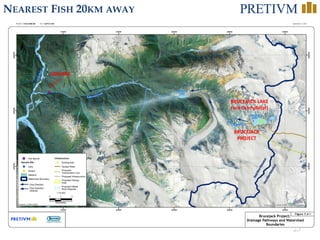

- Pretium Resources owns the high-grade gold Brucejack Project in northern British Columbia which is expected to begin commercial production in 2017.

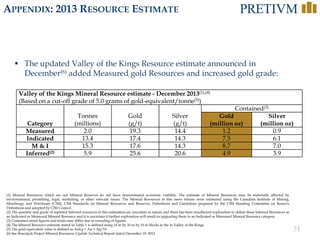

- The project has proven and probable reserves of 6.9 million ounces of gold and is forecast to produce on average 404,000 ounces annually over its 18 year mine life.

- A feasibility study estimates the project will generate over $2 billion in pre-tax net cash flow with an IRR of 34.7% at base case metal prices.