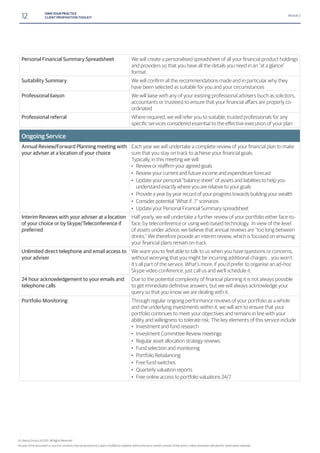

The document discusses creating a compelling client proposition. It suggests that clients will expect clear answers about what they are paying for in a more transparent pricing environment post-RDR. A client proposition should explain the services being provided in a way clients understand and demonstrate value. Many advisers currently provide services clients don't need or want. Research shows clients want responsive, personalized service and are willing to pay more for better service. High net worth clients want specialized, independent advice and transparency. An effective proposition must meet rising client expectations.