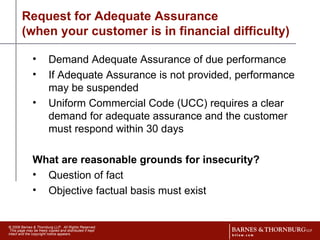

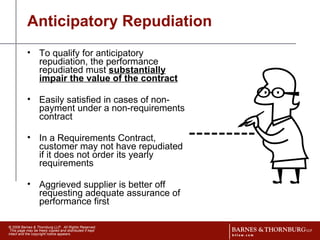

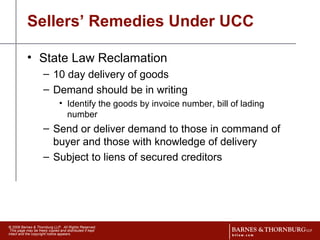

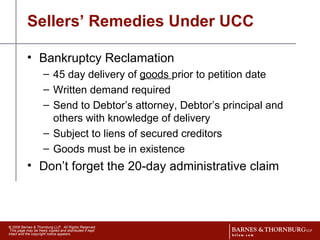

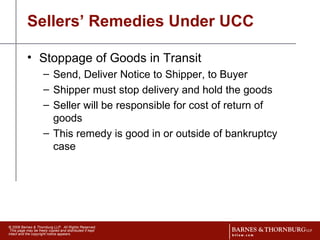

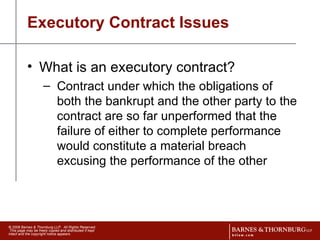

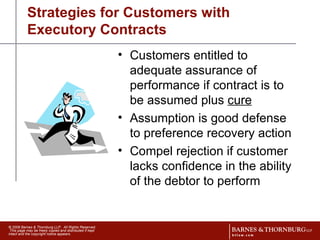

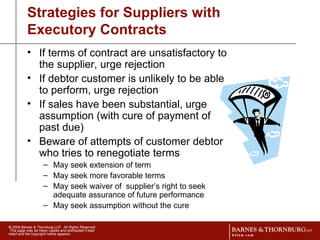

This document summarizes strategies for suppliers dealing with debtors, including offering supply agreements or purchase orders to form valid contracts, ensuring terms and conditions are consistently applied, obtaining thorough credit applications, using personal guaranties, requesting adequate assurance of performance if a customer's financial stability is in question, exercising remedies like reclamation or stoppage of goods, dealing with executory contracts in bankruptcy, and strategies for both customers and suppliers in bankruptcy proceedings.

![Fifty Ways to Leave Your Debtor: Strategies for Suppliers Deborah L. Thorne, Esq. Barnes & Thornburg LLP (312) 357-1313 [email_address]](https://image.slidesharecdn.com/fiftywaystoleaveyourdebtor-100817182008-phpapp02/75/Fifty-Ways-to-Leave-Your-Debtor-1-2048.jpg)

![Thank You Deborah L. Thorne, Esq. Barnes & Thornburg LLP (312) 357-1313 [email_address]](https://image.slidesharecdn.com/fiftywaystoleaveyourdebtor-100817182008-phpapp02/85/Fifty-Ways-to-Leave-Your-Debtor-22-320.jpg)