The document is a subject guide for the MN2177 Core Management Concepts course offered by the University of London International Programmes, encompassing essential theories in economics, management, finance, and social sciences. It outlines the course objectives, learning outcomes, and structure, focusing on the evolution of management practices and key concepts from various academic disciplines. The guide serves as an introduction to the materials needed for studying management, including essential readings and examination advice.

![MN2177 Core management concepts

2

1.3 Syllabus

The full syllabus for this course can be found in Appendix 1 on p.177 at

the end of the guide.

1.4 Aims of the course

The aims of the course are to:

• give you a thorough grounding in the key management sub-disciplines

• provide an overview of the development of these disciplines

• illustrate the disciplinary anchors of these disciplines in sociology,

psychology and economics.

1.5 Learning outcomes for the course

At the end of the course, and having completed the Essential reading and

activities, you should be able to:

• demonstrate an understanding of core management concepts

• apply these concepts to specific business situations

• analyse and evaluate managerial tools such as balance sheets and

marketing plans

• explain the relevance of social science to business practice.

1.6 Overview of learning resources

1.6.1 The subject guide

This subject guide presents a basic introduction to the concepts of

management covered in the course. It seeks to describe and explain

the central concepts, and to provide reading lists and advice on the

examination. However:

1. It is not a textbook and often refers you to other texts or readings.

2. If you do not follow up the Essential readings, you will find it very

difficult to do well in the examination.

For each chapter, we recommend that you begin by reading the text of the

guide itself and thinking about the ‘Test your knowledge and understanding’

question at the end of each chapter, then work through the Essential

readings outlined at the start of the chapter. Further reading is identified

should you wish to study a topic in more detail, and a comprehensive list

can be found on the virtual learning environment (VLE).

The advice normally given to International Programmes students is that,

if they are studying one course over a year, they should allow at least six

hours of study every week.

1.6.2 Essential reading

To study this course, you need to study Essential readings from a range of

textbooks and academic journals.

Textbooks to borrow or purchase

Make sure you have a copy of the core textbook for the course:

Willman, P. Understanding management: social science foundations. (Oxford:

Oxford University Press, 2014) [ISBN 9780198716921].](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-10-320.jpg)

![Chapter 1: Introduction

3

This will be referred to as ‘Willman’ in the reading lists at the beginning of

each chapter, followed by the relevant chapter or theme numbers.

You will also need to refer to several chapters of the following book so

either make sure that you have access to a library copy or purchase it:

Kaplan, R. and A. Atkinson Advanced management accounting. (Harlow: Pearson

Education, 1998) third edition [ISBN 9780130802200].

Detailed reading references in this subject guide refer to the editions of the

set textbooks listed above. New editions of one or more of these textbooks

may have been published by the time you study this course. You can use

a more recent edition of any of the books; use the detailed chapter and

section headings and the index to identify relevant readings. Also check

the VLE regularly for updated guidance on readings.

Other Essential readings

The guide also refers to various other Essential readings. We aim to ensure

that all these are freely available to you. As a general rule, if an Essential

reading is a journal article, you will be able to find it in the Online Library;

if it is an extract from a book, registered students on the course will be

able to download it from the VLE. We have also made a few of the further

readings available to download from the VLE.

If you have any problems accessing any of the Essential readings, let us

know by raising a query via the Student Portal.

1.6.3 Further reading

Please note that as long as you read the Essential reading you are then free

to read around the subject area in any text, paper or online resource. You

will need to support your learning by reading as widely as possible and by

thinking about how these principles apply in the real world. To help you

read extensively, you have free access to the VLE and University of London

Online Library (see below).

A list of Further readings relevant to the subject matter covered in each

chapter is given at the beginning of the chapters. You can find a complete

list of all the Further reading and references cited on the VLE.

You may also find the following additional textbooks useful in relation to

the different parts of the course:

Additional introductory reading

Witzel, M. Builders and dreamers: the making and meaning of management.

(Harlow: Pearson, 2002) [ISBN 9780273654377].

Accounting

Atkinson, A.A., R.S. Kaplan, E. Matsumura and S.M. Young Management

accounting. (Harlow: Pearson, 2011) [ISBN 9780273760160].

Business strategy

Grant, R.M. Contemporary strategy analysis. (Chichester: John Wiley & Sons,

2012) [ISBN 9781119941880].

Finance

Brealey, R.A., S.C. Myers and F. Allen Principles of corporate finance – global

edition. (Maidenhead: McGraw Hill, 2013) [ISBN 9780077151560].

Marketing

Weitz, B.A. and R. Wensley Handbook of marketing. (London: Sage, 2006)

[ISBN 9781412921206].](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-11-320.jpg)

![MN2177 Core management concepts

4

Operations management

Hopp, W.J. and M.L. Spearman Factory physics. (Long Grove, Illinois: Waveland

Press, 2011 reissue of 2008 edition) [ISBN 9781577667391].

Organisational behaviour

Buchanan, D. and A. Huczynski Organisational behaviour. (Harlow: Pearson,

2013) [ISBN 9780273774815].

1.6.4 Online study resources

In addition to the subject guide, it is crucial that you take advantage of the

study resources that are available online for this course, including the VLE

and the Online Library.

You can access the VLE, the Online Library and your University of London

email account via the Student Portal at:

http://my.londoninternational.ac.uk

You should have received your login details for the Student Portal with

your official offer, which was emailed to the address that you gave on

your application form. You have probably already logged in to the Student

Portal in order to register. As soon as you registered, you will automatically

have been granted access to the VLE, Online Library and your fully

functional University of London email account.

If you have forgotten these login details, please click on the ‘Forgotten

your password’ link on the login page.

The VLE

The VLE, which complements this subject guide, has been designed to

enhance your learning experience, providing additional support and a

sense of community. It forms an important part of your study experience

with the University of London and you should access it regularly.

The VLE provides a range of resources for EMFSS courses:

• Self-testing activities: Doing these allows you to test your own

understanding of subject material.

• Electronic study materials: The printed materials that you receive from

the University of London are available to download, including updated

reading lists and references.

• Past examination papers and Examiners’ commentaries: These provide

advice on how each examination question might best be answered.

• A student discussion forum: This is an open space for you to discuss

interests and experiences, seek support from your peers, work

collaboratively to solve problems and discuss subject material.

• Videos: There are recorded academic introductions to the subject,

interviews and debates and, for some courses, audio-visual tutorials

and conclusions.

• Recorded lectures: For some courses, where appropriate, the sessions

from previous years’ Study Weekends have been recorded and made

available.

• Study skills: Expert advice on preparing for examinations and

developing your digital literacy skills.

• Feedback forms.

Some of these resources are available for certain courses only, but we

are expanding our provision all the time and you should check the VLE

regularly for updates.](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-12-320.jpg)

![Chapter 2: Management and the firm

7

Chapter 2: Management and the firm

2.1 Learning outcomes and reading

2.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• explain key elements in the history of the firm

• discuss the main theories of firm formation

• outline several key managerial problems in the firm.

2.1.2 Essential reading

Willman, Chapters 1 and 2.

2.1.3 Further reading

Chandler, A. The visible hand: the managerial revolution in American business.

(Harvard: Harvard University Press, 1977) [ISBN 9780674940529].

Di Maggio, P. ‘Introduction: making sense of the contemporary firm and

prefiguring its future’ in Di Maggio, P. (ed.) The twenty-first century firm:

changing organisation in international perspective. (Princeton: Princeton

University Press, 2001) [ISBN 9781400828302].

Jensen, M.C. and W.H. Meckling ‘The theory of the firm: managerial behaviour,

agency costs and ownership structure’, Journal of Financial Economies 3

1976, pp.305–60.

Williamson, O.E. ‘The modern corporation; origin, evolution, attributes’,

Journal of Economic Literature 19 1981, pp.1537–68.

2.1.4 Works cited

Arrow, K. J. The limits of organization. (New York: Norton, 1974)

[ISBN 9780393093230].

Bromiley, P. The behavioral foundations of strategic management. (Oxford,

Blackwell, 2005) [ISBN 9781405124706].

