Cost of Goods Sold.docx

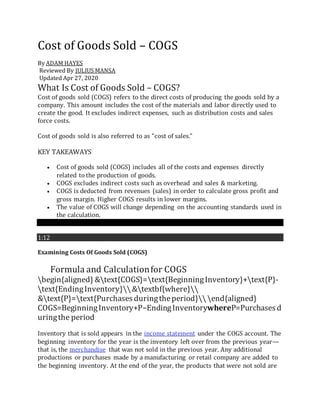

- 1. Cost of Goods Sold – COGS By ADAM HAYES Reviewed By JULIUS MANSA Updated Apr 27, 2020 What Is Cost of Goods Sold – COGS? Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good. It excludes indirect expenses, such as distribution costs and sales force costs. Cost of goods sold is also referred to as "cost of sales." KEY TAKEAWAYS Cost of goods sold (COGS) includes all of the costs and expenses directly related to the production of goods. COGS excludes indirect costs such as overhead and sales & marketing. COGS is deducted from revenues (sales) in order to calculate gross profit and gross margin. Higher COGS results in lower margins. The value of COGS will change depending on the accounting standards used in the calculation. Volume 75% 1:12 Examining Costs Of Goods Sold (COGS) Formula and Calculationfor COGS begin{aligned} &text{COGS}=text{BeginningInventory}+text{P}- text{EndingInventory}&textbf{where} &text{P}=text{Purchases duringtheperiod}end{aligned} COGS=BeginningInventory+P−EndingInventorywhereP=Purchasesd uringthe period Inventory that is sold appears in the income statement under the COGS account. The beginning inventory for the year is the inventory left over from the previous year— that is, the merchandise that was not sold in the previous year. Any additional productions or purchases made by a manufacturing or retail company are added to the beginning inventory. At the end of the year, the products that were not sold are

- 2. subtracted from the sum of beginning inventory and additional purchases. The final number derived from the calculation is the cost of goods sold for the year. COGS only applies to those costs directly related to producing goods intended for sale. The balance sheet has an account called the current assets account. Under this account is an item called inventory. The balance sheet only captures a company’s financial health at the end of an accounting period. This means that the inventory value recorded under current assets is the ending inventory. Since the beginning inventory is the inventory that a company has in stock at the beginning of its accounting period, it means that the beginning inventory is also the company’s ending inventory at the end of the previous accounting period. What Does the COGS Tell You? The COGS is an important metric on the financial statements as it is subtracted from a company’s revenues to determine its gross profit. The gross profit is a profitability measure that evaluates how efficient a company is in managing its labor and supplies in the production process. Because COGS is a cost of doing business, it is recorded as a business expense on the income statements. Knowing the cost of goods sold helps analysts, investors, and managers estimate the company’s bottom line. If COGS increases, net income will decrease. While this movement is beneficial for income tax purposes, the business will have less profit for its shareholders. Businesses thus try to keep their COGS low so that net profits will be higher. Cost of goods sold (COGS) is the cost of acquiring or manufacturing the products that a company sells during a period, so the only costs included in the measure are those that are directly tied to the production of the products, including the cost of labor, materials, and manufacturing overhead. For example, the COGS for an automaker would include the material costs for the parts that go into making the car plus the labor costs used to put the car together. The cost of sending the cars to dealerships and the cost of the labor used to sell the car would be excluded. Furthermore, costs incurred on the cars that were not sold during the year will not be included when calculating COGS, whether the costs are direct or indirect. In other words, COGS includes the direct cost of producing goods or services that were purchased by customers during the year.

