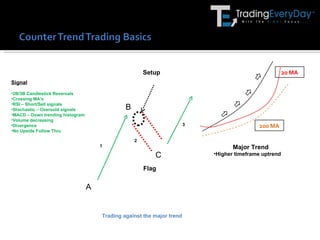

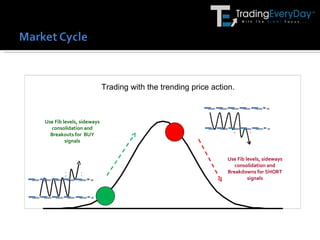

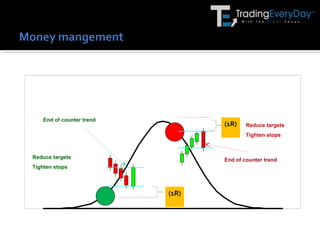

The document discusses counter trend trading and provides advice for being successful at it. It notes that traders are often not aware they are counter trend trading until they are in the trade. It recommends focusing on the speed of the trend and looking for aggressive pullbacks or retracements for entry opportunities. It warns that counter trends are short-lived and advises having a plan focused on trading with the overall trend direction for better odds of success.