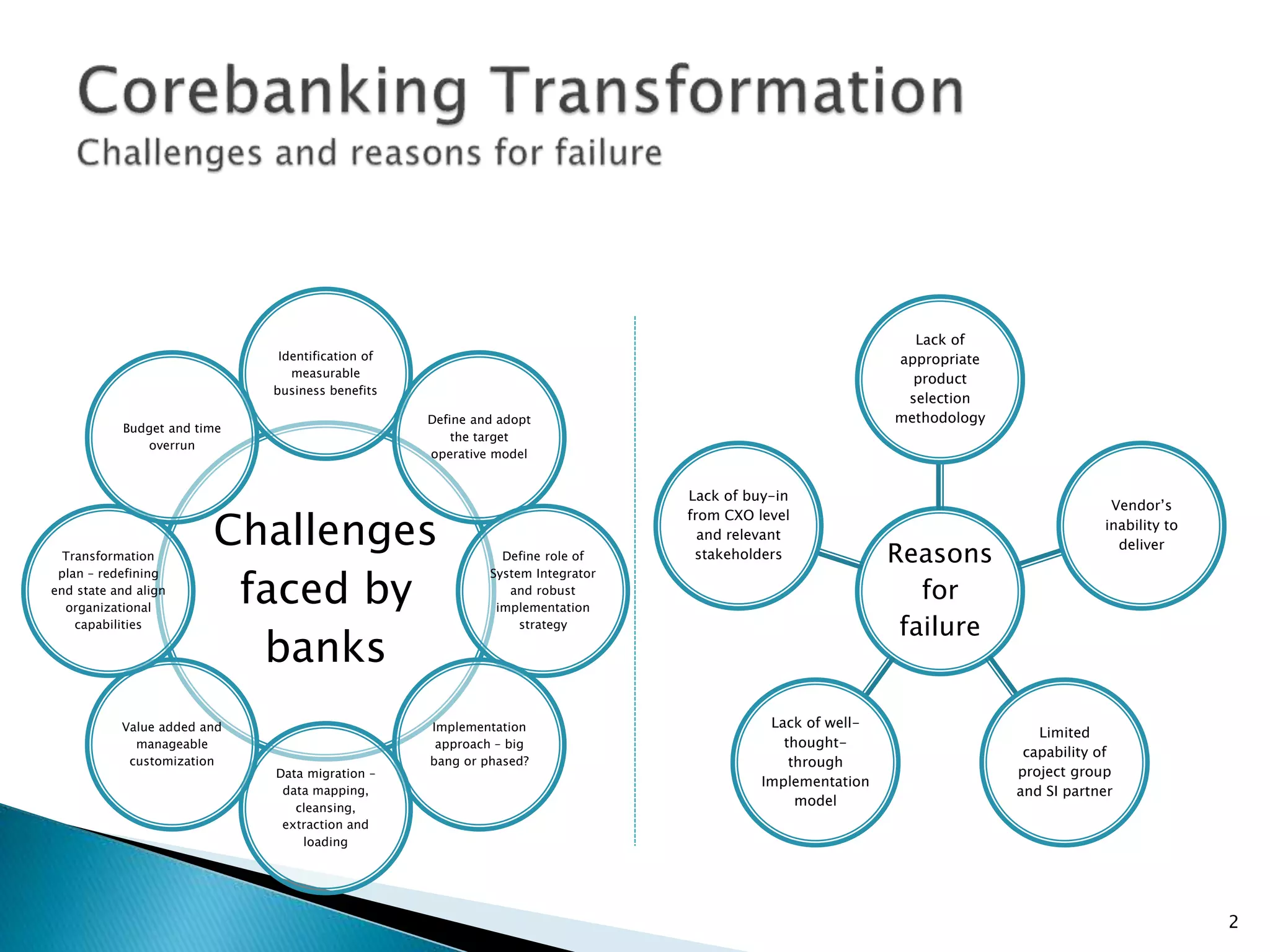

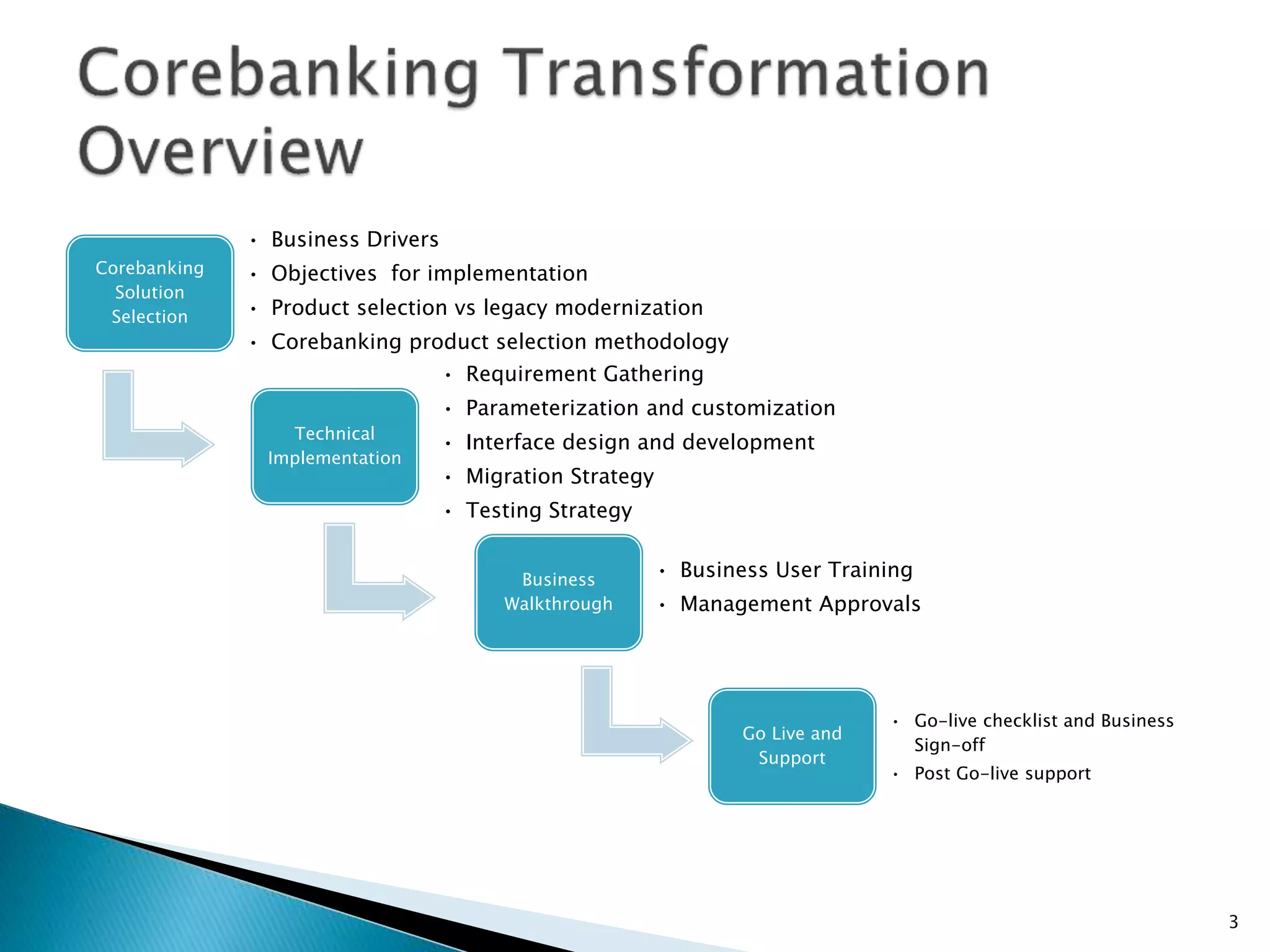

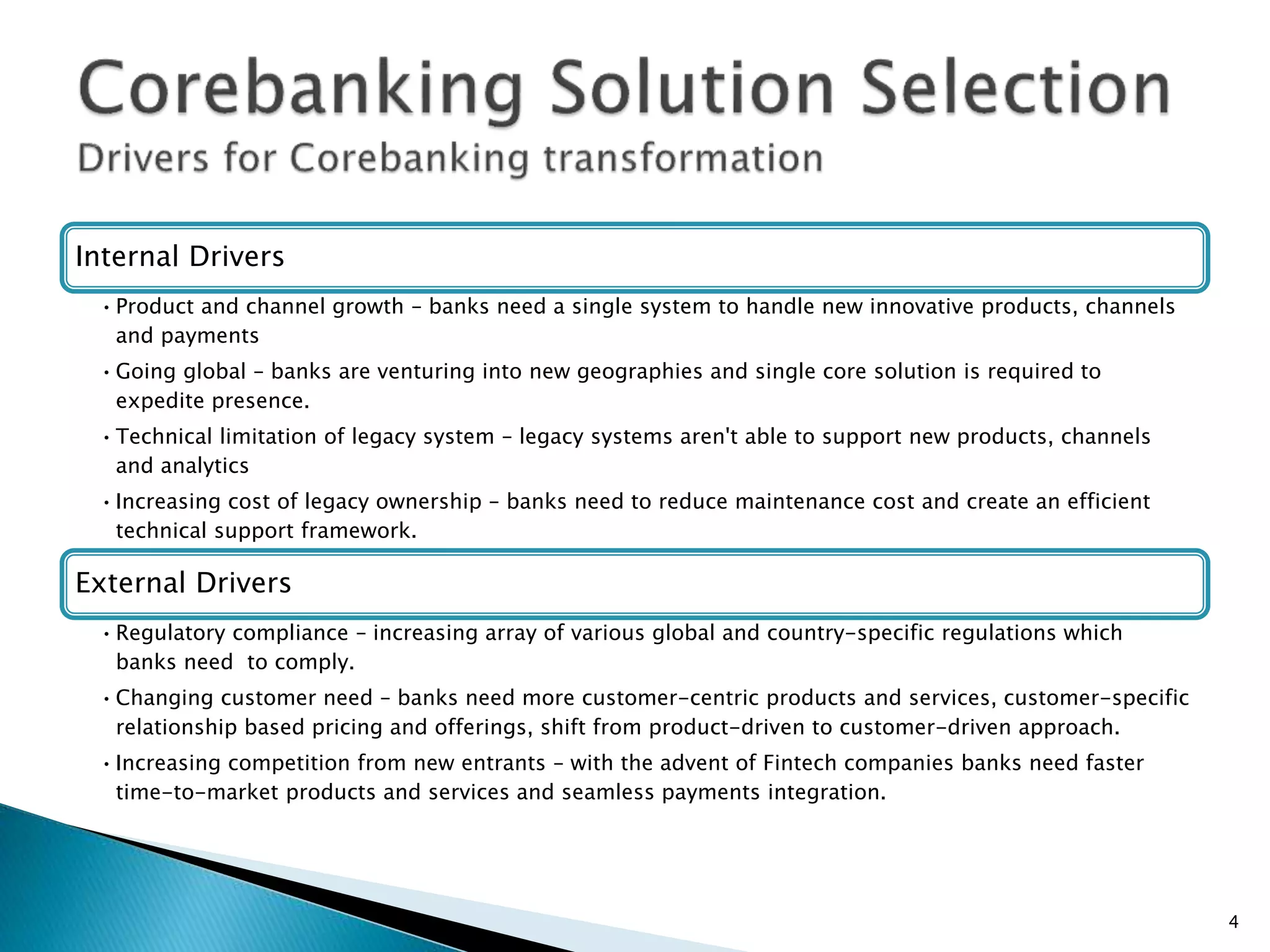

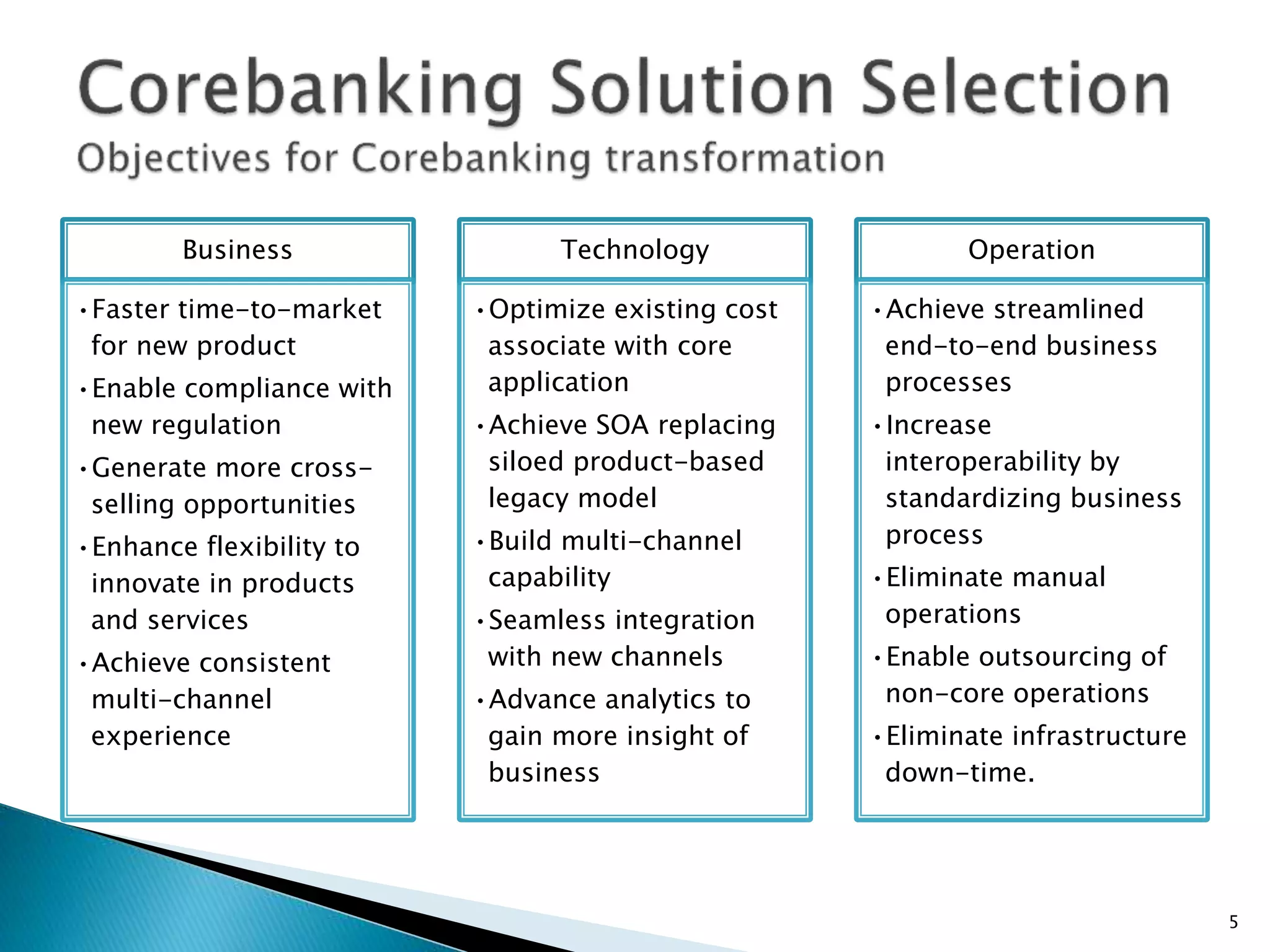