- 3. As a rule of thumb, if you want to know if an expense falls under COGS, ask: "Would this expense have been an expense even if no sales were generated?" Accounting Methods and COGS The value of the cost of goods sold depends on the inventory costing method adopted by a company. There are three methods that a company can use when recording the level of inventory sold during a period: First In, First Out (FIFO), Last In, First Out (LIFO), and the Average Cost Method.1 FIFO The earliest goods to be purchased or manufactured are sold first. Since prices tend to go up over time, a company that uses the FIFO method will sell its least expensive products first, which translates to a lower COGS than the COGS recorded under LIFO. Hence, the net income using the FIFO method increases over time.1 LIFO The latest goods added to the inventory are sold first. During periods of rising prices, goods with higher costs are sold first, leading to a higher COGS amount. Over time, the net income tends to decrease.1 Average Cost Method The average price of all the goods in stock, regardless of purchase date, is used to value the goods sold. Taking the average product cost over a time period has a smoothing effect that prevents COGS from being highly impacted by extreme costs of one or more acquisitions or purchases1 . Exclusions From COGS Deduction Many service companies do not have any cost of goods sold at all. COGS is not addressed in any detail in generally accepted accounting principles (GAAP), but COGS is defined as only the cost of inventory items sold during a given period. Not only do service companies have no goods to sell, but purely service companies also do not have inventories. If COGS is not listed on the income statement, no deduction can be applied for those costs.2 Examples of pure service companies include accounting firms, law offices, real estate appraisers, business consultants, professional dancers, etc. Even though all of these industries have business expenses and normally spend money to provide their services, they do not list COGS. Instead, they have what is called "cost of services," which does not count towards a COGS deduction. Cost of Revenue vs. COGS

- 4. Costs of revenue exist for ongoing contract services that can include raw materials, direct labor, shipping costs, and commissions paid to sales employees. These items cannot be claimed as COGS without a physically produced product to sell, however. The IRS website even lists some examples of "personal service businesses" that do not calculate COGS on their income statements. These include doctors, lawyers, carpenters, and painters.3 Many service-based companies have some products to sell. For example, airlines and hotels are primarily providers of services such as transport and lodging, respectively, yet they also sell gifts, food, beverages, and other items. These items are definitely considered goods, and these companies certainly have inventories of such goods. Both of these industries can list COGS on their income statements and claim them for tax purposes.3 Operating Expenses vs. COGS Both operating expenses and cost of goods sold (COGS) are expenditures that companies incur with running their business. However, the expenses are segregated on the income statement. Unlike COGS, operating expenses (OPEX) are expenditures that are not directly tied to the production of goods or services. Typically, SG&A (selling, general, and administrative expenses) are included under operating expenses as a separate line item. SG&A expenses are expenditures that are not directly tied to a product such as overhead costs. Examples of operating expenses include the following: Rent Utilities Office supplies Legal costs Sales and marketing Payroll Insurance costs Limitations of COGS COGS can easily be manipulated by accountants or managers looking to cook the books. It can be altered by: Allocating to inventory higher manufacturing overhead costs than those incurred Overstating discounts Overstating returns to suppliers Altering the amount of inventory in stock at the end of an accounting period Overvaluing inventory on hand

- 5. Failing to write-off obsolete inventory When inventory is artificially inflated, COGS will be under-reported which, in turn, will lead to higher than the actual gross profit margin, and hence, an inflated net income. Investors looking through a company’s financial statements can spot unscrupulous inventory accounting by checking for inventory buildup, such as inventory rising faster than revenue or total assets reported. Example of How to Use COGS As a historical example, let's calculate the cost of goods sold for J.C. Penney (NYSE: JCP) for fiscal year (FY) ended 2016. The first step is to find the beginning and ending inventory on the company's balance sheet: Beginning inventory: Inventory recorded on the fiscal year ended 2015 = $2.72 billion Ending inventory: Inventory recorded on the fiscal year ended 2016 = $2.85 billion Purchases during 2016: Using the information above = $8.2 billion4 Using the formula for COGS, we can compute the following: $2.72 + 8.2 - 2.85 = $8.07 billion If we look at the company's 2016 income statement, we see that the reported COGS is $8.07 billion, the exact figure that we calculated here.5 Compete Risk Free with $100,000 in Virtual Cash Put your trading skills to the test with our FREE Stock Simulator. Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money. Practice trading strategies so that when you're ready to enter the real market, you've had the practice you need. Introduction to Inventory and Cost of Goods Sold