Cassis, Y. ‘Big business’ in Jones, G. and Zeitlin, J. (eds) The Oxford

handbook of business history. (Oxford: Oxford University Press, 2007)

[ISBN 9780199263684; 9780199573950], p171–94.

Coase, R.H. ‘The nature of the firm’, Economica, 4(16), 1937, pp.386–405.

Coase, R.H. The firm, the market and the law. (Chicago, Ill: University of

Chicago Press, 1988) [ISBN 9780226111001].

Davis, G. Managed by the markets. (Oxford: Oxford University Press, 2009)

[ISBN 9780199216611].

Doeringer, P. and M. Piore Internal labour markets and manpower analysis.

(Armonk, NY: M.E. Sharpe, [1971] 1985) [ISBN 9780873323321].

Ghoshal, S. and P. Moran ‘Bad for practice: a critique of the transaction cost

theory’, Academy of Management Review 21(1) 1996, pp.13–47.

Gospel, H. ‘The management of labor and human resources’ in Jones, G. and

Zeitlin, J. (eds) The Oxford handbook of business history. (Oxford: Oxford

University Press, 2007) [ISBN 9780199573950], pp.420–46.

Landes, D.S. The Unbound Prometheus: Technological Change and Industrial

Development in Western Europe from 1750 to the Present. (Cambridge:

Cambridge University Press, 2003) [ISBN 9780521534024].

Michie, R.C. The global securities market. (Oxford: Oxford University Press,

2006) [ISBN 9780199280612].

Penrose, E. The theory of the growth of the firm. (Oxford: Oxford University

Press, [1959] 2009) [ISBN 9780191570360].](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-15-320.jpg)

![MN2177 Core management concepts

8

Pfeffer, J. New directions for organisational theory. (Oxford: Oxford University

Press, 1997) [ISBN 9780195114348].

Prais, S.J. The evolution of giant firms in Britain. (Cambridge: Cambridge

University Press, 1981) [ISBN 9780521282734].

Salaman, G. Class and the corporation. (London: Fontana, 1981)

[ISBN 9780006355182].

Thompson, E.P. The making of the English working class. (London: Penguin,

1966) [ISBN 9780394703220].

Williamson, O.E. The economic institutions of capitalism. (New York: Free Press,

1985) [ISBN 9780684863740].

2.2 Introduction

The corporate firm is a rather late arrival on the scene. Before the 19th

century, only a handful of corporate-type entities existed and these

were largely extensions of state power. Companies such as the Hudson

Bay Company or the Dutch East India Company were important agents

of empire. Governments granted them exclusive rights to trade and

to conduct business in certain markets or products. So, for example,

in 1670 the Hudson Bay Company was granted exclusive rights to fur

trapping in large areas of Canada by the British government. It was a truly

international venture, being the idea of two Frenchmen who gained a

Royal Charter in Britain with the encouragement of Boston merchants. The

company built forts, extended the speaking of English, founded cities and

established distribution channels. The Hudson Bay Company still exists in

Canada as a chain of department stores. At its inception, the company had

32 investors who shared risks and returns.

The Dutch East India Company, founded earlier, in 1602, funded risky

long-distance trading in any items between Europe and the Far East.

Investors, primarily in Amsterdam, would pool funds to support risky

trips which, if successful, provided huge returns. This in turn prompted

the development of the Amsterdam securities market in which spot and

future contracts, call and put options, hedging and short selling were all

possible (Michie, 2006, p.27). The number of investors was very large

indeed. These entities have some important characteristics for the future

analysis of the firm. Investors control supply side risk (with monopoly)

before sharing investor risk, they get government to provide the support,

and they diversify away some operational risk by embracing a range of

uncorrelated activities.

2.3 The British experience

The Industrial Revolution took off in Britain in the early 19th century and,

as Michie notes, in the period before 1850, ‘The British economy remained

mostly untouched by joint stock enterprise’ (2006, p.69). Enterprises

were either entrepreneurially owned, as in manufacturing, or owned by

local inhabitants, as in utilities and canals, and were funded by retained

profit or bank loans. Railways changed everything, requiring large-scale

finance but set against the prospect of steady low-risk returns from

natural monopoly. This provided investors with an attractive alternative to

government debt.

A crucial early development in Britain occurred in the textile industry:

the growth of the factory. As well as the massive impact on output, it is

significant for the development of management as an activity. Historically,

cloth had been produced domestically (for example, in the home),

usually by workers who had other concerns such as farming, using simple](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-16-320.jpg)

![MN2177 Core management concepts

10

own distribution and purchasing facilities, whose various

functions, including marketing, were entrusted to a hierarchy of

salaried managers, and which tended to cluster around sectors

where economies of scale and scope could be achieved through

mass production.

(2007, p.178)

This was more true of the USA than many parts of Europe.

The impact of the First World War was crucial. First, these mass-

production industries – food, chemicals, oil, engineering – became central

to the war effort, and expanded considerably. There was little product

market competition. After the war, there were further merger waves in

these sectors, particularly in Germany (Cassis, 2007, p.181). Big business

became bigger. Second, there was a massive change to the labour market:

labour markets were tight (because labour was scarce) and labour was

crucial to the fighting of industrialised war. In Europe, a significant

proportion of the male labour force was in the army, then dead. Unions

became strong and employers had to bargain. Global securities markets

collapsed. There was a mass of government debt to compete with equity

investment. Governments wanted to control the securities markets in

which this debt was traded and capital markets contracted. UK investors

sold massive amounts of overseas securities and the London stock market

became more localised. US investors had a very good war, and US markets

– particularly New York – grew massively. As Michie puts it:

…the global securities market was reduced to a series of

compartmentalized marketplaces only loosely linked to each

other rather than the fully integrated system that was in full

flow before 1914.

(2006, p.204)

After the War, in the 1920s and 1930s, government involvement in

business, particularly in European labour and capital markets, continued.

2.5 Market failure and management

Coase argues that firms exist because of market – or, more specifically,

price mechanism – failure in the presence of transaction costs.

[T]he fact that it costs something to enter into…transactions

means that firms will emerge to organize what would otherwise

be market transactions whenever their costs were less than

the costs of carrying out the transactions through the market.

(1988, p.7)

Certain types of transactions in markets entail considerable costs of price

discovery, negotiation and enforcement. For such transactions, Coase

argues, it may be more efficient for what he terms an ‘entrepreneur’ to use

‘authority’ to direct resources to their most efficient ends. The boundary of

the firm is set where the costs of organising a transaction within the firm

equal the costs of carrying it out through the market. Within this boundary,

the firm makes products or services; beyond it, it buys or sells them.

The revolutionary idea that Coase introduced in 1937 was the notion of

transaction costs. Much later, he argued that without transaction costs

firms would not exist, but nor would markets (1988, pp.6–8). Although

economists were primarily interested in markets, they focused primarily

on prices, and when they discussed market structure, they referred to

the number of firms and products, rather than the ‘social institutions that

facilitate exchange’ (1988, p.8) and thus defined transaction costs.](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-18-320.jpg)

![Chapter 3:Taylorism, motivation and performance

17

Chapter 3: Taylorism, motivation and

performance

3.1 Learning outcomes and reading

3.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• describe the main elements of Taylor’s approach

• discuss the strengths and limitations of scientific management

• explain the main elements of the human relations approach.

3.1.2 Essential reading

Willman, Theme 1.

3.1.3 Further reading

Braverman, H. Labor and monopoly capital. (New York: Monthly Review Press,

1974) [ISBN 0853453403]; 1988 edition [ISBN 9780853459408].

Guillen, M.F. Models of management: work, authority and organisation in

a comparative perspective. (Chicago: Chicago University Press, 1994)

[ISBN 9780226310367].

McGregor, D. The human side of enterprise. (New York: McGraw-Hill, [1960]

2006) [ISBN 9780140091243] Chapter 1: Management and scientific

knowledge.

Taylor, F.W. The principles of scientific management. (New York, Harper, 1923)

[ISBN 9781599866796] Chapter 1.

