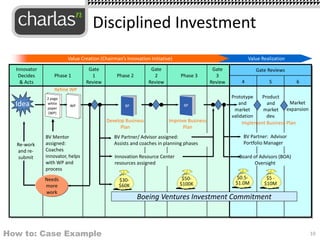

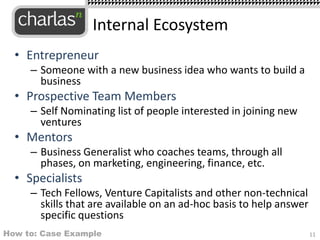

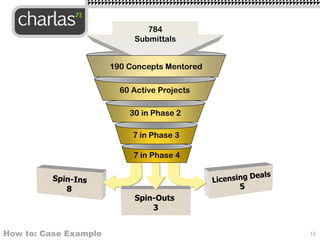

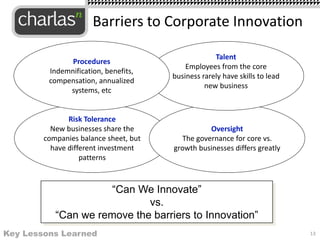

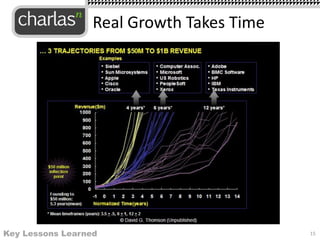

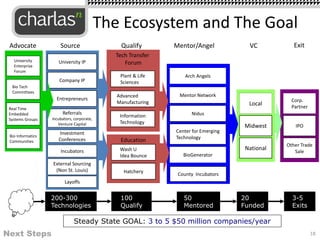

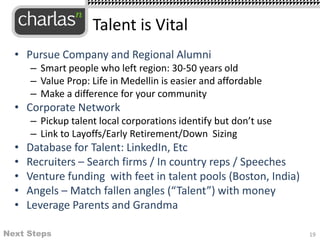

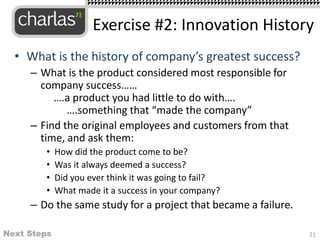

The document discusses corporate venturing and provides lessons from a case study. It begins by outlining reasons for corporate ventures including making money, subsidizing R&D, finding new technologies, and attracting talent. It then details a case study of a chairman's initiative at one company that provided funding and support for employee ideas. Key lessons from the case include the importance of an internal innovation ecosystem and barriers to corporate innovation. The document concludes with next steps around sourcing talent, assessing venture risks, studying past innovation histories, and setting goals.