- 6. Did you know?To make the topic of Inventory and Cost of Goods Sold even easier to understand, we created a collection of premium materials called AccountingCoach PRO. Our PRO users get lifetime access to our inventory and cost of goods sold cheat sheet, flashcards, quick tests, business forms, and more. Inventory is merchandise purchased bymerchandisers(retailers, wholesalers, distributors)for the purpose of beingsold to customers.The cost of the merchandise purchased but not yet sold is reported in the account Inventoryor Merchandise Inventory. Inventoryis reported as a current asset on the company's balance sheet. Inventoryis a significant asset that needsto be monitored closely. Too much inventory can result in cash flow problems, additional expenses(e.g., storage, insurance), and losses if the itemsbecome obsolete. Too littleinventory can result in lost salesand lost customers. Because of the cost principle, inventoryis reported on the balance sheet at the amount paid to obtain (purchase) the merchandise, not at its sellingprice. Inventoryis also a significant asset of manufacturers. However, in order to simplify our explanation, we will focus on a retailer. Confused? Send Feedback Cost of Goods Sold Cost of goods sold is the cost of the merchandise that was sold to customers. The cost of goods sold is reported on the income statement when the sales revenues of the goods sold are reported. A retailer'scost of goods sold includesthe cost from its supplier plus any additional costs necessaryto get the merchandise intoinventory and ready for sale. For example, let'sassume that Corner Shelf Bookstore purchasesa college textbook from a publisher. IfCorner Shelf's cost from the publisher is $80 for the textbook plus$5 in shippingcosts, Corner Shelf reports$85 in itsInventory account until the book is sold. When the book is sold, the $85 is removed from inventory and is reported as cost of goods sold on the income statement. Confused? Send Feedback When Costs Change If the publisher increasesthe sellingprices of its books, the bookstore will have a higher cost for the next book it purchasesfrom the publisher. Anybooks in the bookstore's inventorywill continue to be reported at their cost when purchased. For example, ifthe Corner Shelf Bookstore hason itsshelf a book that had a cost of $85, Corner Shelfwill continue to report the cost of that one book at itsactual cost of $85 even if the same book now hasa cost of $90. The cost principle will not allow an amount higher than cost to be included in inventory. Let's assume the Corner ShelfBookstore had one book in inventory at the start of the year 2019 and at different timesduring2019 purchased four identical books. During the year 2019 the cost of these books increased due to a paper shortage. The following chart shows the costs of the five books that have to be accounted for. It also assumes that none of the books has been sold as of December 31, 2019.

- 7. Special Feature: Review what you are learningby working the three interactive crossword puzzles dedicated to thistopic. They are completelyfree. Inventory & Cost of Goods Sold Puzzles Confused? Send Feedback Cost Flow Assumptions If the Corner Shelf Bookstore sells only one of the five books, which cost should Corner Shelf report as the cost of goods sold? Should it select $85, $87, $89, $89, $90, or an average of the five amounts? A related question is which cost should Corner Shelf report as inventory on its balance sheet for the four books that have not been sold? Accounting rulesallow the bookstore to move the cost from inventory to the cost of goods sold by using one of three cost flows: 1. First In, First Out (FIFO) 2. Last In, First Out (LIFO) 3. Average Note that these are cost flow assumptions. This means that the order in which costs are removed from inventory can be different from the order in which the goods are physicallyremoved from inventory. In other words,Corner Shelf could sell the book that was on hand at December 31, 2018 but could remove from inventory the $90 cost of the book purchased in December 2019 (if it elects the LIFOcost flow assumption). Inventory Systems Each of the three cost flow assumptionslisted above can be used in either of two systems (or methods) of inventory: A. Periodic B. Perpetual A. Periodic inventory system. Under this system the amount appearingin the Inventory account is not updated when purchasesof merchandise are made from suppliers. Rather, the Inventoryaccount is commonly updated or adjusted only once—at the end of the year. During the year the Inventoryaccount will likely show only the cost of inventory at the end of the previous year.

