The document provides an overview of the growing GovTech market, including:

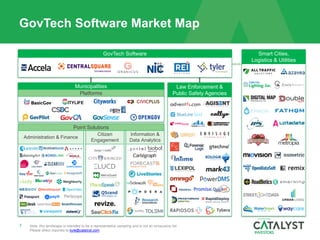

1) The GovTech industry was formed to make government processes more efficient and secure in response to public demand for modernized systems.

2) The U.S. government spends over $3 trillion annually across 19 million employees, though only 7% goes to IT currently.

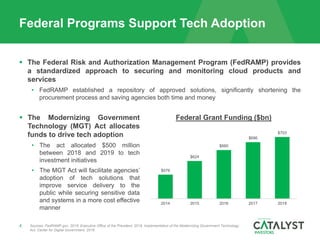

3) Federal programs like the Modernizing Government Technology Act and FedRAMP are helping drive adoption of new technologies in the public sector.

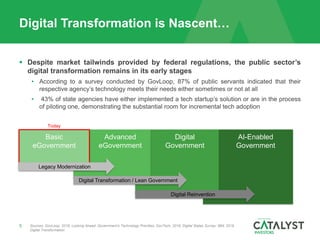

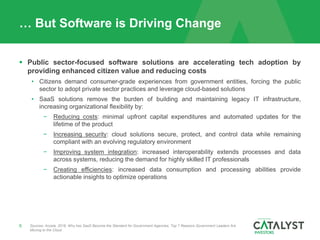

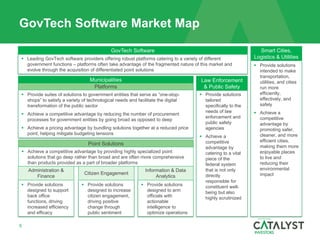

4) While digital transformation is still nascent, software solutions around platforms, data analytics, citizen engagement and more are accelerating change.