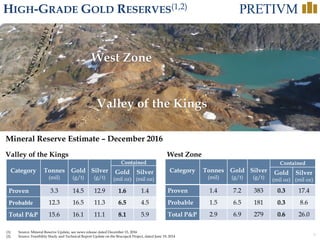

The document provides an overview of Pretium Resources Inc. and its Brucejack high-grade gold project in northern British Columbia. Construction is underway, with commercial production targeted for 2017. The project is fully funded and has high-grade reserves of 8.1 million ounces of gold. The economics are robust even at lower gold prices, with an after-tax IRR of 16.8-36.3% and payback of 3.5-5 years depending on gold price. The project is open in multiple directions, offering potential to expand resources and reserves as exploration continues.