- 8. Under the periodicinventory system, purchasesof merchandise are recorded in one or more Purchases accounts. At the end of the year the Purchases account(s) are closed and the Inventory account is adjusted to equal the cost of the merchandise actuallyon hand at the end of the year. Under the periodic system there is no Cost of Goods Sold account to be updated when a sale of merchandise occurs. In short, under the periodicinventory system there is no way to tell from the general ledger accounts the amount of inventory or the cost of goods sold. B. Perpetual inventory system. Under thissystem the Inventoryaccount is continuously updated. The Inventoryaccount is increased with the cost of merchandise purchased from suppliersand it is reduced by the cost of merchandise that has been sold to customers. (The Purchasesaccount(s) do not exist.) Under the perpetual system there isa Cost of Goods Sold account that is debited at the time of each sale for the cost of the merchandise that wassold. Under the perpetual system a sale of merchandise will result in two journal entries: one to record the sale and the cash or accounts receivable, and one to reduce inventory and to increase cost of goods sold. Confused? Send Feedback Inventory Systems and Cost Flows Combined The combination of the three cost flow assumptionsand the two inventory systemsresultsin six available options when accounting for the cost of inventoryand calculatingthe cost of goods sold: A1. Periodic FIFO A2. Periodic LIFO A3. Periodic Average B1. Perpetual FIFO B2. Perpetual LIFO B3. Perpetual Average Confused? Send Feedback A1. Periodic FIFO "Periodic" meansthat the Inventoryaccount is not routinelyupdated duringthe accounting period. Instead, the cost of merchandise purchased from suppliersisdebited to an account called Purchases.At the end of the accounting year the Inventoryaccount is adjusted to equal the cost of the merchandise that has not been sold. The cost of goods sold that will be reported on the income statement will be computed by taking the cost of the goods purchased and subtractingthe increase in inventory (or addingthe decrease in inventory). "FIFO" isan acronym for First In, First Out. Under the FIFOcost flow assumption, the first (oldest) costs are the first ones to leave inventoryand become the cost of goods sold on the income statement. The last (or recent)costs will be reported as inventoryon the balance sheet. Remember that the costs can flow differentlythan the goods. Ifthe Corner Shelf Bookstore usesFIFO, the owner may sell the newest book to a customer, but is allowed to report the cost of goods sold as $85 (the first, oldest cost).

- 9. Let's illustrate periodicFIFOwith the amountsfrom the Corner Shelf Bookstore: As before, we need to account for the total goods available for sale (5 books at a cost of $440). Under FIFOwe assign the first cost of $85 to the one book that was sold. The remaining$355 ($440 - $85) is assigned to inventory. The $355 of inventory costs consists of $87 + $89 + $89 + $90. The $85 cost assigned to the book sold is permanentlygone from inventory. If Corner Shelf Bookstore sellsthe textbook for $110, its gross profit under periodicFIFOwill be $25 ($110 - $85). If the costs of textbooks continue to increase, FIFOwill always result in more profit than other cost flows, because the first cost is always lower. A2. Periodic LIFO "Periodic" meansthat the Inventory account is not updated duringthe accountingperiod. Instead, the cost of merchandise purchased from suppliersisdebited to an account called Purchases. At the end of the accounting year the Inventoryaccount is adjusted to equal the cost of the merchandise that is unsold. The other costs of goods will be reported on the income statement asthe cost of goods sold. "LIFO" isan acronym for Last In, First Out. Under the LIFOcost flow assumption, the last (or recent) costs are the first ones to leave inventory and become the cost of goods sold on the income statement. The first (or oldest) costs will be reported as inventoryon the balance sheet. Remember that the costs can flow differentlythan the goods. In other words, if Corner Shelf Bookstore uses LIFO, the owner maysell the oldest (first) book to a customer, but can report the cost of goods sold of $90 (the last cost). It's important to note that under LIFO periodic (not LIFOperpetual)we wait until the entire year isover before assigningthe costs. Then we flow the year's last costs first, even if those goods arrived after the last sale of the year. For example, assume the last sale of the year at the Corner Shelf Bookstore occurred on December 27. Also assume that the store's last purchase of the year arrived on December 31. Under LIFOperiodic, the cost of the book purchased on December 31 is sent to the cost of goods sold first, even though it's physically impossible for that book to be the one sold on December 27. (This reinforces our previous statement that the flow of costs does not have to correspond with the physical flow of units.) Let's illustrate periodicLIFObyusing the data for the Corner ShelfBookstore:

- 10. As before we need to account for the total goods available for sale: 5 books at a cost of $440. Under periodic LIFOwe assign the last cost of $90 to the one book that was sold. (If two books were sold, $90 would be assigned to the first book and $89 to the second book.) The remaining$350 ($440 - $90) is assigned to inventory. The $350 of inventory cost consists of $85 + $87 + $89 + $89. The $90 assigned to the book that was sold is permanentlygone from inventory. If the bookstore sold the textbook for $110, its gross profit under periodic LIFOwill be $20 ($110 - $90). If the costs of textbooks continue to increase, LIFOwill alwaysresult in the least amount of profit. (The reason is that the last costs will alwaysbe higher than the first costs. Higher costs result in lessprofits and usuallylower income taxes.) Confused? Send Feedback A3. Periodic Average Under "periodic" the Inventory account is not updated and purchasesof merchandise are recorded in an account called Purchases.Under thiscost flow assumption an average cost is calculated using the total goods available for sale (cost from the beginninginventoryplusthe costs of all subsequent purchases made duringthe entire year). In other words, the periodicaverage cost is calculated after the year is over—after all the purchasesof the year have occurred. This average cost is then applied to the units sold duringthe year as well as to the unitsin inventory at the end of the year. As you can see, our facts remain the same-there are 5 books available for sale for the year 2019 and the cost of the goods available is $440. The weighted average cost of the books is $88 ($440 of cost of goods available ÷ 5 books available)and it is used for both the cost of goods sold and for the cost of the books in inventory.

