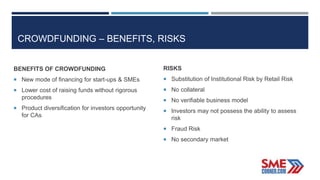

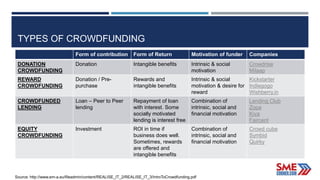

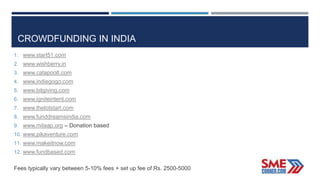

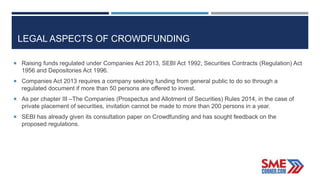

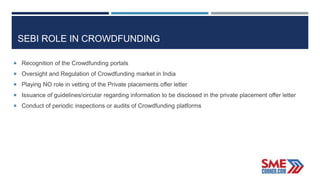

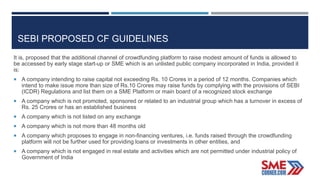

The document discusses the concept of crowdfunding, its working mechanisms, benefits, risks, and its regulatory landscape in India. It highlights the rise of crowdfunding as a viable funding option for start-ups and SMEs, outlining the proposed guidelines by SEBI to regulate the crowdfunding market. Additionally, it notes the rapid growth of the crowdfunding industry and its potential in the Indian market, emphasizing regulatory requirements for companies seeking to raise funds through this method.