3.1.4 Works cited

Abernathy, W.J. The productivity dilemma. (Baltimore: Johns Hopkins, 1978)

[ISBN 9780801820816].

Batt, R. and Moynihan, L. ‘The viability of alternative call centre production

models’, Human Resource Management Journal, 12(4), 2002, pp.14–34.

Burawoy, M. Manufacturing consent: changes in the labor process under

monopoly capitalism. (Chicago: University of Chicago Press, 1979)

[ISBN 9780226080383].

Granovetter, M. ‘Economic action and social structure: a theory of

embeddedness’, American Journal of Sociology 91 1985, pp.481–510.

Lewchuk, W. ‘Fordism and British motor car employees, 1896–1932’

in H.F. Gospel and C.R. Littler Managerial strategies and industrial

relations: an historical and comparative study. (Farnham: Ashgate, 1983)

[ISBN 9780435323653].

Marglin, S. ‘What do bosses do?’, Review of Radical Political Economics 6 1974,

pp.60–112.

Mayo, E. The human problems of an industrial civilization. (New York:

Macmillan, 1933).

Nelson, D. Frederick W. Taylor and the rise of scientific management. (Madison:

University of Wisconsin Press, 1980) [ISBN 9780299081607].

Nelson, D. A mental revolution: scientific management since Taylor. (Columbus,

OH: Ohio State University Press, 1992) [ISBN 9780814205679].

Norwich, J.J. A History of Venice. (London: Allen Lane, 1982)

[ISBN 0713915625].

Quattrone, P. ‘Accounting for God: accounting practices in the Society of Jesus’,

Accounting, Organisations and Society 29 2004, pp.647–83.](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-25-320.jpg)

![MN2177 Core management concepts

18

Rose, M. Industrial behaviour. (London: Penguin, 1988) [ISBN 0140091335].

Sabel, C.F. Work and politics: the division of labor in industry. (Cambridge:

Cambridge University Press, 1982) [ISBN 9780521230025].

Thompson, E.P. The making of the English working class. (London: Penguin,

1966) [ISBN 9780394703220].

Willman, P. Technological change, collective bargaining and industrial efficiency.

(Oxford: Oxford University Press, 1986) [ISBN 9780198272625].

Witzel, M. Builders and dreamers: the making and meaning of modern

management. (Harlow: Prentice Hall (2002) [ISBN 9780272654377].

Wren, D.A. The History of Management Thought. (New York, Wiley, 2005).

[ISBN 9780471669227].

3.2 Introduction

The 19th and early 20th centuries in Europe and USA were, arguably,

characterised by two features relevant to the design and conduct of

business. The first was a belief in technological progress (and its benefits).

The second was an inclination towards optimisation; put differently, if one

thought systematically and rationally about a business problem, one could

improve the chosen dependent variable – efficiency, productivity, profits,

etc. In the absence of a theory of the firm, many analysts and practitioners

felt the appliance of science to the factory could yield substantial benefits.

Many had an engineering background (Witzel, 2002) and, again arguably,

saw the optimisation problem as an engineering problem.

The problem to be optimised was how to run the most efficient business.

Intellectual furniture existed; there were not many examples of large-

scale manufacturing businesses but there was a history of large-scale

organisation in two fields: government (particularly military) and religion

(particularly international religious orders). In these organisations, many

‘managerial’ techniques had been developed. I offer two examples.

Jesuits knew about accounting. They had resources, international reach

and an objective: saving souls. But,

A strictly economic analysis of the nature and role of accounting

as an instrument for allocating, monitoring, and administering

resources within the hierarchical structure of the Society of

Jesus would leave undiscovered important aspects of the

practices deployed by the Order to manage, organise, and

account for its multifaceted activities.

(Quattrone, 2004, p.675)

How to optimise the allocation of resources to maximise the saving of

souls? The first thing one needs is a management accounting system to

tell you where the resources come from and go to. The second thing, more

controversial perhaps, is you have to put an economic value on a soul. At

the margin, one might have to choose which soul to save or whether the

expenditure was worth the return.

Venice knew about fighting wars at sea to generate and protect trade (they

are not the only historical example). In the Arsenale, they built assembly

lines.

[Venice] could standardise designs and build up stores of spare

parts, making it possible to complete even major refits in a

fraction of the time… the designs themselves, as well as the

techniques, could be revolutionized….One of the secrets of

Venice’s rise to power lay in the fact that she never saw the twin

necessities of defence and commerce as altogether separate…

the nobles were merchants and the merchants noble…

(Norwich, 1982, p.109)](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-26-320.jpg)

![Chapter 4:The rise and decline of labour

27

Chapter 4: The rise and decline of labour

4.1 Learning outcomes and reading

4.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• outline the key features of the history of labour unions

• describe the potential benefits of unions to firms and employees

• discuss the reasons for union decline in modern industrial societies.

4.1.2 Essential reading

Freeman, R. and Medoff, J. What do unions do? (New York: Basic Books, 1984)

[ISBN 9780465091324] Chapter 11.

Willman, Chapter 3, Theme 2.

4.1.3 Further reading

Gospel, H. ‘The management of labor and human resources’ in Jones, G. and

J. Zeitlin, J. (eds) The Oxford handbook of business history. (Oxford: Oxford

University Press, 2007) [ISBN 9780199573950], pp.420–47.

Pencavel, J. ‘The demand for union services: an exercise’, Industrial and Labor

Relations Review 24(2) 1971, pp.180–90.

4.1.4 Works cited

Berg, M. The machinery question and the making of political economy.

(Cambridge: Cambridge University Press, 1980) [ISBN 9780521227827].

Blanchflower, D. and A. Bryson ‘Changes over time in union relative wage

effects in the UK and the US revisited’, Chapter 7 in J.T. Addison and

C. Schnabel (eds) International handbook of trade unions. (Cheltenham

England and Northampton Mass., USA: Edward Elgar, 2003)

[ISBN 9781840649796].

Blanchflower, D. and A. Bryson ‘What effect do unions have on wages now?’,

Journal of Labor Research 25(3) 2004, pp.383–414.

Braverman, H. Labor and monopoly capital (New York: Monthly Review Press,

1974) [ISBN 9780853453406].

Crouch, C. Trade unions: the logic of collective action. (London: Fontana, 1982)

[ISBN 978006358732].

Davis, G. Managed by the markets. (Oxford: Oxford University Press, 2009)

[ISBN 9780199216611].

Freeman, R. and J. Rogers What workers want. (Ithaca: ILR Press, 1999)

[ISBN 9780801485633].

Gomez, R., A. Bryson and P. Willman ‘Voice transformation: the shift from

union to non-union voice in Britain’ in A. Wilkinson et al. (eds) The Oxford

handbook of participation in organisations. (Oxford: Oxford University Press,

2010) [ISBN 9780199207268].

Hobsbawm, E. The age of extremes: the short twentieth century, 1914–1991.

(London: Michael Joseph, 1994) [ISBN 0718133072]. Vintage (1996)

[9780679730057].

Marglin, S. ‘What do bosses do?’, Review of Radical Political Economics 6 1974,

pp.60–112.

Tuchman, B. The proud tower. (London: Macmillan, 1966)

[ISBN 9781299237247].](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-35-320.jpg)

![MN2177 Core management concepts

28

Willman, P. Technological change, collective bargaining and industrial efficiency.

(Oxford: Oxford University Press, 1986) [ISBN 9780198272625].

Willman, P., T.J. Morris and B. Aston Union business: trade union organisation

and financial reform in the Thatcher years. (Cambridge: Cambridge

University Press, 1993) [ISBN 9780521417259].

4.2 Introduction

Although circumstances in the 19th century differed between Western

countries, particularly between nation-states in Europe and the immigrant

society of the USA, it is fair to say that industrialisation in both required

the creation of an industrial labour force. The rhythms, seasonality and

control structures of a pre-industrial and agrarian society were very

different from those needed by factory systems in the 19th century. This

was the transition that obsessed both Marx and Durkheim. Although

their analyses were very different, they were both concerned with the

disappearance of one labour pattern and its replacement by another. In

practice, it was a process that was both political and economic, full of

conflict, and lasting in its impact on both industrial practice and academic

theory.

