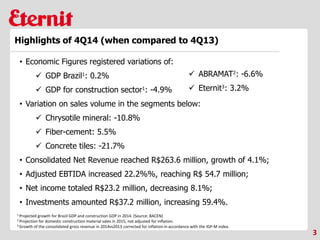

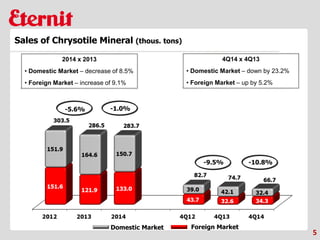

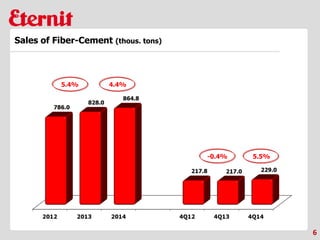

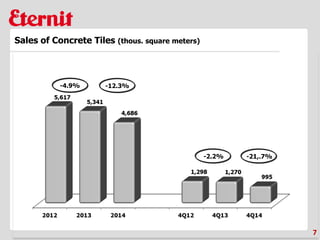

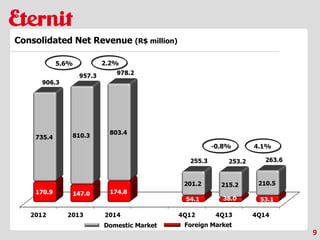

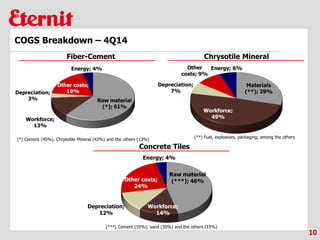

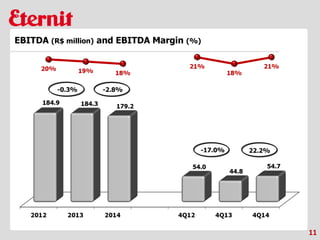

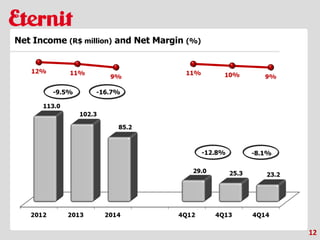

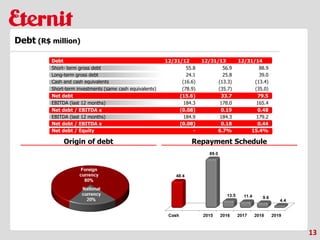

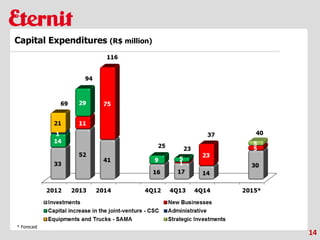

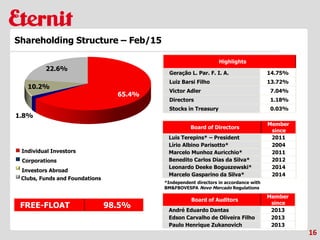

The document summarizes a company's earnings call for the fourth quarter of 2014. It provides an overview of the company's financial and operational performance including a 4.1% increase in consolidated net revenue. It also discusses factors that impacted results such as declines in GDP for Brazil and the construction sector. Projections for 2015 domestic construction material sales are included along with highlights on product line performance and investments.