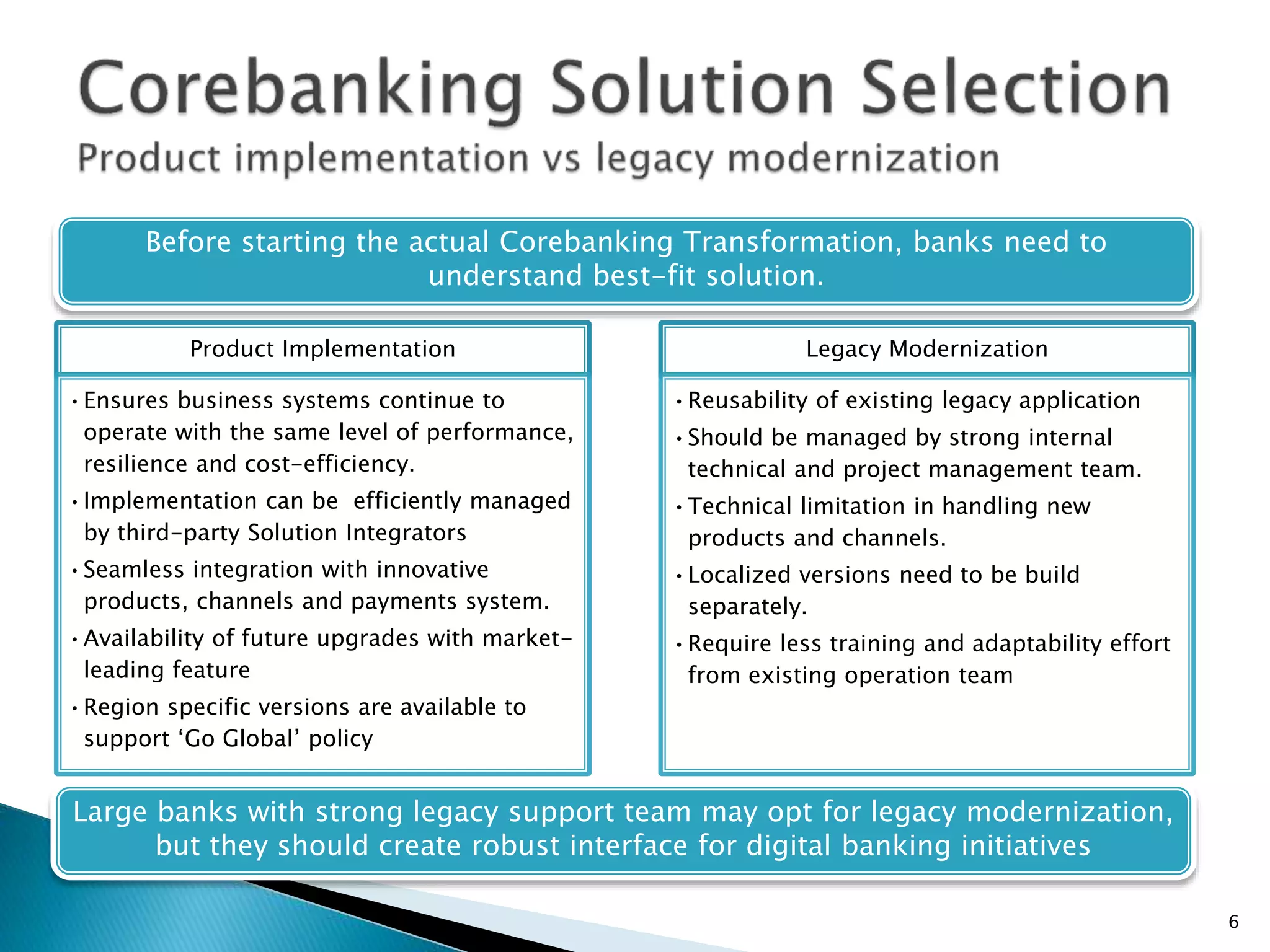

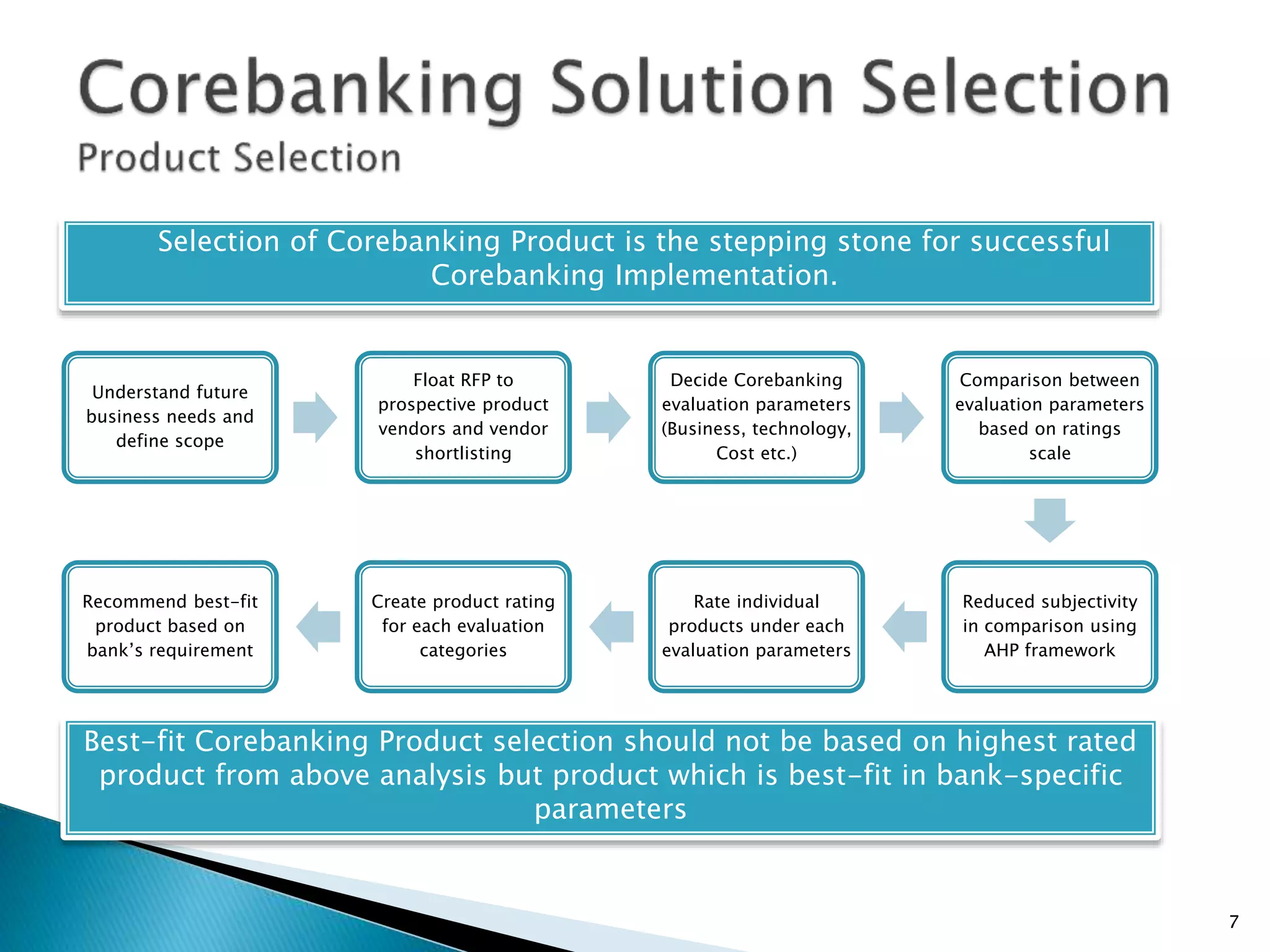

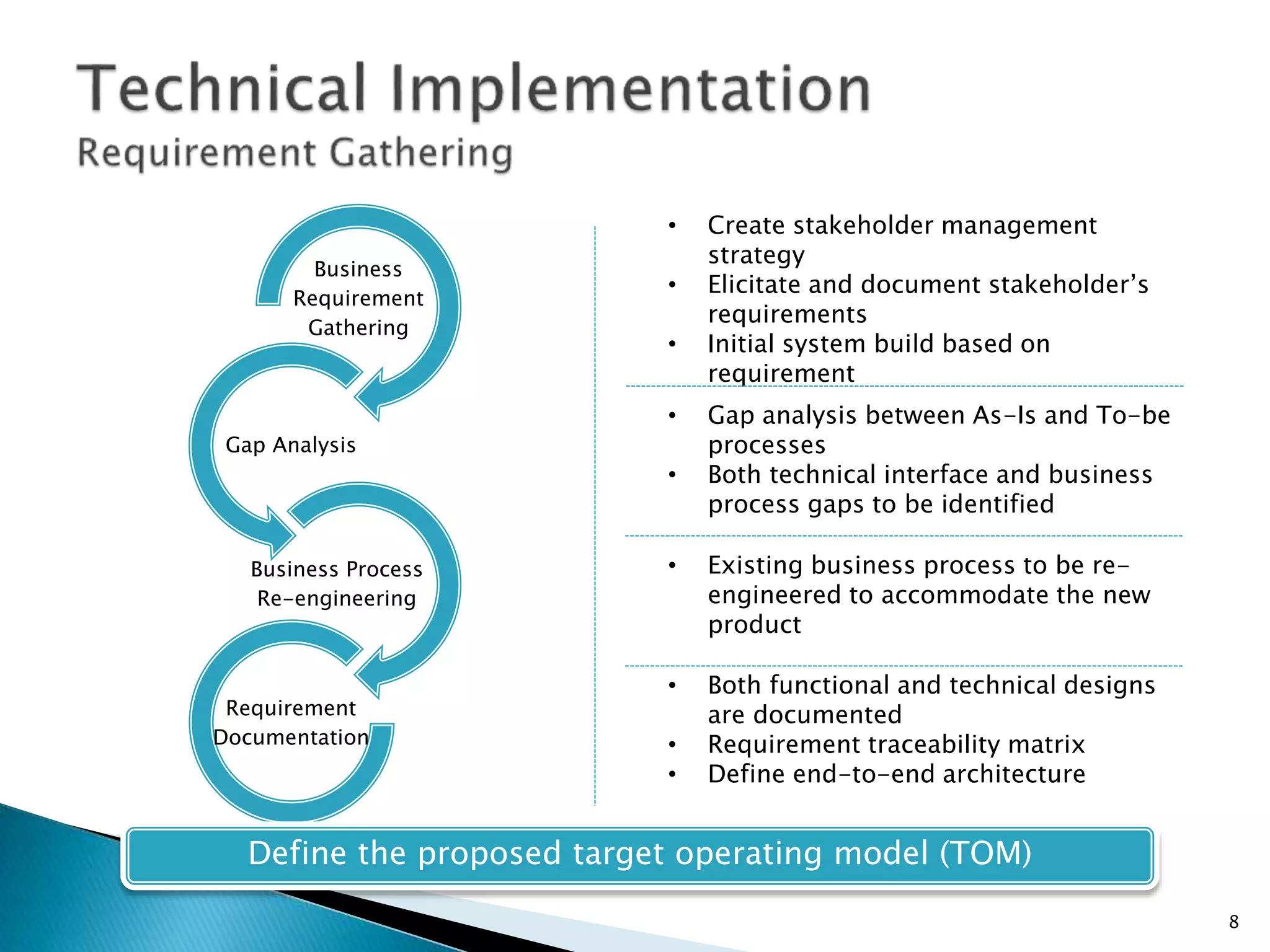

