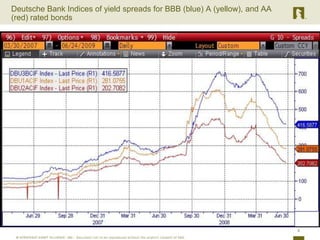

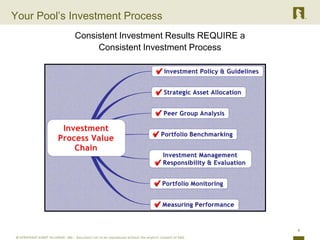

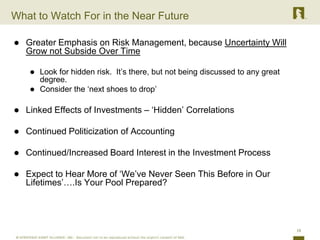

The document discusses the evolution of investment issues leading up to and following the 2008 financial crisis, highlighting the risks associated with sub-prime mortgages and structured products. It emphasizes the importance of a consistent investment process and risk management amidst ongoing economic uncertainties. Additionally, it raises concerns about unrealistic trust in rating agencies and the potential impacts of regulatory and accounting changes on investment strategies.