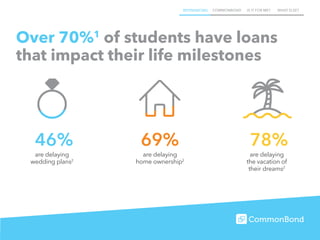

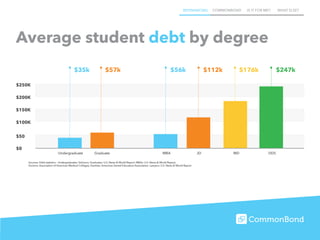

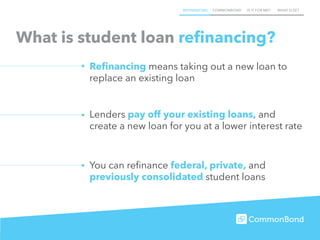

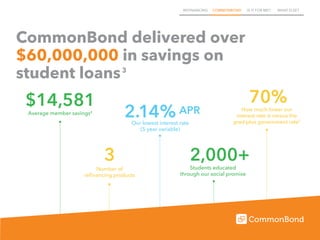

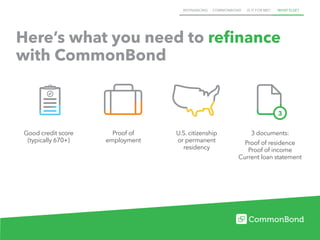

The document discusses student loan refinancing through CommonBond, detailing its benefits, such as lower interest rates and savings potential. It emphasizes the challenges students face due to loan debt and outlines the necessary criteria for refinancing, such as having good credit and proof of employment. CommonBond also highlights its impact by funding education for children in need through a partnership with Pencils of Promise.