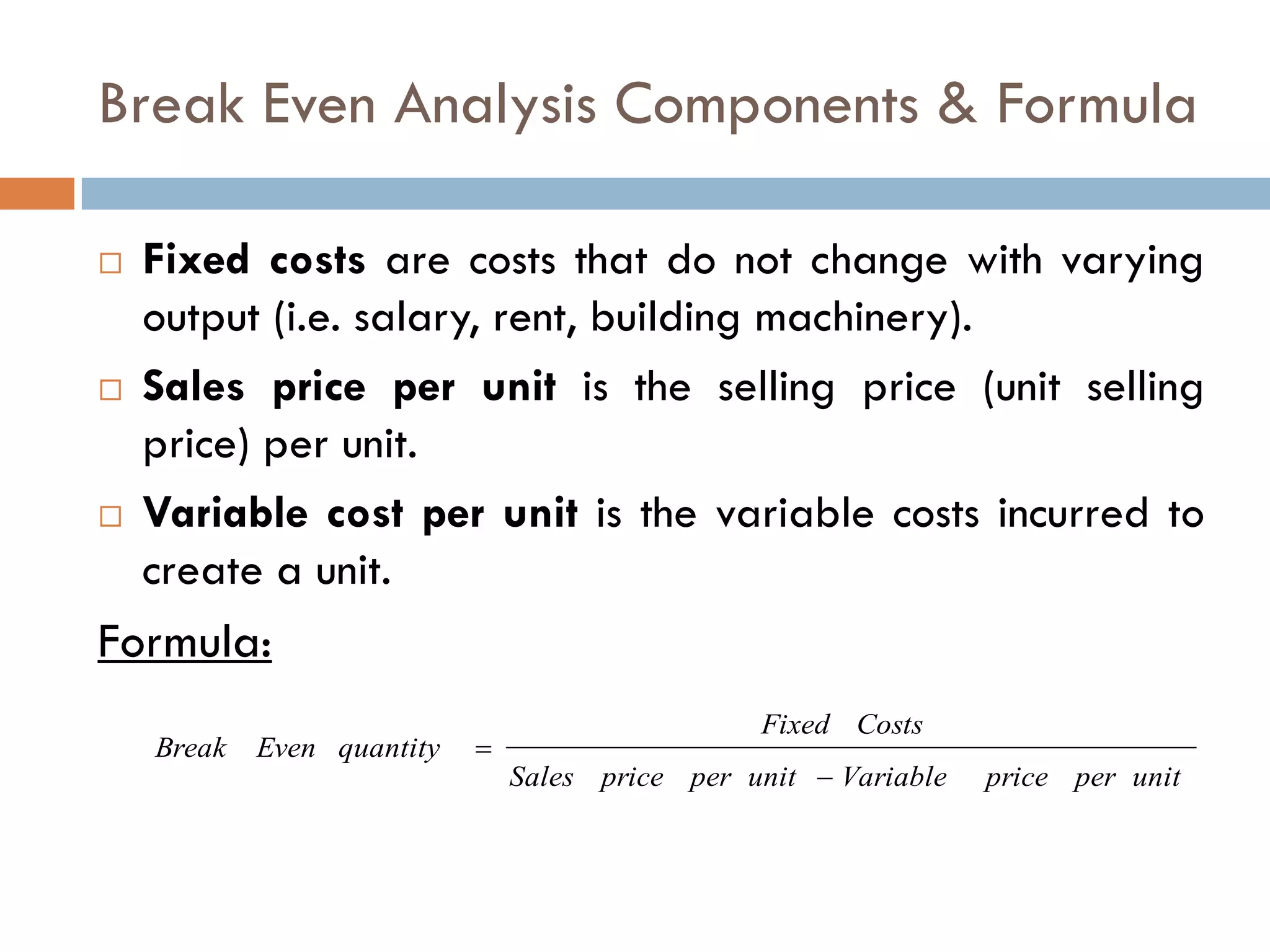

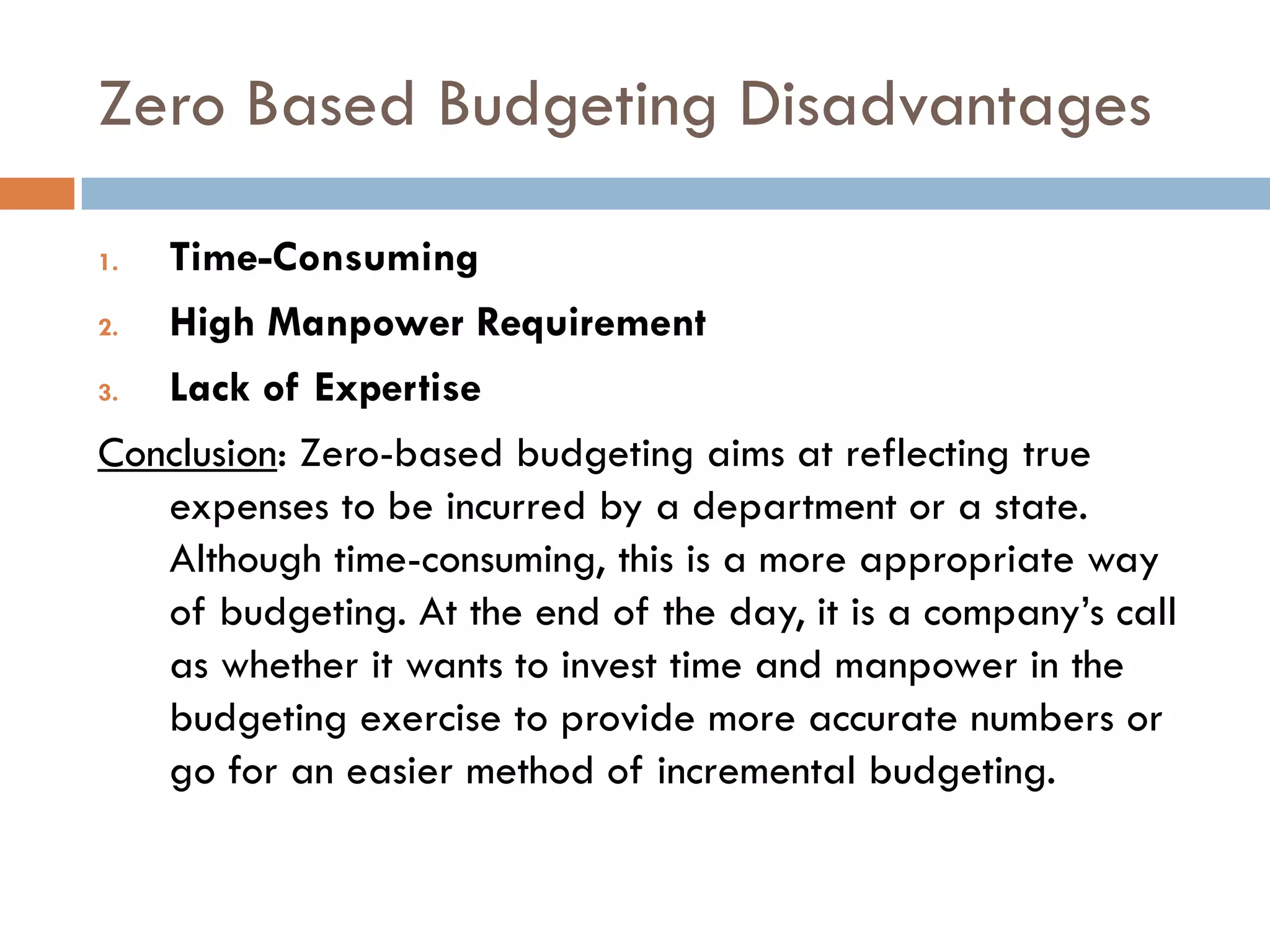

Control involves measuring performance against plans and standards, and taking corrective actions when needed. It is a continuous process that occurs at all levels of management. Traditional control techniques include budgetary control and break-even analysis. Budgetary control involves preparing budgets, coordinating departments, comparing actuals to budgets, and taking actions. Break-even analysis calculates the sales volume needed to cover total costs. Modern techniques include PERT, CPM, and zero-based budgeting. PERT and CPM are project management tools that use charts to plan and schedule tasks. Zero-based budgeting requires justifying all planned expenses rather than basing the budget on previous periods.