This document summarizes CR2's performance in 4Q07 and provides guidance for 2008. Key highlights include:

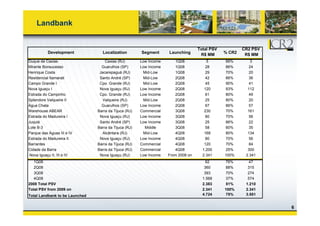

- 4Q07 launches totaled R$463.5 million, with CR2's share being R$350 million.

- Contracted sales in 4Q07 were R$85.3 million, with CR2's share being R$59.2 million.

- Guidance for 2008 forecasts CR2's PSV from launches will total R$1.2 billion.