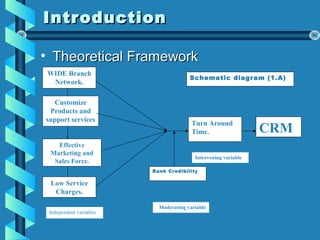

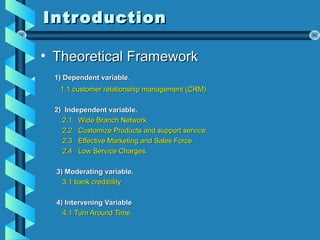

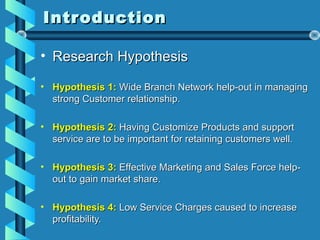

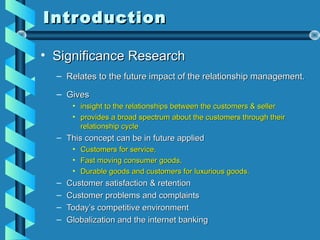

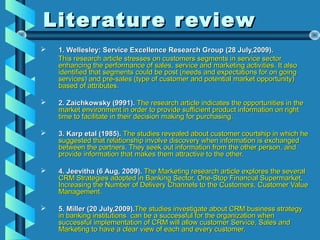

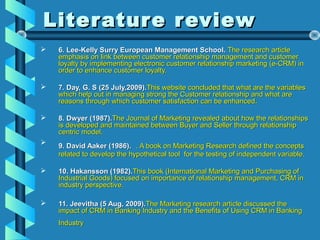

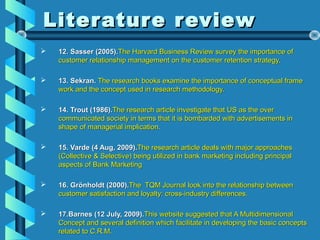

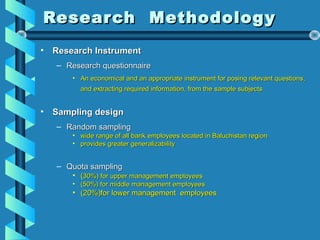

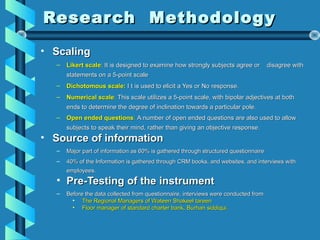

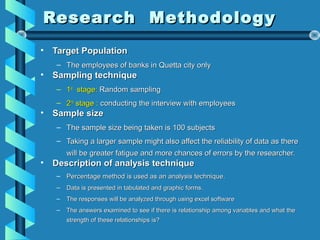

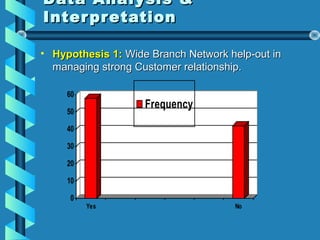

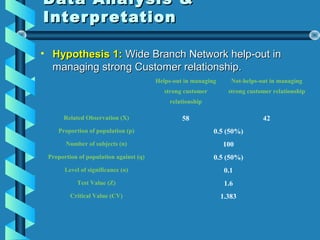

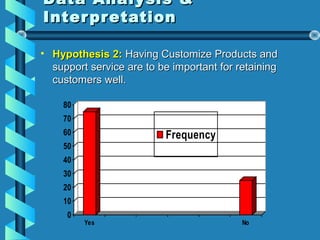

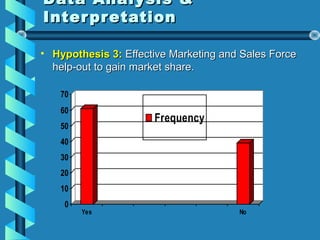

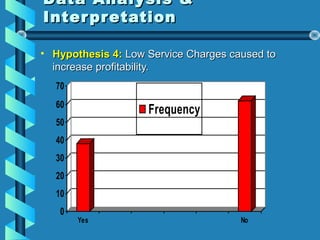

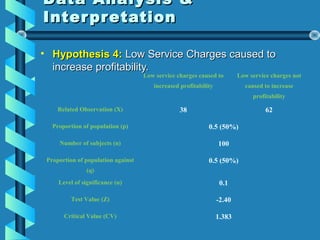

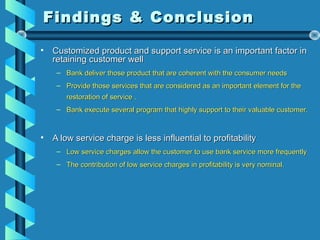

This document discusses customer relationship management (CRM) and its importance for banking industry survival. It begins with an introduction in the name of Allah and provides key objectives for the research. The introduction discusses the background and problem statement, highlighting how customers are essential for business survival. It presents a theoretical framework and discusses hypotheses regarding how wide branch networks, customized products/services, effective marketing, and low service charges can help manage customer relationships. The research methodology discusses tools like questionnaires, sampling techniques, and data analysis that will be used. Finally, the literature review summarizes several research articles and studies related to CRM strategies, implementation, and impact in the banking sector.