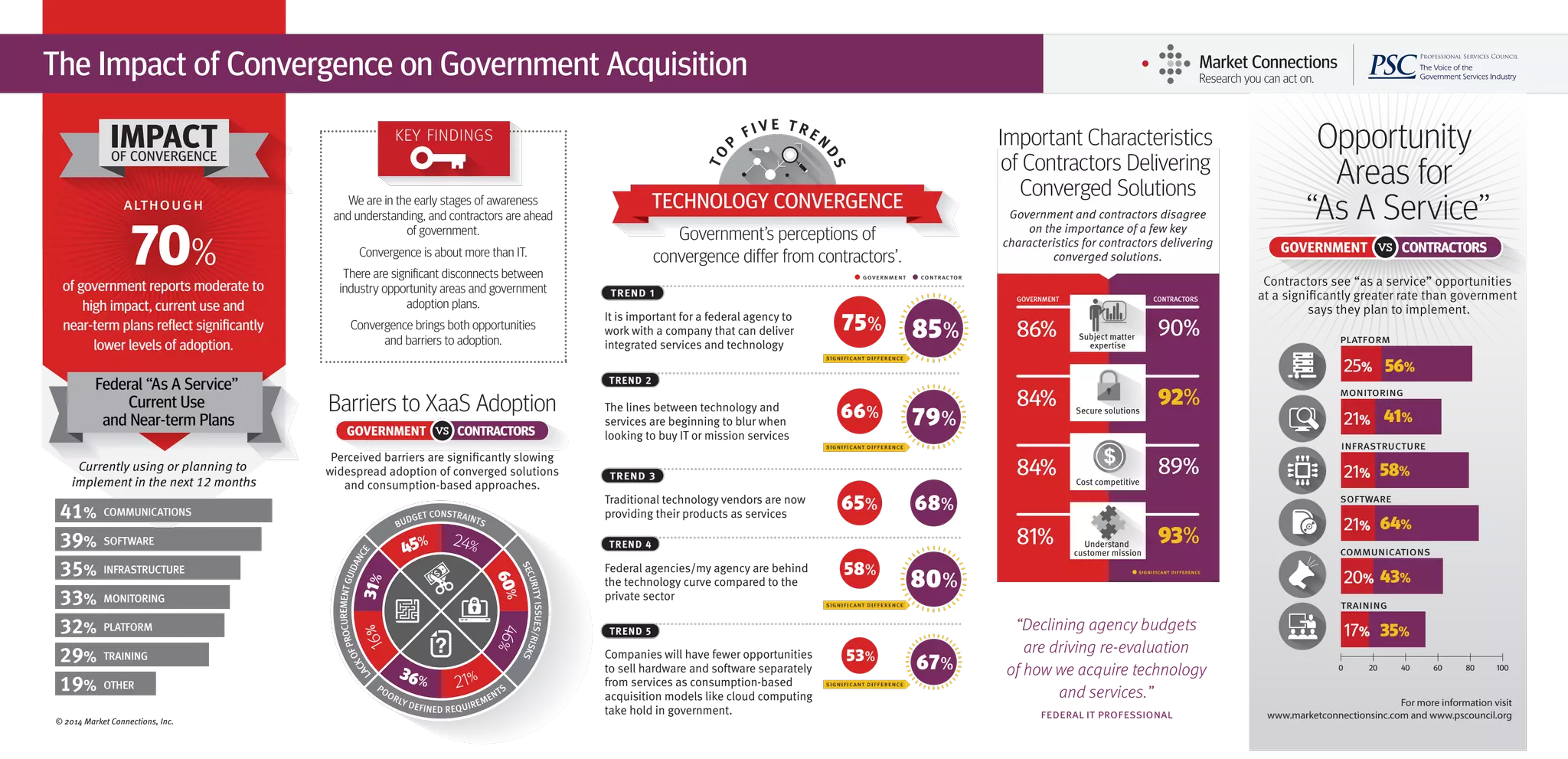

The document discusses the early stages of government awareness and understanding of convergence in acquisition, highlighting how contractors are ahead in recognizing opportunities versus government adoption. It identifies significant barriers to the adoption of 'as a service' solutions, such as budget constraints and security concerns, while illustrating disagreements between contractors and government regarding essential characteristics for delivering converged solutions. Overall, the findings indicate that while there is moderate to high impact from convergence, actual adoption rates remain low across various federal services.