The document is the earnings report for Eternit Group for the first quarter of 2014. It summarizes the company's financial and operational performance compared to the same period in 2013. Some key points:

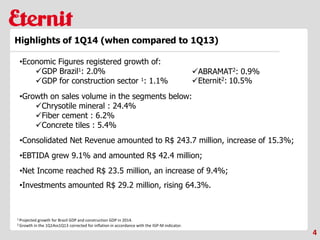

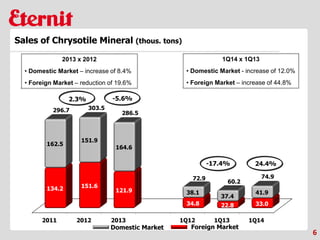

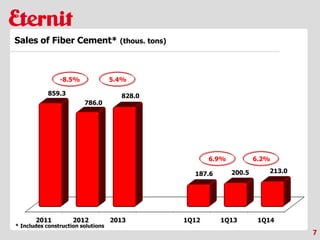

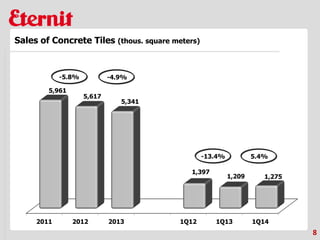

- Sales volumes grew for chrysotile mineral (24.4%), fiber cement (6.2%), and concrete tiles (5.4%).

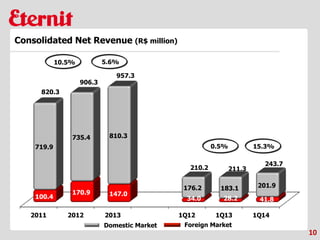

- Consolidated net revenue increased 15.3% to R$243.7 million.

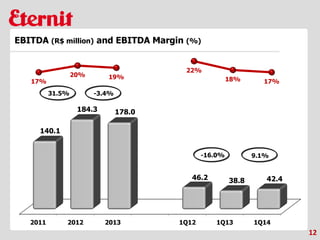

- EBITDA grew 9.1% to R$42.4 million.

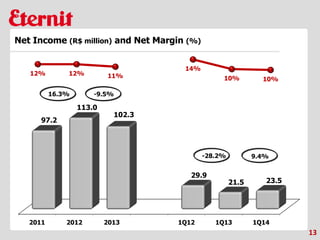

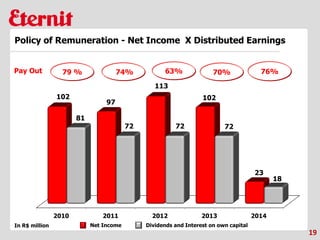

- Net income increased 9.4% to R$23.5 million.

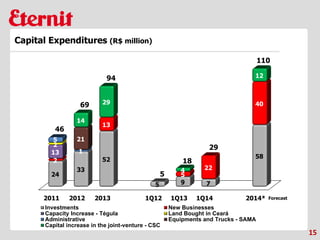

- Investments amounted to R$29.2 million, rising 64.3%