- 11. Since the bookstore sold only one book, the cost of goods sold is $88 (1 x $88). The four books still on hand are reported at $352 (4 x $88) of cost in the Inventoryaccount. The total of the cost of goods sold plusthe cost of the inventory should equal the total cost of goods available ($88 + $352 = $440). If Corner Shelf Bookstore sellsthe textbook for $110, itsgross profit under the periodic average method will be $22 ($110 - $88). This gross profit is between the $25 computed under periodic FIFOand the $20 computed under periodic LIFO. B1. Perpetual FIFO Under the perpetual system the Inventory account is constantly(or perpetually)changing. When a retailer purchasesmerchandise, the retailer debitsitsInventoryaccount for the cost; when the retailer sells the merchandise to itscustomers its Inventoryaccount is credited and its Cost of Goods Sold account is debited for the cost of the goods sold. Rather than staying dormant as it does with the periodic method, the Inventoryaccount balance is continuously updated. Under the perpetual system, twotransactions are recorded when merchandise issold: (1) the sales amount is debited to Accounts Receivable or Cash and is credited to Sales, and (2) the cost of the merchandise sold is debited toCost of Goods Sold and is credited to Inventory. (Note: Under the periodic system the second entryis not made.) With perpetual FIFO, the first (or oldest) costs are the first moved from the Inventoryaccount and debited to the Cost of Goods Sold account. The end result under perpetual FIFOisthe same as under periodic FIFO. In other words, the first costs are the same whether you move the cost out of inventory with each sale (perpetual)or whether you wait until the year is over (periodic). Confused? Send Feedback B2. Perpetual LIFO Under the perpetual system the Inventoryaccount is constantly(or perpetually)changing. When a retailer purchasesmerchandise, the retailer debitsitsInventoryaccount for the cost of the merchandise. When the retailer sellsthe merchandise to its customers, the retailer creditsits Inventoryaccount for the cost of the goods that were sold and debitsits Cost of Goods Sold account for their cost. Rather than staying dormant as it does with the periodic method, the Inventoryaccount balance is continuously updated.

- 12. Under the perpetual system, twotransactions are recorded at the time that the merchandise is sold: (1) the sales amount is debited to Accounts Receivable or Cash and is credited to Sales, and (2) the cost of the merchandise sold is debited to Cost of Goods Sold and is credited to Inventory. (Note: Under the periodic system the second entryis not made.) With perpetual LIFO, the last costs available at the time of the sale are the first to be removed from the Inventoryaccount and debited to the Cost of Goods Sold account. Since thisis the perpetual system we cannot wait until the end of the year to determine the last cost—an entrymust be recorded at the time of the sale in order to reduce the Inventoryaccount and to increase the Cost of Goods Sold account. If costs continue to rise throughout the entire year, perpetual LIFOwill yield a lower cost of goods sold and a higher net income than periodic LIFO. Generallythis meansthat periodic LIFOwill result in less income taxesthan perpetual LIFO. (If you wish to minimize the amount paid in income taxesduring periods of inflation, you should discussLIFOwith your tax adviser.) Once again we'll use our example for the Corner Shelf Bookstore: Let's assume that after Corner Shelf makesits second purchase in June 2019, Corner Shelf sells one book. This meansthe last cost at the time of the sale was $89. Under perpetual LIFOthe following entry must be made at the time of the sale: $89 will be credited to Inventoryand $89 will be debited to Cost of Goods Sold. If that was the only book sold duringthe year, at the end of the year the Cost of Goods Sold account will have a balance of $89 and the cost in the Inventoryaccount will be $351 ($85 + $87 + $89 + $90). If the bookstore sells the textbook for $110, its gross profit under perpetual LIFOwill be $21 ($110 - $89). Note that thisis different than the gross profit of $20 under periodicLIFO. Confused? Send Feedback B3. Perpetual Average Under the perpetual system the Inventoryaccount is constantly(or perpetually)changing. When a retailer purchasesmerchandise, the costs are debited to its Inventoryaccount; when the retailer sells the merchandise to its customersthe Inventoryaccount is credited and the Cost of Goods Sold account is debited for the cost of the goods sold. Rather than staying dormant as it does with the periodicmethod, the Inventory account balance under the perpetual average ischanging whenever a purchase or sale occurs. Under the perpetual system, twosets of entriesare made whenever merchandise issold: (1) the sales amount is debited to Accounts Receivable or Cash and is credited to Sales, and (2) the cost of the

