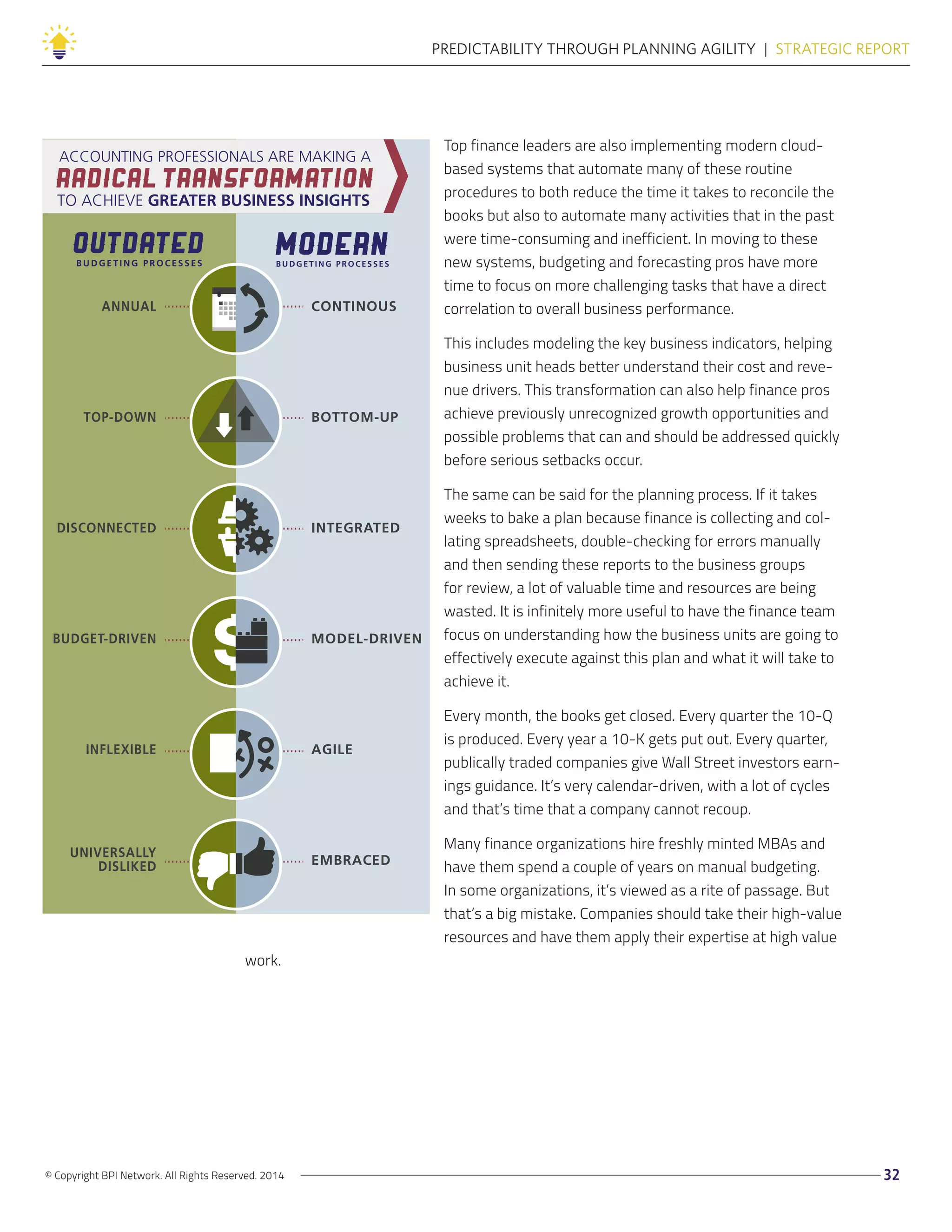

This strategic report discusses the increasing complexity and global nature of business environments, emphasizing the need for finance professionals to adapt their processes to enhance predictability and agility in budgeting and forecasting. It advocates for the adoption of modern financial management systems over traditional methods, highlighting the benefits of cloud-based solutions that facilitate rapid updates and data integration. Ultimately, the report underscores that effective forecasting and flexible processes are essential for enabling companies to respond swiftly to market changes and drive sustainable growth.