This chapter is not a full history of this process. It is structured around

several propositions. First, industrialisation in general and the factory

system in particular required a labour force substantially different both

in its social structure and its labour practices from what preceded it.

Second, this was neither a comfortable nor welcome process for many

members of that labour force, and their resistance to it took the form both

of unionisation and political action. Third, the performance attributes of

that labour force were sufficiently central to the success of specific firms

that strategies for the management of workforces needed to move beyond

compulsion to cooperation: capital-intensive operations required both

skills and continuity, and both gave employees bargaining power. Fourth,

the generation of compliance necessitated a specific set of managerial

activities which began as labour welfare and continues as human resource

management.

Eric Hobsbawm (1994), a Marxist historian, coined the term ‘the short

twentieth century’ to refer to the period between 1914 and 1991. It covers

the period from the start of the First World War to the collapse of the

former USSR. It was in his interpretation one long set of wars, conducted

by different means but which, particularly for Europe, resulted in major

changes for labour and labour markets. Millions of employees put on

uniforms and were killed. Immigration to the USA aside, international

labour mobility shrank massively. But production and labour compliance

became central to the fighting of wars that were won, increasingly, by the

industrial production of food, energy and fighting machinery. In the latter

part of the period, the central conflict was between a capitalist system

and an ostensibly socialist, worker-owned, one. The paradox for both

was that labour had to be controlled, but it also had to be bought. In this

climate, we see the elaboration of the institutional machineries of labour

performance and cooperation. In order to set the stage for this, let us turn

to 19th century background.](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-36-320.jpg)

![Chapter 5:The rise of human resource management

37

Chapter 5: The rise of human resource

management

5.1 Learning outcomes and reading

5.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• describe the history of personnel and human resource management

• discuss the content of human resource management approaches

• explain the relationship between human resource management and

organisational behaviour.

5.1.2 Essential reading

Willman, Chapter 4.

To complete Activity 5.2 you will also need to read:

Coyle-Shapiro, J.A-M. and M. Parzefall (2008) ‘Psychological contracts’

in C.L. Cooper and J. Barling (eds) The SAGE handbook of

organizational behaviour: volume 1. (London: SAGE Publications, 2008)

[ISBN 9781412923859], pp.17–34; available at: http://eprints.lse.

ac.uk/26866/1/Psychological_contracts_(LSERO).pdf

5.1.3 Further reading

Baron, J. and D. Kreps Strategic human resources: frameworks for general

managers. (New York: John Wiley, 1999) [ISBN 9780471072539]

Chapter 2.

Becker, B. and B. Gerhard ‘The impact of human resource management

on organisational performance: progress and prospects’, Academy of

Management Journal 39(4) 1996, pp.779–801.

Tichy, N.M., C.J. Fombrun and M.A. Devanna ‘Strategic human resource

management’, Sloan Management Review 23(2,Winter) 1982, pp.47–61.

5.1.4 Works cited

Argyris, C. Understanding organizational behavior. (Homewood, Ill.: Dorsey

Press, 1960).

Bass, B.M. Leadership and performance beyond expectations. (New York: Free

Press, 1985) [ISBN 9780029018101].

Beer, M., B. Spector and P.R. Lawrence Managing human assets. (New York:

Free Press, 1984) [ISBN 9780029023907].

Colquitt, J.A., J.A. LePine and M.T. Wesson Organisational behaviour: improving

performance and commitment in the workplace. (New York: McGraw Hill,

2009) [ISBN 9780071318112].

De Menezes, L.M., S.J. Wood and G. Gelade ‘The integration of human resource

and operation management practices and its link with performance: A

longitudinal latent class study’, Journal of Operations Management 28(6),

2010, pp.455–71.

Dobbin, F., J.R. Sutton, J.W. Meyer and W.R. Scott ‘Equal opportunity law and

the construction of internal labor markets’, American Journal of Sociology

99(2) 1993, pp.396–427.

Ghoshal, S. and P. Moran ‘Bad for practice: a critique of the transaction cost

theory’, Academy of Management Review 21(1) 1996, pp.13–47.](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-45-320.jpg)

![MN2177 Core management concepts

38

Guillen, M.F. Models of management: work, authority and organisation in

a comparative perspective. (Chicago: Chicago University Press, 1994)

[ISBN 9780226310367].

Hamel, G. and C.K. Prahalad Competing for the future. (Harvard: Harvard

Business School Press, 1996) [ISBN 9780875847160].

Huselid, M.A. ‘The impact of human resource management practices on

turnover, productivity, and corporate financial performance’, Academy of

Management Journal 38 1995, pp.635–72.

Jurgens, U., T. Malsch and K. Dohse Breaking from Taylorism. (Cambridge:

Cambridge University Press, 1993) [ISBN 9780521405447].

Kotter, J. ‘What leaders really do’, Harvard Business Review, 68, 1990,

pp.103–11.

MacDuffie, J.P. ‘Human resource bundles and manufacturing performance:

Organizational logic and flexible production systems in the world auto

industry’, Industrial & Labor Relations Review 48 1995, pp.197–221.

Pfeffer, J. Competitive advantage through people (Boston: HBS Press, 1994)

[ISBN 9780875847177].

Rose, M. Industrial behaviour. (London: Penguin, 1988)

[ISBN 9780140091335].

Rousseau, D.M. Psychological contract in organisations: understanding written

and unwritten agreements. (Newbury Park: Sage, 1995) [ISBN to come].

Schein, E.H. Organizational psychology. (Upper Saddle River, NJ: Prentice-Hall,

1970) [ISBN 9780136411345].

Ulrich, D. The human resource proposition. (Harvard: HBR Press, 2005)

[ISBN 9781591397076].

Wall, T. and S. Wood ‘The romance of human resource management and

business performance and the case for big science’, Human Relations 58(4)

2005, pp.1–34.

Willman, P. and G. Winch Innovation and management control: labour

relations at BL Cars. (Cambridge: Cambridge University Press, 1985)

[ISBN 9780521268028].

Witzel, M. Builders and dreamers: the making and meaning of management.

(Harlow: Pearson, 2002) [ISBN 9780273654377].

Wren, D.A. The history of management thought. (New York: Wiley, 2005).

[ISBN 9780471669227].

Wright, P. M. and G.C. McMahan ‘Theoretical perspectives for strategic human

resource management’, Journal of Management, 18(2), 1992, pp.295–320.

Yukl, G.A. Leadership in organizations. (Upper Saddle River, NJ: Pearson/

Prentice Hall, 2006) [ISBN 9780138142681].

5.2 Introduction

Human relations thinking and the adoption of its techniques were

often associated with the creation of personnel departments. Guillen

(1994, pp.73–74) notes the rapid spread of personnel departments in

manufacturing in the USA in the second quarter of the 20th century. These

evolved into the modern human resources departments whose toolkit is the

human relations legacy. Second, there is an academic legacy. As Rose notes:

…technology supplanted the human relations climate as

the favourite variable for explaining human behaviour…

increasingly, investigators took the title of ‘organisation

theorists’. Combined with applied psychology, the sociology of

organisations formed the core of a newly popular and heavily

promoted academic area, organisational behaviour.

(Rose, 1988, p.81)

We shall look at both the practice of human resource management and

theories in organisational behaviour below.](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-46-320.jpg)

![Chapter 6:The origins of management science

49

Chapter 6: The origins of management

science

6.1 Learning outcomes and reading

6.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• describe quantitative modelling approaches to operations management

• explain the basic concepts of queuing systems, inventory control and

linear programming

• discuss some of the challenges facing the implementation of these

management science concepts.

6.1.2 Essential reading

Hopp, W.J. and M.L. Spearman Factory physics. (New York: McGraw-Hill, 2007)

[ISBN 9781577667391] Chapter 2, pp.48–56.

6.1.3 Further reading

Ackoff, R.L. ‘The future of operational research is past’, Journal of the

Operational Research Society 30 1979, pp.93–104.

Hillier, F.S. and G.J. Lieberman Introduction to operations research. (New York:

McGraw-Hill, 2004) [ISBN 9780071238281].