- 13. merchandise sold is debited toCost of Goods Sold and is credited to Inventory. (Note: Under the periodic system the second entryis not made.) Under the perpetual system, "average" meansthe average cost of the itemsin inventory as of the date of the sale. This average cost is multiplied bythe number of unitssold and is removed from the Inventory account and debited tothe Cost of Goods Sold account. We use the average as of the time of the sale because this is a perpetual method. (Note: Under the periodic system we wait until the year is over before computingthe average cost.) Let's use the same example again for the Corner ShelfBookstore: Let's assume that after Corner Shelf makesits second purchase, Corner Shelfsells one book. This means the average cost at the time of the sale was $87.50 ([$85 + $87 + $89 + $89] ÷ 4]). Because thisis a perpetual average, a journal entry must be made at the time of the sale for $87.50. The $87.50 (the average cost at the time of the sale) is credited to Inventoryand is debited to Cost of Goods Sold. After the sale of one unit, three unitsremain in inventory and the balance in the Inventoryaccount will be $262.50 (3 books at an average cost of $87.50). After Corner Shelf makesits third purchase, the average cost per unit will change to $88.125 ([$262.50 + $90]÷ 4). As you can see, the average cost moved from $87.50 to $88.125—thisis whythe perpetual average method is sometimes referred to as the moving average method. The Inventory balance is $352.50 (4 books with an average cost of $88.125 each). Confused? Send Feedback Comparison of Cost Flow Assumptions Below is a recap of the varying amountsfor the cost of goods sold, gross profit, and endinginventory that were calculated above.

- 14. The example assumesthat costs were continuallyincreasing. The resultswould be different if costs were decreasingor increasingat a slower rate. Consult with your tax advisor concerningthe election of cost flow assumption. Specific Identification In addition to the six cost flow assumptionspresented in Parts 1 - 4, businesseshave another option: expense to the cost of goods sold the specific cost of the specific item sold. For example, Gold Dealer, Inc. has an inventory of gold and each nugget has an identification number and the cost of the nugget. When Gold Dealer sells a nugget, it can expense to the cost of goods sold the exact cost of the specific nugget sold. The cost of the other nuggetswill remain in inventory. (Alternatively, Gold Dealer could use one of the other six cost flow assumptionsdescribed in Parts 1 - 4.) Confused? Send Feedback LIFO Benefits Without Tracking Units In Part 1 and Part 2 you saw that duringthe periods of increasing costs, LIFOwill result in less profits. In the U.S. this can mean less income taxes paid by the company. Most companiesview lower taxesas a significant benefit. However, the process of tracking costs and then assigningthose costs to the units sold and the unitson hand could be too expensive for the amount of income tax savings. To gain the benefit of LIFOwithout the tracking of costs, there is a method known as dollar value LIFO. This topic is discussed in intermediate accountingtextbooks. The Internal Revenue Service also allows companies to use dollar value LIFObyapplyingprice indexes. (You should seek the advice of an accounting and/or tax professional to assess the cost and benefit of these techniques.) Confused? Send Feedback Inventory Management Over the past few decadessophisticated companies have made great stridesin reducingtheir levelsof inventory. Rather than carry large inventories, they ask their suppliersto deliver goods "just in time."

