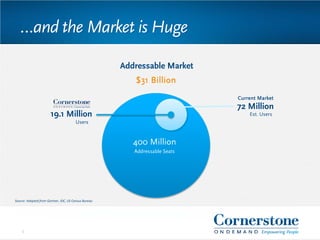

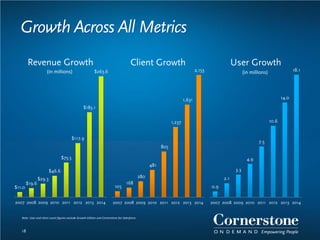

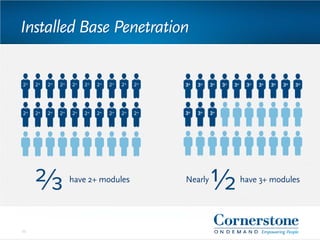

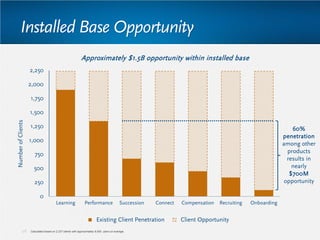

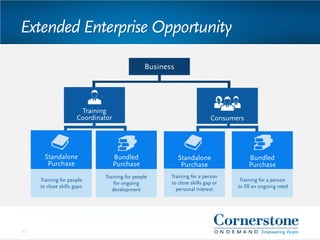

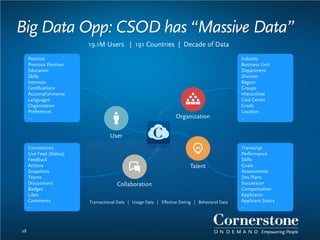

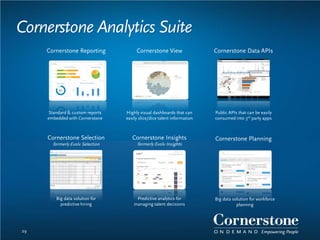

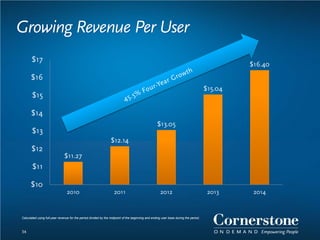

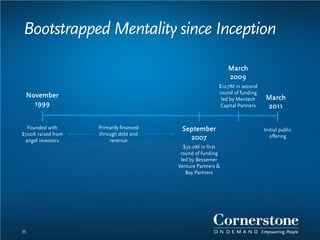

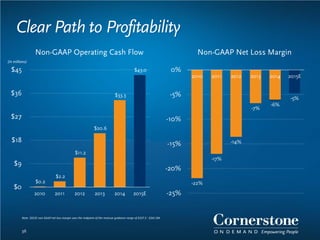

Cornerstone provides a corporate overview and highlights for the second quarter of 2015. It discusses its evolution over the past 15 years from a smaller company focused on learning into a global leader in talent management solutions. Cornerstone has a large addressable market opportunity of over $31 billion given the changing nature of work. It has achieved strong growth across key metrics like revenue, clients, and users in recent years through organic growth and strategic acquisitions. Cornerstone is well positioned for continued growth by leveraging opportunities in new market segments, industries, its installed base, and emerging technologies like big data and its platform. It is focused on achieving profitability and has a clear path to do so given its strong momentum, revenue per user growth,