The document discusses different ways to classify costs for accounting and decision making purposes. It covers:

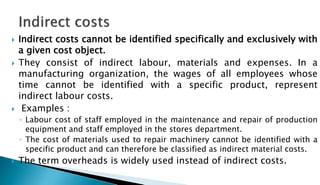

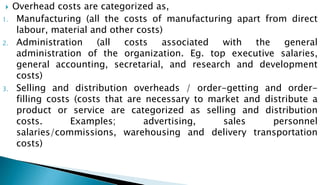

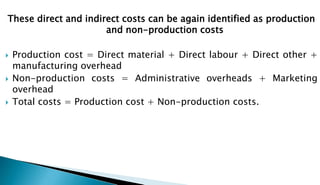

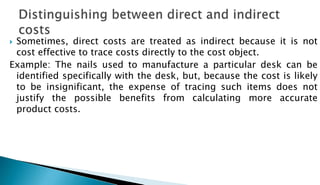

1. Direct and indirect costs can be classified as production or non-production costs. Direct costs like materials and labor can be traced to specific products, while indirect costs like maintenance cannot.

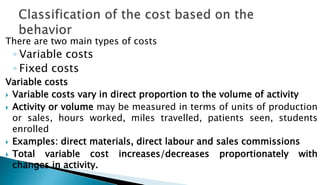

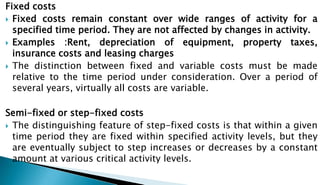

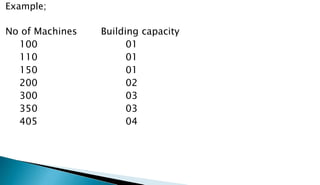

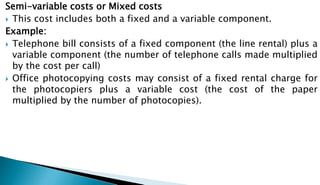

2. Costs are also classified as fixed, variable, or mixed depending on how they change with activity levels. Variable costs change with activity while fixed costs do not.

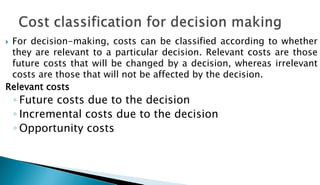

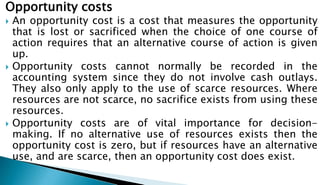

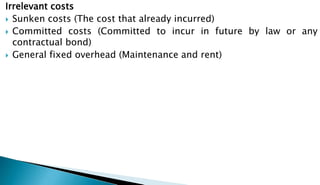

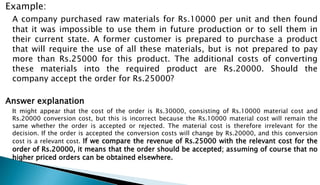

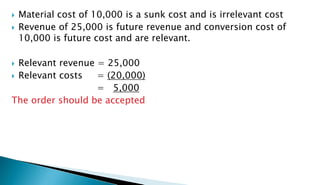

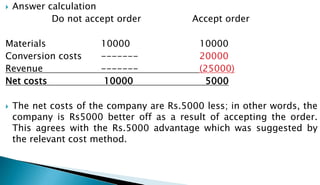

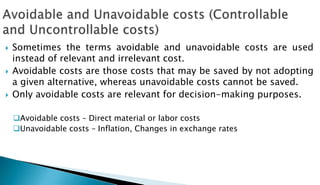

3. For decision making, costs are classified as relevant or irrelevant. Only future costs changed by a decision and opportunity costs are relevant. Sunk costs that cannot be recovered are irrelevant.