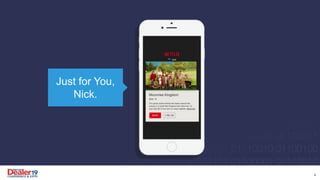

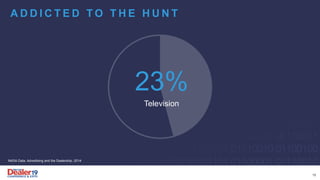

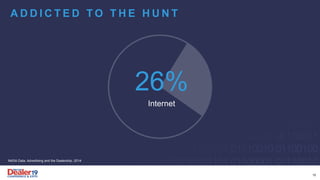

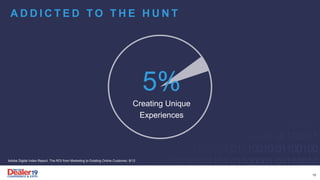

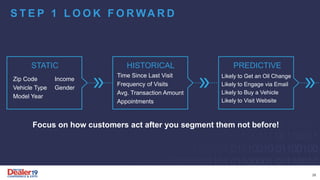

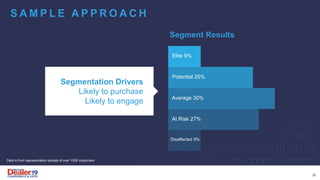

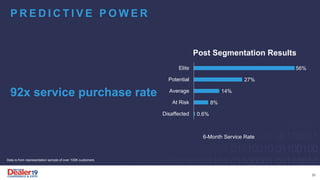

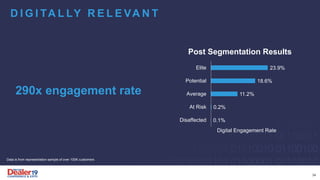

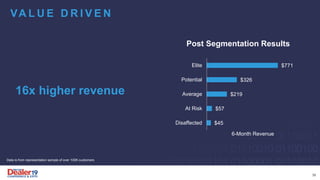

This document discusses strategies for dealerships to create higher value customers by getting "addicted to data." It recommends segmenting customers based on predictive attributes like visit frequency or engagement. The top 20% of customers account for 66% of revenue but dealerships typically underinvest in these valuable segments. By customizing experiences for different customer segments identified through data analysis, dealerships can increase engagement, visits, and revenue from their highest potential customers.