Kirby, M.W. ‘Operations research trajectories: the Anglo-American experience

from the 1940s to the 1990s’, Operations Research 48 2000, pp.661−70.

Mitchell, G. The practice of operational research. (Chichester: Wiley, 1993)

[ISBN 9780471939825].

Pidd, M. Tools for thinking: modelling in management science. (Chichester: Wiley,

2003) [ISBN 9780470847954].

6.1.4 Works cited

Ackoff, R.L. and M.W. Sasieni Fundamentals of operations research. (Hoboken,

NJ: John Wiley & Sons, 1968) [ISBN 9780471003335].

Bixby, R.E. ‘Solving real-world linear programs: a decade and more of progress’,

Operations Research 50 2002, p.1.

Dantzig, G.B. ‘Linear programming’, Operations Research, 50(1), 2002, pp.42–47.

Gross, D. and C.M. Harris Fundamentals of queueing theory. (Chichester: Wiley,

1998) [ISBN 0471170836]. (Wiley Interscience, 2008) fourth edition

[ISBN 9780471791270].

Morse, P.M. and G.E. Kimball Methods of operations research. (Cambridge,

Mass.: Technology Press of MIT, 1950).

6.2 Introduction

Taylor’s aspiration (discussed in Chapter 3) was to develop a scientific

management based on the universal application of certain principles.

However, Taylor’s ideas were technological rather than truly scientific. One

outgrowth of scientific management was management science (MS).

Here are three definitions:

1. a scientific method of providing executive departments with

a quantitative basis for decisions regarding the operations

under their control. (Morse and Kimball, 1950)](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-57-320.jpg)

![Chapter 7:Accounting, finance and the firm

57

Chapter 7: Accounting, finance and the

firm

7.1 Learning outcomes and reading

7.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• describe four different perspectives on the firm with the purpose of

comparing their approach to accounting and finance

• discuss the principal–agent model

• explain the differences between economic and sociological models of

the firm.

7.1.2 Essential reading

Willman, Chapter 2, Theme 1.

Watts, R. and J. Zimmerman Positive accounting theory. (Englewood Cliffs, NJ;

London: Prentice-Hall 1986) [ISBN 9780136861713] Chapter 1.

7.1.3 Further reading

Jensen, M. ‘Organization theory and methodology’, The Accounting Review

58(2) 1983, pp.319–39.

Jensen, M.C. and W.H. Meckling ‘The theory of the firm: managerial behaviour,

agency costs and ownership structure’, Journal of Financial Economics 3

1976, pp.305–60.

Miller, P. ‘Accounting as social and institutional practice: an introduction’

in Hopwood, A. and P. Miller (eds) Accounting as social and

institutional practice. (Cambridge: Cambridge University Press 1994)

[ISBN 9780521469654].

Rajan, R.C. and L. Zingales ‘The firm as a dedicated hierarchy: a theory of the

origins and growth of firms’, Quarterly Journal of Economics 116(3) 2001,

pp.805–51.

Simon, H. ‘A behavioural model of rational choice’, The Quarterly Journal of

Economics 69(1) 1955, pp.99–118.

7.1.4 Works cited

A.V. Bhidé The origin and evolution of new businesses. (Oxford: Oxford

University Press, 2000) [ISBN 9780195131444].

Burchell, S., C. Clubb, A. Hopwood, J. Hughes and J. Nahapiet ‘On the roles

of accounting in organizations and society’, Accounting, Organizations and

Society 5(1) 1980, pp.5–27.

Chapman, C.S., D.J. Cooper and P.B. Miller (eds) Accounting, organizations

and institutions: essays in honour of Anthony Hopwood. (Oxford; New York:

Oxford University Press, 2009) [ISBN 9780199546350].

Jackson, T. Inside Intel: Andrew Grove and the rise of the world’s most

powerful chip company. (New York, NY: Dutton Books, 1997)

[ISBN 9780525941415].

Mackenzie, D. An engine, not a camera: how financial models shape markets.

(Cambridge: MIT Press, 2006) [ISBN 9780262633673].

Rajan, R.C. and L. Zingales ‘Financial dependence and growth’, American

Economic Review 88(3) 1998, pp.559–86.

Weetman, P. Financial accounting: an introduction. (Harlow: Pearson, 2013)

sixth edition [ISBN 9780273789253].](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-65-320.jpg)

![Chapter 8: Management accounting: costing

65

Chapter 8: Management accounting:

costing

8.1 Learning outcomes and reading

8.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• describe the distinction between direct and indirect costs

• discuss different costing mechanisms

• compare the different approaches to costing, with examples.

8.1.2 Essential reading

Willman, Theme 0.

Kaplan, R. and A. Atkinson Advanced management accounting. (Harlow: Pearson

Education, 1998) third edition [ISBN 9780130802200] Chapters 3 and 4.

8.1.3 Further reading

Cooper, R. and B. Chew ‘Control tomorrow’s costs through today’s designs’,

Harvard Business Review January–February 1996).

Hiromoto, T. ‘Another hidden edge – Japanese management accounting’,

Harvard Business Review July–August 1988.

Johnson, H. and R. Kaplan Relevance lost: the rise and fall of management

accounting. (Boston, MA: Harvard Business School Press, 2001) [ISBN

9780875842547], Chapters 1 and 3.

Merchant, K. and M. Shields ‘When and why to measure costs less accurately to

improve decision making’, Accounting Horizons 7(2) 1993, pp.76–81.

8.1.4 Works cited

Labro, E. ‘Is a focus on collaborative product development warranted from a

cost commitment perspective?’, Supply Chain Management, 11(6), 2006,

pp.503–09.

Weetman, P. Financial and management accounting. (Harlow: Financial Times/

Prentice Hall, 2006) fourth edition [ISBN 9780273703693].

8.2 Purposes of cost accounting

Costing procedures assist in making decisions regarding:

• mix of products, services and customers offered

• enhancement of the productivity of operations

• development of competitive strategy, for example, inventories.

Additionally, cost accounting provides information for financial accounting

disclosures. A debate in costing revolves around the question of whether

each objective implies a different approach to assessing cost.

Let us begin with a set of definitions:

Variable costs: Costs that vary proportionately with the level of an

activity such as a production or sales activity.

Fixed costs: Costs that remain constant despite changes in the level of

an activity such as a production or sales activity.](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-73-320.jpg)

![Chapter 9: Management accounting: decentralisation and performance measurement

73

Chapter 9: Management accounting:

decentralisation and performance

measurement

9.1 Learning outcomes and reading

9.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• introduce themes in management accounting relating to the collecting,

processing and analysis of information regarding the internal

functioning of the firm

• describe the relationship between performance measurement and

decentralised forms of organisation

• apply the balanced scorecard.

9.1.2 Essential reading

Willman, Themes 4 and 5.

Kaplan, R. and A. Atkinson Advanced management accounting. (Harlow: Pearson

Education, 1998) third edition [ISBN 9780130802200] Chapter 8.

9.1.3 Further reading

Christensen, J. and J. Demski Accounting theory: an information content

perspective. (Boston: McGraw-Hill/Irwin, 2002) [ISBN 9780072296914]

Chapter 10.

Ittner, C.D. Larcker, M. Meyer ‘Subjectivity and the weighting of performance

measures: evidence from a balanced scorecard’, The Accounting Review

78(3) 2003, pp.725–58.

Merchant, K. and W.A. van der Stede Management control systems. (Harlow:

Financial Times/Prentice Hall, 2007) [ISBN 9780273737612] Chapter 11,

pp.470−79.

Meyer, M. and V. Gupta ‘The performance paradox’, Research in Organizational

Behaviour 16 1993, pp.309–69, especially pp.325–53.

Meyer, M. Rethinking performance measurement: beyond the balanced

scorecard. (Cambridge; New York: Cambridge University Press, 2002)

[ISBN 9780521812436 (hbk)].

9.1.4 Works cited

Braverman, H. Labor and monopoly capital. (New York: Monthly Review Press,

1974) [ISBN 9780853453406].

