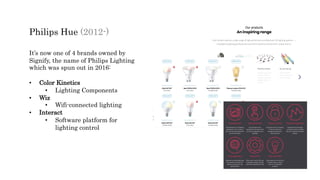

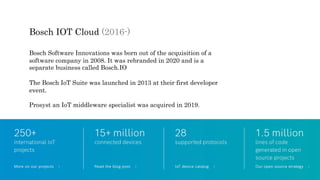

This document discusses several connected product experiences and the lessons learned from them. It covers Philips Hue smart lights, Centrica Hive home automation, Wiithings health trackers, HP Instant Ink printer ink subscriptions, and Bosch's IoT cloud platform. Key lessons include reacting quickly to competitors or early customer interest; expanding product lines while de-risking with spinoffs; leveraging an existing brand; and engaging developers through open source approaches.