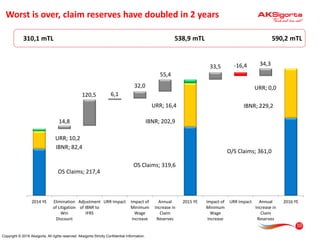

This document provides an earnings call presentation summarizing Aksigorta's 2016 fourth quarter and full year financial results. Some key points:

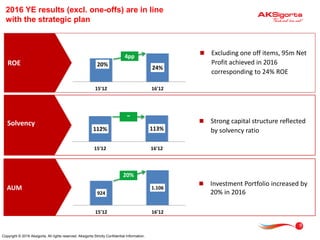

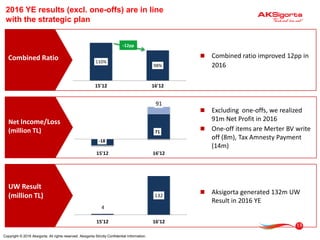

- Aksigorta achieved a profitable growth in 2016, with 17% premium increase and 9% growth excluding MTPL. Net profit was 95 million TL excluding one-off items.

- Combined ratio improved to 98% in 2016 from 101% in 2015, excluding one-offs. UW profit was 138 million TL in 2016 excluding IBNR deferral.

- For 2017, Aksigorta expects 12-14% premium growth, a 1 percentage point improvement in combined ratio to 98%, and 8-10% growth in net profit to 95 million TL.