Chandler, A. The visible hand: the managerial revolution in American business.

(Harvard: Harvard University Press, 1977).

Kaplan, R. ‘The evolution of management accounting’, The Accounting Review

LIX(3) 1984, pp.390–418.

Kogut, B. and D. Parkinson ‘Adoption of the multidivisional structure’, Industrial

and Corporate Change 7(2) 1998, pp.249–73.

Kaplan, R. and D. Norton The balanced scorecard. (Harvard: Harvard Business

School Press, 1996) [ISBN 9780875846514].](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-81-320.jpg)

![Chapter 10: Financial accounting

83

Chapter 10: Financial accounting

10.1 Learning outcomes and reading

10.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• discuss the three elements of the financial report, namely, the balance

sheet, the profit and loss statement and the cash flow statement

• interrogate the qualitative requirements of financial accounting for

relevance, reliability, comparability and understandability.

10.1.2 Essential reading

Willman, Chapter 8.

Weetman, P. Financial accounting: an introduction. (Harlow: Pearson, 2013)

sixth edition [ISBN 9780273789253] Chapter 7.

10.1.3 Further reading

Atrill, P. and E. McLaney Financial accounting for decision makers. (Harlow:

Financial Times Prentice Hall, 2013) [ISBN 9780273785637], Chapters 2

and 3.

Higson, C. ‘Financial statements: Economic analysis and interpretation’ (2006).

Weetman, P. Financial accounting: an introduction. (Harlow: Pearson, 2013)

sixth edition [ISBN 9780273789253] especially Chapters 8–12.

10.2 Management accounting and financial accounting

The distinction between management accounts and financial accounts is

long standing. Management accounting tools tend to be used for specific

managerial purposes and can be varied (though not in an unlimited way)

by managers pursuing particular objectives: for example, they may choose

a particular costing method or resource allocation tool; they may collect

information weekly, monthly or less often. In addition, management

accounts may collect information which is non-financial (e.g. on specific

activities), though often this information is collected because it is seen to

predict future cash flows.

Financial accounts, by contrast, are there in part to control managerial

agency and have predominantly (but not exclusively) an external

audience. They must contain certain elements and be set out in a

particular way to attain standards. Table 10.1 attempts to summarise the

differences between management and financial accounting.

Management accounting Financial accounting

Nature of reports Specific purpose General purpose

Level of detail Disaggregated Aggregated

Regulations Unregulated Regulated

Reporting interval As required Mostly annual

Time orientation Past and future Mostly past period

Information Financials and non-financials Mostly quantifiable in

monetary terms

Table 10.1: Management accounting and financial accounting compared](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-91-320.jpg)

![Chapter 11: Modern portfolio theory

91

Chapter 11: Modern portfolio theory

11.1 Learning outcomes and reading

11.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• introduce the financial framework relating to risk and reward

• describe asset allocation and long-term rates of return of different

asset classes

• discuss the relative returns of asset class selection and security

selection.

11.1.2 Essential reading

Willman, Chapter 8.

D. Hillier, M. Grinblatt and S. Titman Financial markets and corporate

strategy. (Maidenhead: McGraw-Hill Higher Education, 2011)

[ISBN 9780077129422], Chapter 4.

11.1.3 Further reading

Dimson, E. and P. Marsh Triumph of the optimists: 101 years of global investment

returns. (Princeton, NJ; Oxford: Princeton University Press, 2002)

[ISBN 9780691091945].

Swensen, D. Pioneering portfolio management: an unconventional

approach to institutional investment. (New York: Free Press, 2009)

[ISBN 9781416554035].

Williams, A. Managing your investment manager: a complete guide to

selection, measurement and control. (Homewood: Dow Jones Irwin, 1986)

[ISBN 9780870947230].

11.1.4 Works cited

Fama, E.F. ‘Efficient capital markets: a review of theory and empirical work’,

Journal of Finance, 25(2), 1970, pp.383–428.

Fama, E.F. ‘Efficient capital markets II’, Journal of Finance, 46(5), 1991,

pp.1575–1617.

11.2 Interest rates and the time value of money

For most financial decisions, costs and benefits occur at different points

in time. Consider an investment opportunity that costs $100,000 today

and pays $105,000 in one year. Is the net value of the project $105,000–

$100,000?

No. In comparing these two payments we need to take account of the time

value of money: the difference between money today and in the future.

Suppose the one-year interest rate with the bank is seven per cent. This

investment alternative enables us to have $107,000 in one year, which is

superior to the project. In one year $107,000–$105,000 = $2,000.

What is the value of difference between these two projects today?

If the interest rate is seven per cent, then what amount would we need to

invest today to have $105,000 in one year?

= X * 1.07 = $105,000](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-99-320.jpg)

![Chapter 11: Modern portfolio theory

95

11.9.3 Strong market efficiency

Market prices incorporate even the most private information held by

the deepest insiders in corporations. This means that no trading would

produce alpha. The strong form assumes that all information, both public

and private, is reflected in today’s stock price, so that nothing – not even

insider information – can be used to beat the market.

11.10 Optimal portfolio choice

The diversification benefits of having different assets in a portfolio derives

from the fact that asset prices move differently.

Covariance is the expected product of the deviation of two returns from

their means.

Cov (Ri, Rj) = E[(Ri – E(Ri)) * (Rj − E(Rj)]

Correlation controls for the differing volatilities of the stocks.

Corr (Ri, Rj) = Cov (Ri, Rj)/(SD (Ri) * SD (Rj))

The correlation is between −1 and + 1, providing an indication of the

strength of the relationship between the two assets.

Asset

class

Equities Fixed

income

Cash Hedge

funds

Private

equity

Real

assets

Equities 1

Fixed

income

0.25 1

Cash 0.02 0.03 1

Hedge

funds

0.38 0.14 0.22 1

Private

equity

0.41 –0.24 0.07 0.22 1

Real

assets

0.47 0.27 –0.06 0.45 0.36 1

Table 11.2: Asset class correlations (January 1970–December 2008)

The table shows correlations between different asset classes in the 40

years before the financial crash. It illustrates the data we might use to

construct an efficient portfolio.

11.10.1 The variance of a two-stock portfolio

Var (Rp) = X1 * Var (R1) + X2 * Var (R2) + 2 * X1 * X2 * Cov (R1,R2)

SD (Rp) = √Var (Rp)

The greater the covariation or the correlation of the two stocks, the higher

the volatility and the risk of the portfolio.

11.10.2 The variance of a portfolio

The variance of a portfolio is equal to the sum of the covariances of the

returns of all pairs of stocks in the portfolio, multiplied by each of their](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-103-320.jpg)

![Chapter 12: Security analysis and valuation

99

Chapter 12: Security analysis and

valuation

12.1 Learning outcomes and reading

12.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• describe the meaning of different financial ratios

• explain their application in conducting financial analysis of firms.

12.1.2 Essential reading

Atrill, P. and E. McLaney Financial accounting for decision makers. (Harlow:

Financial Times Prentice Hall, 2013) [ISBN 9780273785637], Chapter 8.

Willman, Theme 7.

12.1.3 Further reading

Graham, B. and D. Dodd Security analysis. (New York: McGraw-Hill, 1934).

Weetman, P. Financial accounting: an introduction. (Harlow: Pearson, 2013)

sixth edition [ISBN 9780273789253].

12.2 Financial ratios

Financial ratios are so-called because they develop a profile of a business’

financial health by relating two figures in the financial statements.

There are six different types of ratio:

• investment

• profitability

• margins

• efficiency

• financial leverage

• solvency and liquidity.

In this chapter we calculate some of the financial ratios of British Airways

in 2007/08.

12.3 Investment ratios

Investors in a company wish to know how well their investment has

performed.

Earnings per share = Profit after tax for ordinary

shareholders/No. of ordinary shares in issue

This ratio is frequently reported in the media as the headline figure

comparing the quarterly and annual performance of firms. The comparison

is made from one period to the next to assess the trend.

