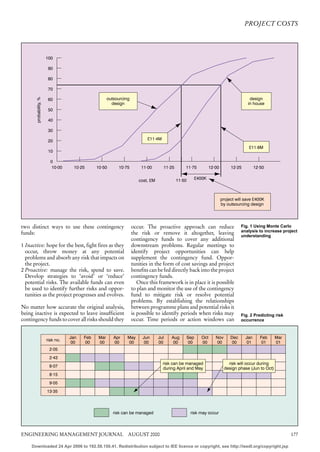

The document discusses methods to prevent project costs from escalating beyond original estimates. It identifies five common causes of cost escalation: changes to requirements, technology costs, changing quotations, organizational instability, and underestimating risks. Developing an accurate initial budget is crucial to preventing later cost issues. The budget should account for uncertainties and risks using techniques like Monte Carlo analysis. Contingency funds should then be proactively managed to mitigate risks as the project progresses, rather than passively waiting for problems. Regular risk analysis and contingency tracking can help surface issues before costs escalate.