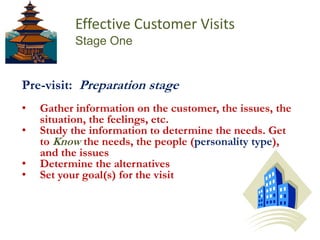

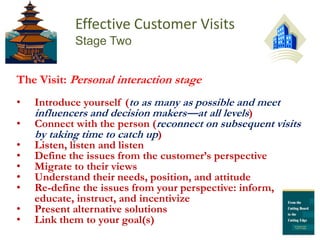

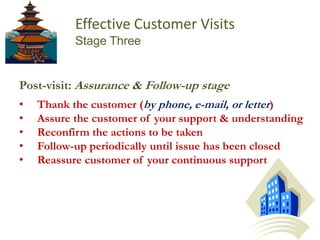

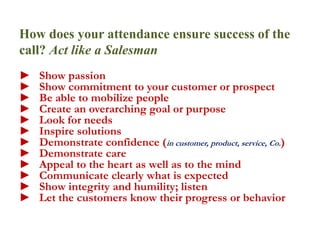

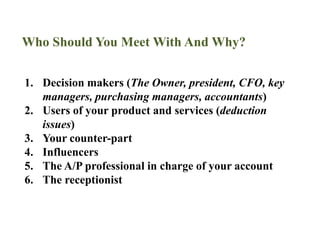

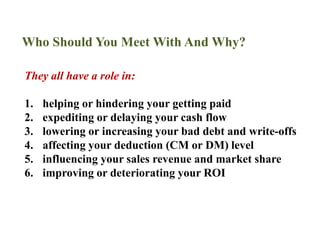

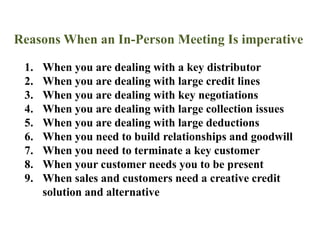

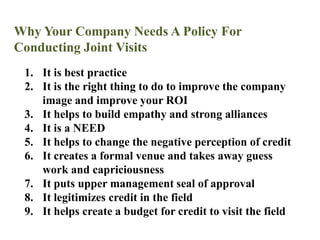

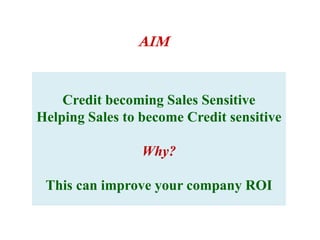

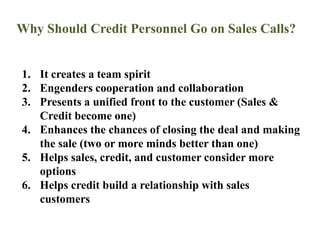

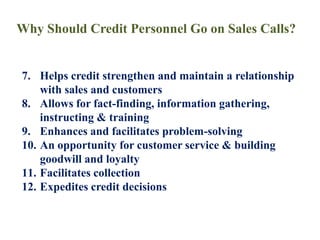

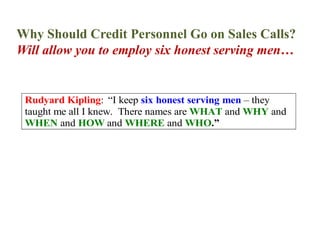

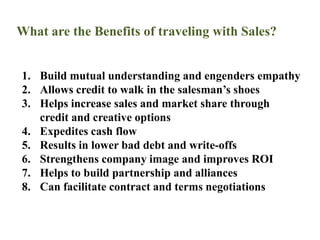

The document outlines the importance and benefits of credit personnel traveling with sales teams for joint customer visits. It emphasizes that such interactions foster collaboration, enhance customer relationships, and improve company ROI by allowing credit professionals to observe, understand customer needs, and present a unified front. Additionally, it discusses the processes involved in effective customer visits and the necessary preparations and follow-ups to ensure successful outcomes.

![How does your attendance ensure success of the call? It introduces the credit perspective…bringing the expert…presenting as a teamIt brings new options and alternativesIt eliminates distortions and misunderstandings when it comes to credit offerings and processAllows the credit professional to explain the process and ask for the needed requirements [Apps/ FS/ Docs]Allows for first hand observation and assessment without intermediariesAllows credit to meet the decision makers and financial personnel](https://image.slidesharecdn.com/creditandsalesjointcalls-100804232912-phpapp02/85/Credit-and-Sales-Joint-Calls-15-320.jpg)