British Airways’ earnings per share (‘EPS’):](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-107-320.jpg)

![Chapter 13:The origins of modern strategy

105

Chapter 13: The origins of modern

strategy

13.1 Learning outcomes and reading

13.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• discuss the core concepts of business strategy

• describe the main elements of the Porter framework

• outline the strengths and limitations of the approach.

13.1.2 Essential reading

Porter, M.E. ‘The five competitive forces that shape strategy’, Harvard Business

Review, January 2008, pp.78–93.

Willman, Chapter 6.

13.1.3 Further reading

Grant, R.M. Contemporary strategy analysis. (Chichester: John Wiley & Sons,

2012) [ISBN 9781119941880].

Porter, M.E. Competitive strategy: techniques for analysing industries and firms.

(New York: Macmillan, 1980) [ISBN 9780684841489].

Whittington, R. What is strategy – and does it matter? (Ontario: Thomson

International, 2000) second edition [ISBN 9781861523778].

13.1.4 Works cited

Ansoff, I. Corporate strategy. (New York, NY: McGraw-Hill, 1965)

[ISBN 9780070021112].

Boston Consulting Group Strategy alternatives for the British motorcycle

industry. (London: Her Majesty’s Stationery Office, 1975)

[ISBN 9780100090651].

Chandler, A. Strategy and structure: chapters in the history of American

enterprise. (London: MIT Press, 1962) [ISBN 9781587981982].

Mintzberg, H. The rise and fall of strategic planning: reconceiving

roles for planning, plans, planners. (New York: Free Press, 1994)

[ISBN 9780029216057].

Mintzberg, H, B. Ahlstrand and J. Lampel Strategy safari: a guided tour through

the wilds of strategic management. (New York: Simon and Schuster, 2005)

[ISBN 9780743270571].

Pettigrew, A. The awakening giant: continuity and change in Imperial Chemical

Industries. (Oxford: Blackwell, 1985) [ISBN 9780631133568].

13.2 Two key definitions of ‘strategy’

The business strategy field is relatively new (from the 1960s), but as we

will see in the next five chapters, it has some controversial aspects, not

least about what the term ‘strategy’ means. The first definition below from

the business historian widely regarded as the ‘founder’ of strategy focuses

on management; the second, from a major critic, focuses on markets:

The determination of the basic long-term goals and objectives

of an enterprise and the adoption of courses of action and the

allocation of resources necessary for carrying out these goals.

(Chandler, 1962, p.13)](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-113-320.jpg)

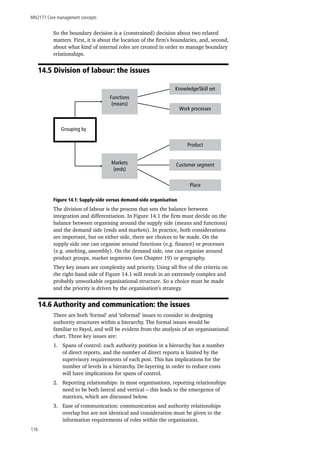

![Chapter 14: Understanding organisational structures

113

Chapter 14: Understanding organisational

structures

14.1 Learning outcomes and reading

14.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• outline the main types of organisational structure within firms

• discuss the basic principles of organisational design

• describe the relationship between organisational structure and

strategy.

14.1.2 Essential reading

Willman, Chapter 5.

14.1.3 Further reading

Mintzberg, H. Structure in fives: designing effective organisations. (Harlow:

Prentice Hall, 1983) [ISBN 9780138554798] pp.1–25.

Pfeffer, J. New directions for organisational theory. (Oxford: Oxford University

Press, 1997) [ISBN 9780195114348].

Scott, W.R. Organisations: rational, natural and open systems. (Harlow: Prentice

Hall, 1997) fourth edition [ISBN 9780132663540].

14.1.4 Works cited

Albrow, M. Bureaucracy. (London: Macmillan, 1970) [ISBN 978033311265].

Fayol, H. General and industrial management. (London: Pitman,

1916) (Financial Times/Prentice Hall, revised edition, 1988)

[ISBN 9780273029816].

Gouldner, A. Patterns of industrial bureaucracy. (Glencoe, IL: The Free Press,

1954).

Hamel, G. The future of management. (Boston: Harvard Business Review Press,

2007) [ISBN 9781422102503].

Nonaka, H. and I. Takeuchi The knowledge-creating company. (Oxford: Oxford

University Press, 1995) [ISBN 9780195092691].

14.2 Introduction

As we saw in Chapter 1, early writing on the structure of business

organisations was influenced by prior thinking about how large

organisations, such as the church and, particularly, the state, operated. The

central concept of bureaucracy, articulated by Max Weber in the early 20th

century, was designed to explore and characterise the attributes of efficient

public administration. This is some distance from the modern colloquial

use of the term ‘bureaucracy’, which implies inflexibility and inefficiency

(Albrow). The core idea behind bureaucracy was rationality – specifically,

that an organisation could be structured around universal principles which

ensured effectiveness.](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-121-320.jpg)

![Chapter 15:The analysis of organisations

123

Chapter 15: The analysis of organisations

15.1 Learning outcomes and reading

15.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• describe some main currents in organisational theory

• relate these to current debates in business strategy.

15.1.2 Essential reading

Pfeffer, J. New directions for organization theory: problems and prospects.

(Oxford: Oxford University Press, 1997) [ISBN 9780195114348],

Conclusion.

15.1.3 Further reading

Han, S.K. ‘Mimetic isomorphism and its effects on the audit services market’,

Social Forces 73 1994, pp.637–63.

Hannan, M. and J. Freeman ‘The population ecology of organisations’,

American Journal of Sociology 82 1977, pp.929–64.

Podolny, J. Status signals. (Princeton: Princeton University Press, 2008)

[ISBN 9780691136431] Introduction and Chapter 1.

Williamson, O.E. ‘Comparative economic organisation: the analysis of discrete

structural alternatives’, Administrative Science Quarterly 36(2) 1991,

pp.269–98.

15.1.4 Works cited

Di Maggio, P. and W. Powell ‘The iron cage revisited: institutional isomorphism

and collective rationality in organisational fields’, American Sociological

Review 48 1983, pp.147–60.

Donaldson, L. American Anti-management theories of organisation: a critique

of paradigm proliferation. (Cambridge: Cambridge University Press, 1995)

[ISBN 9780521479172].

McKenna, C.D. The world’s newest profession: management consulting in

the twentieth century. (Cambridge: Cambridge University Press, 2006)

[ISBN 9780521810395].

Meyer, J. and B. Rowan ‘Institutionalised organisations: formal structure as

myth and ceremony’, American Journal of Sociology 83 1977, pp.343–60.

Weber, K., G. Davis and M. Lounsbury ‘Policy as myth and ceremony? The

global spread of stock exchanges 1980–2005’, Academy of Management

Journal 52(6) 2009, pp.1319–47.

Whittington, R., M. Mayer and F. Curto ‘Chandlerism in post-war Europe:

strategic and structural change in France, Germany and the UK, 1950–

1993’, Industrial and Corporate Change 8(3) 1999, pp.519–51.

Zey, M. Rational choice and organizational theory: a critique. (Thousand Oaks,

CA: Sage Publications, 1998) [ISBN 9780803951365].

15.2 Strategy and organisational theory

Industry structure approaches to strategy such as Porter’s do not

particularly need a theory of organisations since they treat the firm as a

single decision point – a piece on a chessboard, so to speak. However, both

the Chandlerian and resource-based theories discussed in the next chapter

have to address organisational issues, as does any concern with strategy](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-131-320.jpg)

![Chapter 16: Contemporary strategic management

131

Chapter 16: Contemporary strategic

management

16.1 Learning outcomes and reading

16.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• describe the resource-based view (RBV) of the firm and its implications

for strategy

• discuss the dynamic capabilities approach to strategy formation

• explain the concept of core competence and its use

• describe the idea of an integrated strategy process.

16.1.2 Essential reading

Whittington, R. What is strategy – and does it matter? (Ontario: Thomson

International, 2000) second edition [ISBN 9781861523778], Chapter 2.

16.1.3 Further reading

Barney, J.B. ‘Firm resources and sustained competitive advantage’, Journal of

Management 17(1) 1991, pp.99–120.

