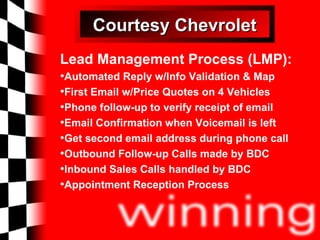

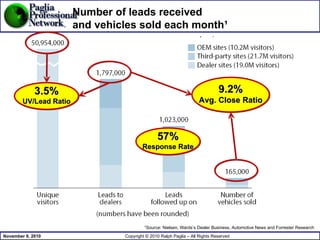

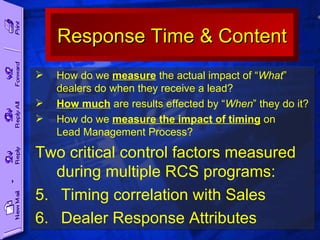

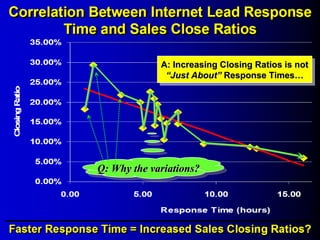

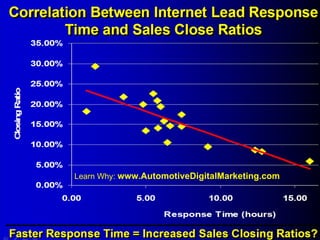

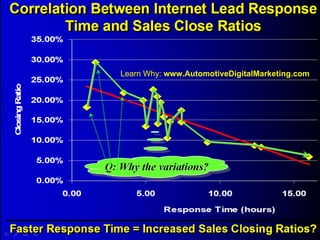

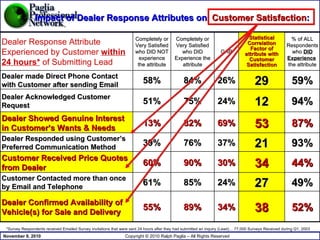

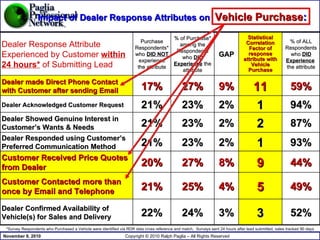

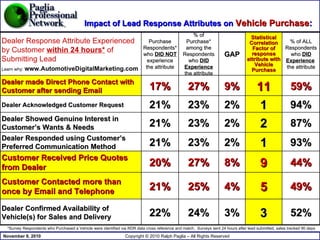

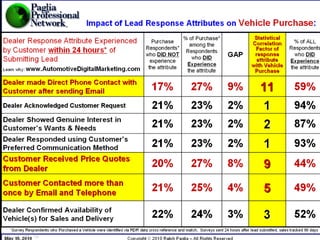

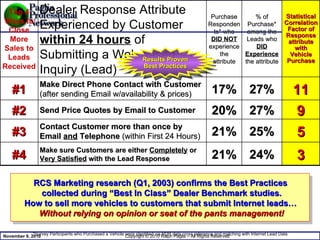

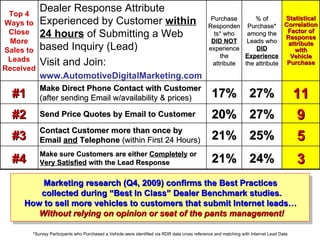

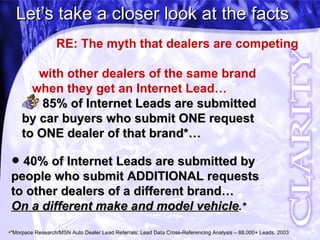

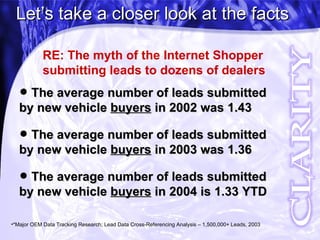

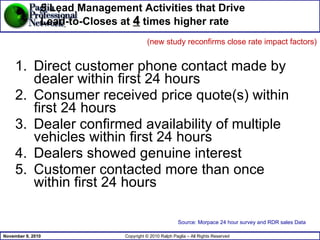

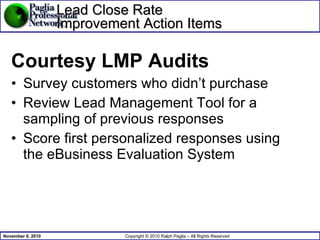

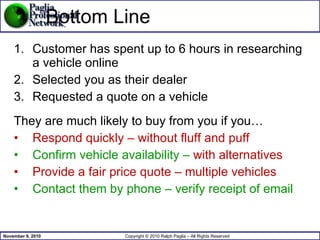

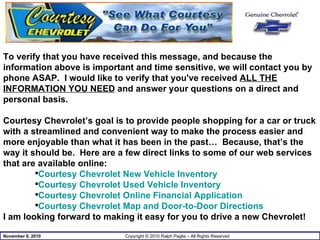

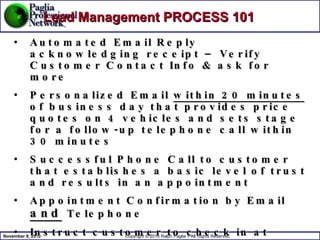

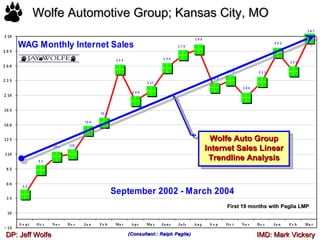

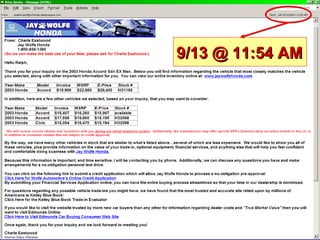

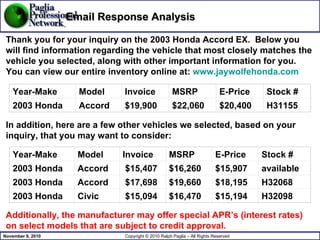

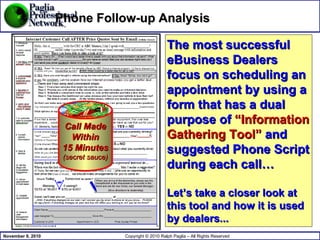

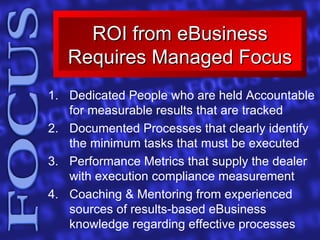

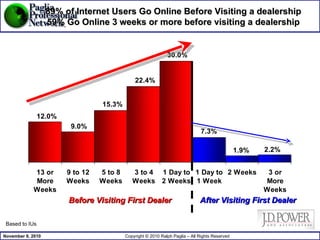

This document discusses best practices for managing sales leads from online inquiries. It provides data showing that responding to leads quickly, providing price quotes, confirming vehicle availability, showing genuine interest