- 15. Suppliersand merchandisershave learned to coordinate their purchasesand sales so that ordersand shipmentsoccur automatically. A company will realize significant benefitsif it can keep itsinventory levelsdown without losing salesor production (if the companyis a manufacturer). For example, Dell Computershas greatlyreduced its inventory in relationship to its sales.Since computer components have been droppingin costs as new technologies emerge, it benefitsDell to keep only a very small inventory of components on hand. It would be a financial hardship ifDell had a large quantityof partsthat became obsolete or decreased in value. Confused? Send Feedback Financial Ratios Keepingtrack of inventoryis important. There are two common financial ratios for monitoring inventory levels: (1) the InventoryTurnover Ratio, and (2) the Days' Sales in Inventory. (These are discussed and illustrated in the Explanation of Financial Ratios.) Confused? Send Feedback Estimating Ending Inventory It is very time-consumingfor a company to physically count the merchandise unitsin its inventory. In fact, it is not unusual for companies to shut down their operations near the end of their accounting year just to perform inventory counts. The companymay assign one set of employees to count and tag the itemsand another set to verify the counts. If a company hasoutside auditors, they will be there to observe the process. (Even if the company's computerskeep track of inventory, accountants require that the computer records be verified byactuallycounting the goods.) If a company counts itsinventory only once per year it must estimate itsinventory at the end of each month in order to prepare meaningful monthlyfinancial statements. In fact, a company mayneed to estimate itsinventory for other reasons as well. For example, if a companysuffers a loss due to a disaster such as a tornado or a fire, it will need to file a claim for the approximate cost of the inventory that was lost. (An insurance adjuster will also compute this amount independentlyso that the company is not paid too much or too little for its loss.) Methods of Estimating Inventory There are two methodsfor estimating endinginventory: 1. Gross Profit Method 2. Retail Method 1. Gross Profit Method. The gross profit method for estimatinginventoryuses the information contained in the top portion of a merchandiser'smultiple-step income statement:

- 16. Let's assume that we need to estimate the cost of inventory on hand on June 30, 2019. From the 2018 income statement shown above we can see that the company's gross profit is 20% of the salesand that the cost of goods sold is 80% of the sales. If those percentagesare reasonable for the current year, we can use those percentagesto help usestimate the cost of the inventory on hand as of June 30, 2019. While an algebraicequation could be constructed to determine the estimated amount of ending inventory, we prefer to simplyuse the income statement format. We prepare a partial income statement for the period beginningafter the date when inventorywas last physically counted, and endingwith the date for which we need the estimated inventorycost. In this case, the income statement will go from January1, 2019 until June 30, 2019. Some of the numbersthat we need are easily obtained from sales records, customers, suppliers, earlier financial statements,etc. For example, salesfor the first half of the year 2019 are taken from the company's records. The beginninginventoryamount is the endinginventoryreported on the December 31, 2018 balance sheet. The purchasesinformation for the first half of 2019 is available from the company's records or its suppliers.The amountsthat we have available are written in italics in the following partial income statement:

- 17. We will fill in the rest of the statement with the answersto the following calculations. The amounts in italics come from the statement above. The bold amount is the answer or result of the calculation. This can also be calculated as80% x Sales of $56,000 = $44,800. Insertingthisinformation into the income statement yieldsthe following:

- 18. As you can see, the endinginventory amount is not yet shown. We compute thisamount bysubtracting cost of goods sold from the cost of goods available: Below is the completed partial income statement with the estimated amount of endinginventory at $26,200. (Note: It is alwaysa good idea to recheck the math on the income statement to be certain you computed the amountscorrectly.) 2. Retail Method. The retail method can be used byretailerswho have their merchandise recordsin both cost and retail sellingprices.A very simple illustration for using the retail method to estimate inventory is shown here:

- 19. As you can see, the cost amountsare arranged into one column. The retail amountsare listed in a separate column. The Goods Available amountsare used to compute the cost-to-retail ratio. In this case the cost of goods available of $80,000 isdivided bythe retail amount of goods available ($100,000). This resultsin a cost-to-retail ratio, or cost ratio, of 80%. To arrive at the estimated endinginventory at cost, we multiplythe estimated endinginventoryat retail ($10,000) timesthe cost ratio of 80% to arrive at $8,000. Confused? Send Feedback Take Our Practice Quiz We recommend that you now take our free Practice Quiz for thistopic so that you can... See what you know See what you don't know Deepen your understanding Improve your retention Note: You can receive instant access to our PRO materials (visual tutorials, flashcards, quick tests, quick testswith coaching, cheat sheets, video seminars, bookkeeping and managerial guides, business forms, printable PDF files, and progress tracking) when you join AccountingCoach PRO.