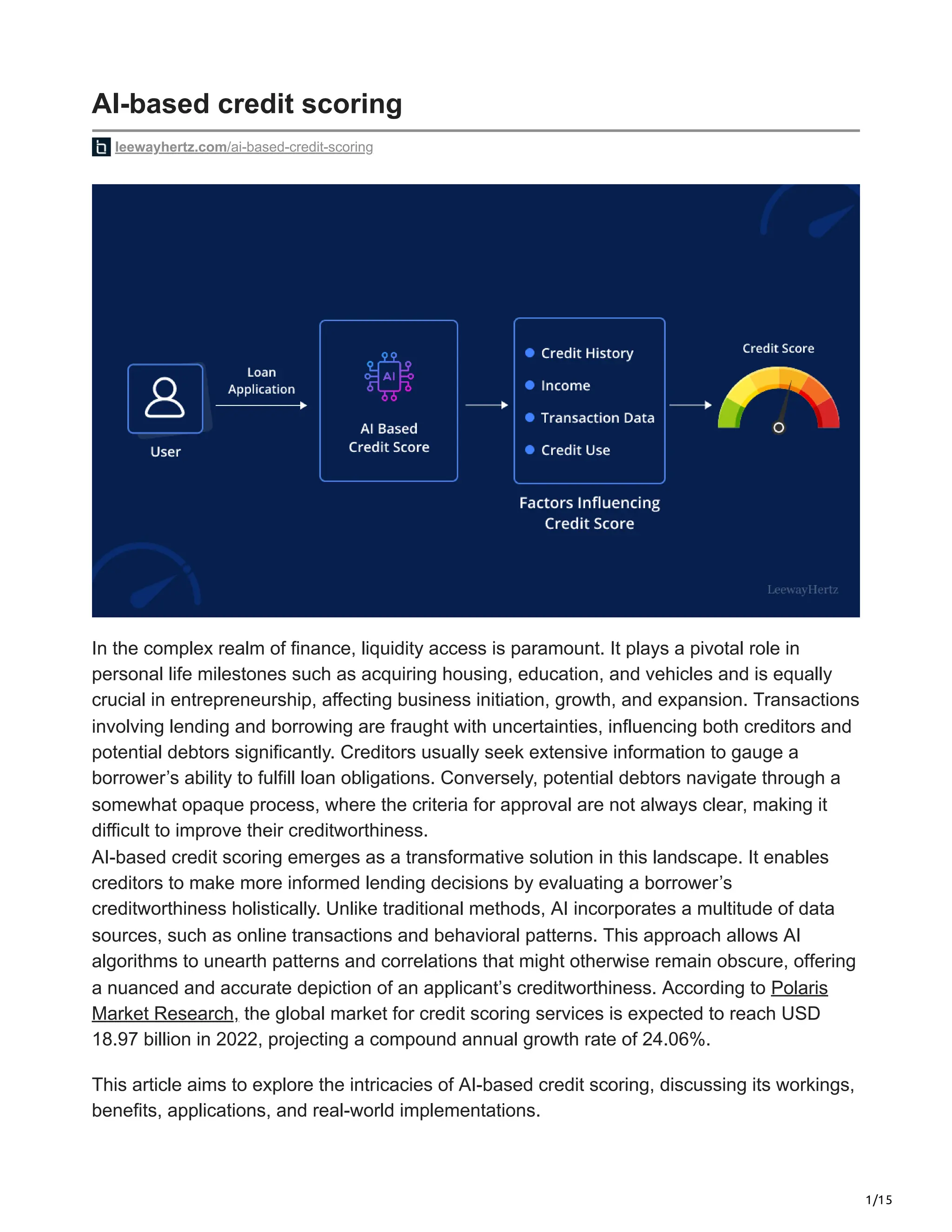

AI-based credit scoring is revolutionizing how lenders assess creditworthiness by utilizing machine learning algorithms that analyze diverse data sources, providing a holistic view of an applicant's financial behavior. This modern approach contrasts with traditional methods that rely on limited historical data, offering more accurate predictions of loan repayment likelihood. The implementation of AI in credit scoring enhances risk assessment, potentially benefiting consumers with fairer lending terms based on their nuanced financial profiles.