in the customer, and following up multiple times significantly increases closing ratios and vehicle purchases. It emphasizes the importance of a well-defined lead management process that incorporates these practices.

![Attributes of Dealer Responses to Sales Leads and their Correlation, or Impact on Customer Satisfaction and Sales Closing Ratios Prepared by: Ralph Paglia [email_address] 505-301-6369](https://image.slidesharecdn.com/courtesychevyleadmanagementprocessv8d-101109074329-phpapp01/85/Courtesy-chevy-lead-management-process-v8d-7-320.jpg)

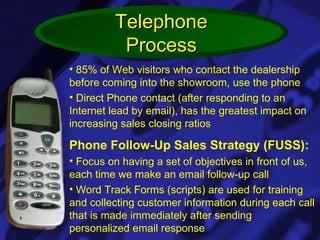

![Internet Leads + Phone Leads + Showroom Visits = Integrated Marketing What does this mean? Internet Leads + Phone Leads + Showroom Visits = Integrated Marketing 2,564 1,928 [(200/.39)/ .21]x.79 436 (200/.39)x.85 200 1,924 1,447 [(150/.39)/ .21]x.79 327 (150/.39)x.85 150 1,282 964 [(100/.39)/ .21]x.79 218 (100/.39)x.85 100 641 482 [(50/.39)/ .21]x.79 109 (50/.39)x.85 50 Total Traffic (Lead+Phone +Showroom) Showroom Traffic from Dealer Web Site Visitors formula Phone Calls from Dealer Web Site formula Web Site Lead Volume](https://image.slidesharecdn.com/courtesychevyleadmanagementprocessv8d-101109074329-phpapp01/85/Courtesy-chevy-lead-management-process-v8d-39-320.jpg)