Eisenhardt, K.M. and J.A. Martin ‘Dynamic capabilities: what are they?’,

Strategic Management Journal 21 2000, pp.1105–121.

Hoskisson, R.E., M.A. Hitt, W.P. Wan and D. Yiu ‘Theory and research in

strategic management: swings of a pendulum’, Journal of Management

25(3) 1999, pp.417–56.

McGahan, A.M. and M.E. Porter ‘The emergence and sustainability of abnormal

profits’, Strategic Organization 1(1) 2003, pp.79–108.

Prahalad, C.K. and G. Hamel, ‘The core competence of the corporation’,

Harvard Business Review 68(3) 1990, pp.79–91.

Priem, R.L. and J.E. Butler ‘Is the resource based “view” a useful perspective

for strategic management research?’, Academy of Management Review 26(1)

2001, pp.22–40.

16.1.4 Works cited

Amit, R. and P.J.H. Shoemaker ‘Strategic assets and organisational rent’,

Strategic Management Journal 14 1993, pp.33–46.

Hamel, G. and C.K. Prahalad Competing for the future. (Harvard: Harvard

Business School Press (1996) [ISBN 9780875847160].

Kogut, B. and U. Zander ‘Knowledge of the firm, combinative capabilities, and

the replication of technology’, Organization Science, 3(3), 1992, pp.383–97.

Nelson, R. and S. Winter An evolutionary theory of economic change.

(Cambridge, MA: Belknap Press, 1982) (Boston, MA: Harvard University

Press, 1990) [ISBN 9780674272286].

Penrose, E. The theory of the growth of the firm. (Oxford: Oxford University

Press, 2009; first published 1959) [ISBN 9780199573844].

Rumelt, R.P ‘Towards a strategic theory of the enterprise’ in R. Lamb (ed.)

Competitive strategic management. (Englewood Cliffs: Prentice Hall, 1984)

[ISBN 9780131549722].

Schumpeter, J.A. The theory of economic development: an inquiry into profits,

capital, credit, interest, and the business cycle. (Cambridge, Mass.: Harvard

University Press, 1934).](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-139-320.jpg)

![Chapter 17: Strategy and decision-making

139

Chapter 17: Strategy and decision-

making

17.1 Learning outcomes and reading

17.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• explain prescriptive and descriptive approaches to decision-making

within organisations

• discuss the three meanings of bounded rationality

• describe biases and heuristics

• outline Prospect theory and framing.

17.1.2 Essential reading

Bazerman, M. Judgment in managerial decision making. (New York: Wiley,

2002) fifth edition [ISBN 9780471398875], Chapter 2.

Bromiley, P. The behavioral foundations of strategic management. (Oxford,

Blackwell, 2005) [ISBN 9781405124706], Chapter 1.

17.1.3 Further reading

Fenton-O’Creevy, M., N. Nicholson, E. Soane and P. Willman Traders: Risks,

decisions and management in financial markets. (Oxford: Oxford University

Press, 2005) [ISBN 9780199226450 pbk)].

Simon, H.A. Administrative behaviour. (New York: Macmillan, 1997; first

published 1947) [ISBN 9780684835822 (pbk)].

17.1.4 Works cited

Cyert, R.M., H.A. Simon and D.B. Trow ‘Observation of a business decision’,

Journal of Organisational Behaviour 29 1956, pp.237–43.

Fama, E.F. ‘Market efficiency, long-term returns, and behavioral finance’,

Journal of Financial Economics 49 1998, pp.283–306.

Feldman, M.S. and J.G. March ‘Information in organisations as signal and

symbol’, Administrative Science Quarterly 26(2) 1981, pp.171–86.

Gigerenzer, G. ‘Striking a blow for sanity in theories of rationality’ in Augier, M.

and J. March (eds) Models of a Man: Essays in Memory of Herbert A. Simon.

(Cambridge, MA: MIT Press, 2004) [ISBN 9780262012089].

Kahneman, D. Thinking, fast and slow. (London: Penguin, 2011)

[ISBN 9780141033570].

Kahneman, D. and A. Tversky ‘Prospect theory: An analysis of decision under

risk’, Econometrica 47 1979, pp.263–91.

17.2 Introduction

There are two literatures looking at decision-making within organisations:

1. rational and prescriptive – logical analysis of the decision task

and the use of deductive methods to derive the behaviour of rational

actors (e.g. expected utility theory in economics)

2. descriptive – empirical, often psychological, seeking general

principles to explain observed preferences and actions (e.g.

identification of heuristics and decision biases).](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-147-320.jpg)

![Chapter 18:The origins of marketing

149

Chapter 18: The origins of marketing

18.1 Learning outcomes and reading

18.1.1 Learning outcomes

By the end of this chapter, and having completed the Essential reading and

activities, you should be able to:

• explain what is meant by the ‘marketing framework’

• discuss the history of marketing theory and the marketing business

orientation

• describe how marketing fits into the traditional economic model of

perfect competition

• outline how marketing makes use of different theories used in other

academic disciplines.

18.1.2 Essential reading

Willman, Theme 6.

Kotler, P. and G. Armstrong Principles of marketing. (Harlow: Pearson Education

Ltd, 2013) sixth European edition [ISBN 9780273742975] Chapter 1.

18.1.3 Further reading

Brassington, F. and S. Pettitt Essentials of marketing. (Harlow: Prentice Hall,

2012) third edition [ISBN 9780273727644].

Nevett, T. and R. Fullerton Historical perspectives in marketing. (Toronto:

Lexington Books, 1988) [ISBN 0669169684].

Pindyck, R. and D. Rubinfeld Microeconomics. (Upper Saddle River, NJ:

Pearson/Prentice Hall, 2012) eighth edition [ISBN 9780133041705].

18.2 Introduction

Before we can start discussing marketing theories and concepts, it is

useful to understand that marketing was (and to a large extent still is) a

composite of a number of other academic disciplines. It is also important

to understand where marketing originated from and what its intellectual

foundations are.

In this chapter we will examine the emergence of marketing as a

management discipline. In particular, we will examine how marketing

fits into the traditional economic model of perfect competition. We shall

see that marketing divorced itself from economics in the mid-to-late

1960s with the emergence of modern founders such as Joseph Kotler and

Theodore Levitt (who were themselves former economists). This will be

followed by a discussion of the four main historical business orientations

(for example, production, product, selling and marketing) and how

marketing fits into this identification as well. The chapter will conclude

with an examination of marketing problems and how marketing students

can draw upon different academic disciplines such as psychology as well

as economics to solve them.](https://image.slidesharecdn.com/subjectguide-160313004644/85/Core-Management-Concepts-UOL-Subject-guide-157-320.jpg)

![MN2177 Core management concepts

154

3. Normative marketing problems are those which concern

themselves with how things ‘should be’. An example of this is the

emergence of corporate social responsibility and ethical marketing (‘no

logo’ movement).

4. Strategic marketing problems involve evaluating the needs of

customers and evaluating how the company can provide a solution to

these needs.

Each problem requires a different set of academic approaches. It takes

time to develop the requisite skills as a marketing analyst or practitioner

to know when to use which approach to solve a given problem. In some

cases, even defining what the problem is requires experience and subtle

knowledge of the problem at hand.

18.9 The triumph of marketing?

Having described the evolution of marketing theory and its evolution as

a discipline of management study, we will now look at a brief account of

the emergence of the current ‘marketing framework’, which has come to

dominate the way in which certain industries and markets operate.

There are four main business orientations, each of which has emerged as a

response to evolutions in the marketplace. If we were to ask the question:

‘What kind of a firm do you (have you) work[ed] for?’ the answer is likely

to be found in one of these four orientations:

• Production: Here the focus is on producing more, selling high

volumes, controlling costs and production efficiency. The firm which

pioneered this orientation was Ford in the early 1900s, with its

adoption of assembly line manufacturing and a standardised product

− the Model T − which was famously available in any colour ‘as long

as it’s black’! (See the mini-case activity below.)

• Product: This orientation moves away from standardised products

and focuses on improving quality. The assumption is that customers