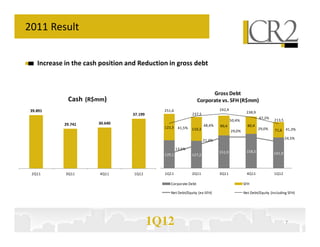

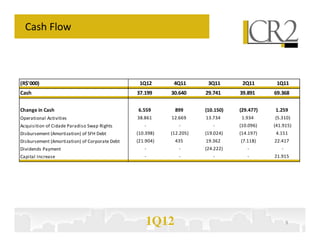

- The company generated R$38.9 million in cash from operations in 1Q12 and increased its cash position by R$6.6 million while reducing gross debt by R$32.3 million.

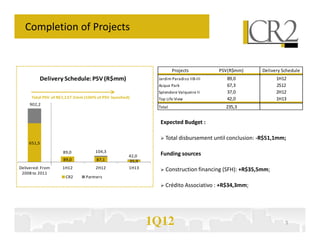

- Four projects are scheduled for completion in 2012 and 2013 with a total PSV of R$235.3 million.

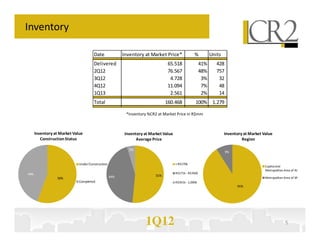

- Contracted sales totaled R$20.4 million in 1Q12.

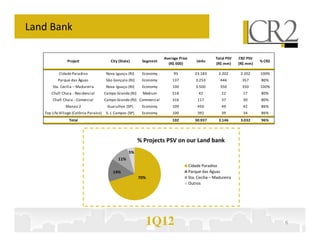

- The company has a land bank of 7 projects with a total PSV of R$3.146 billion, of which 96% is from CR2 projects.