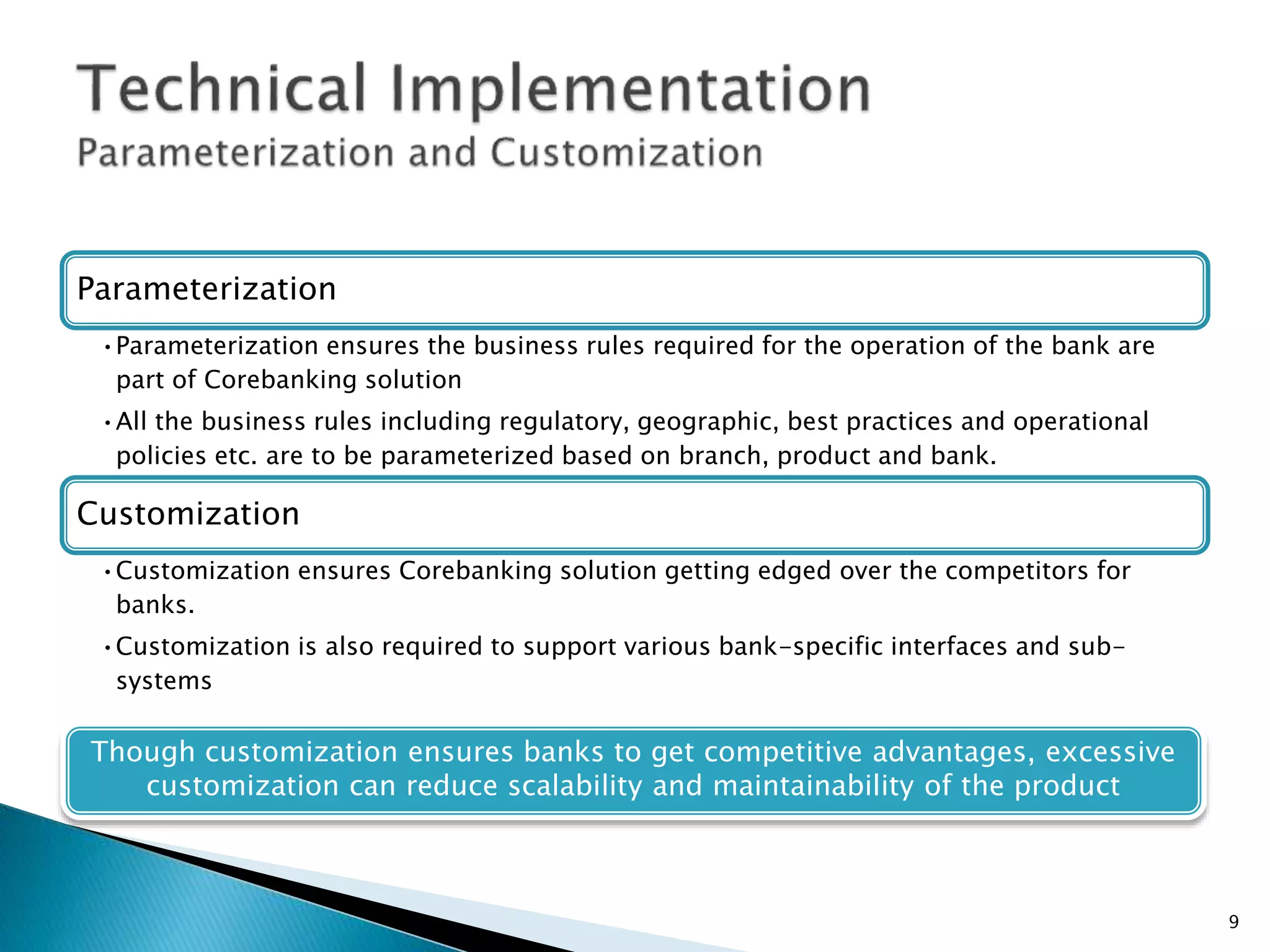

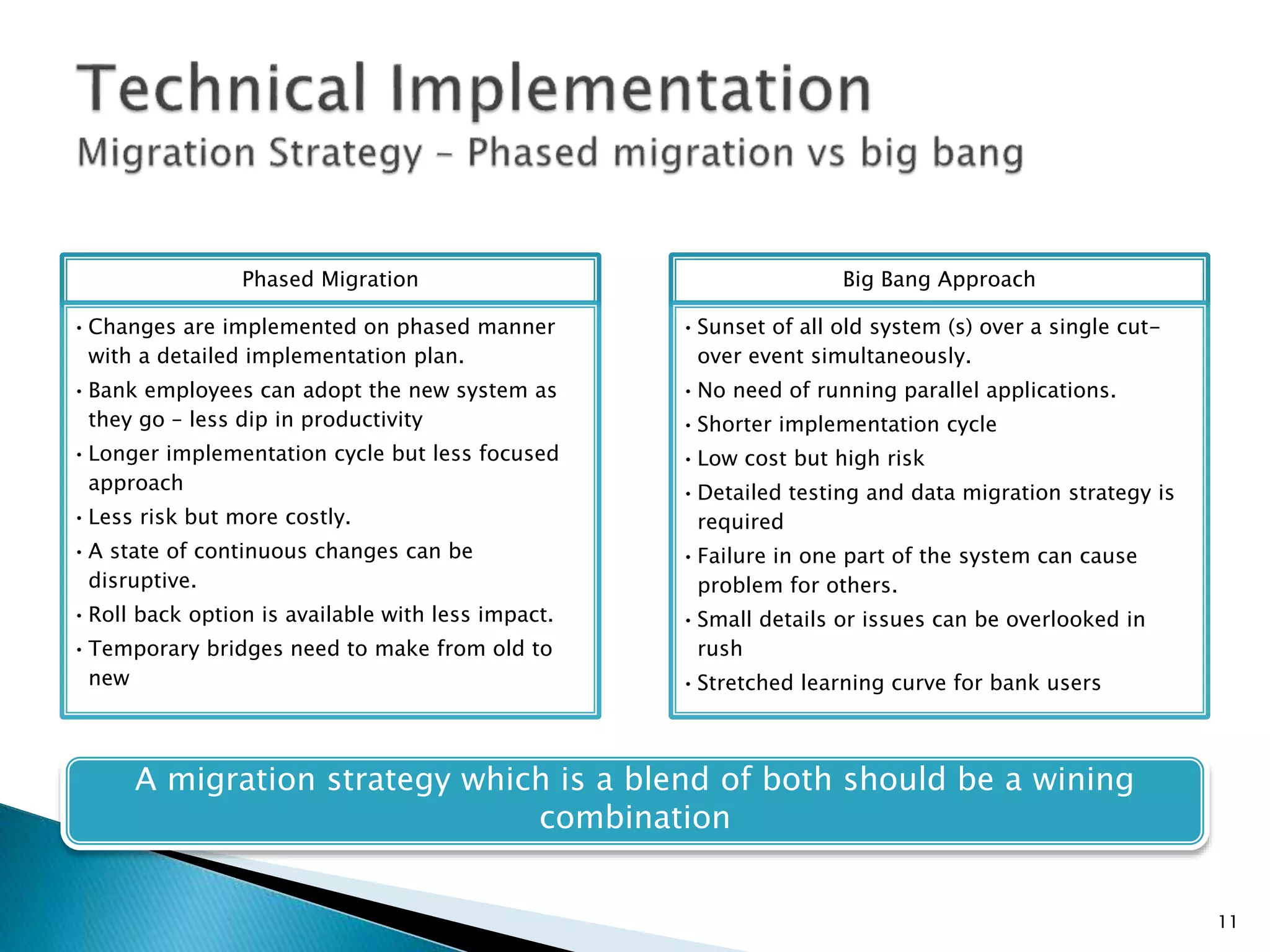

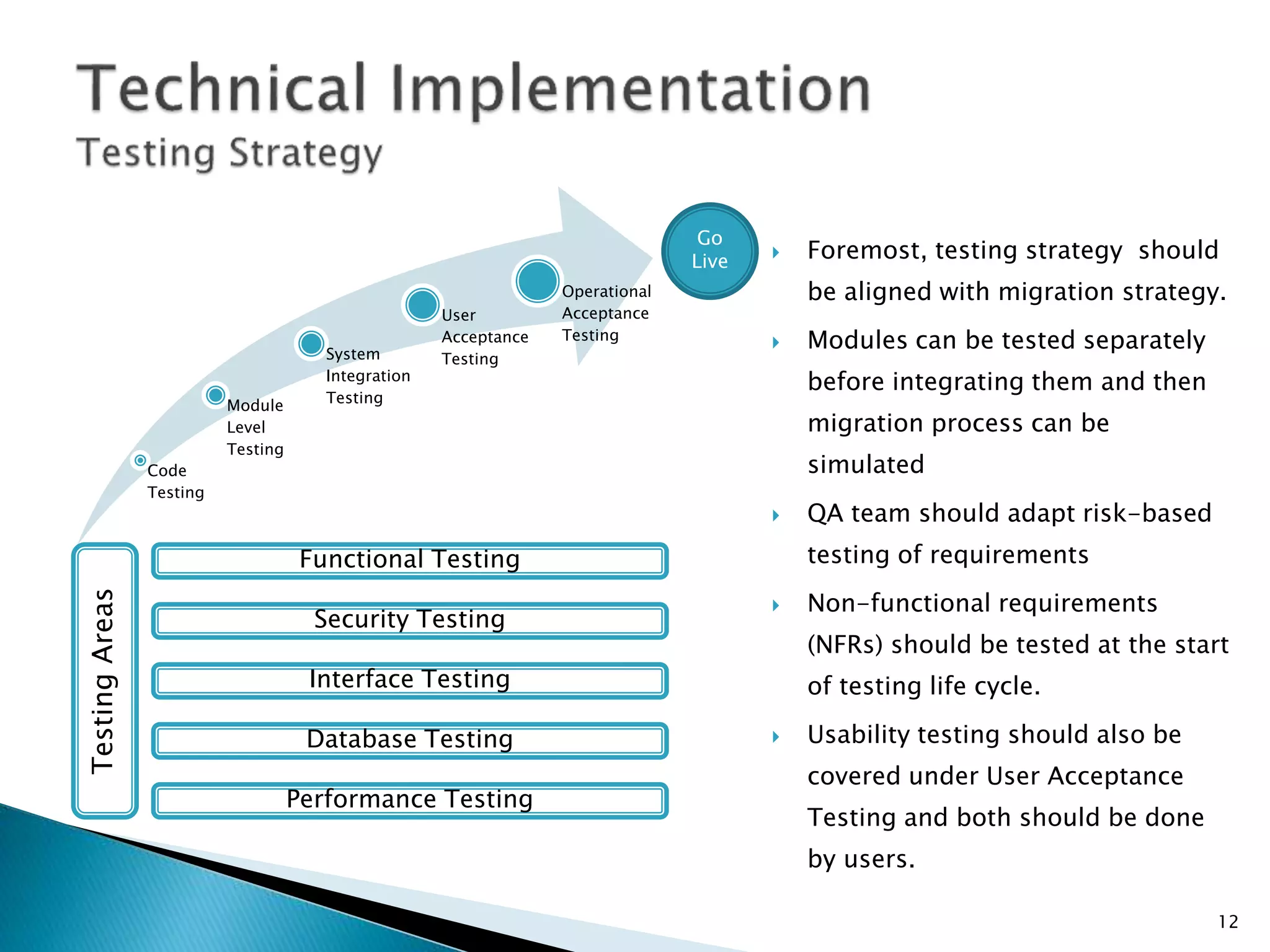

This document discusses the key considerations for a successful core banking system implementation. It begins by outlining common challenges faced by banks during implementation projects. It then covers each phase of the implementation process from product selection and requirement gathering to testing, training, go-live, and post-go live support. For each phase, it provides guidance on best practices such as selecting a product that fits the bank's long-term needs, taking a phased migration approach, and establishing robust testing and support plans. The overall message is that banks must plan thoroughly across all phases of implementation and consider stakeholder buy-in, change management, and post-go-live operations to achieve a smooth transition to a new core banking system.