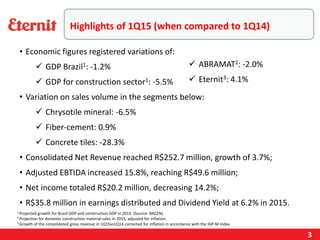

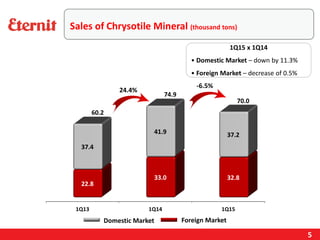

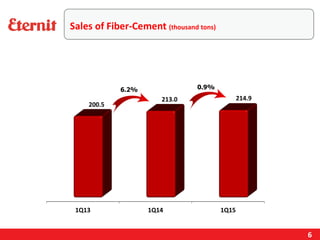

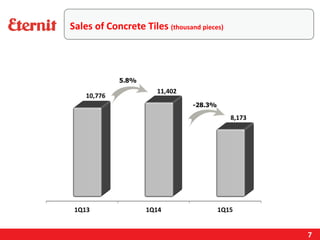

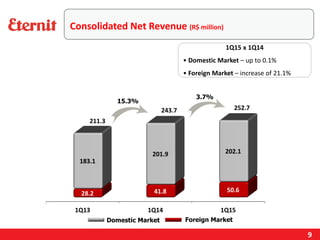

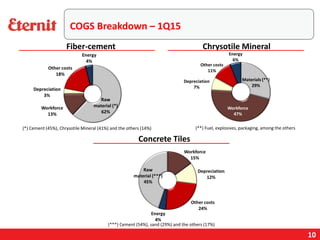

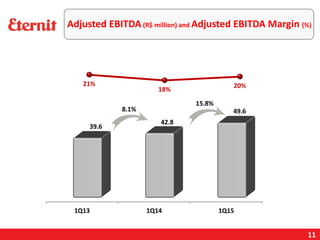

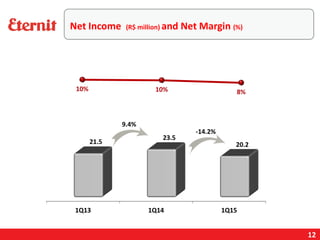

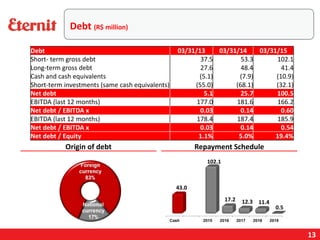

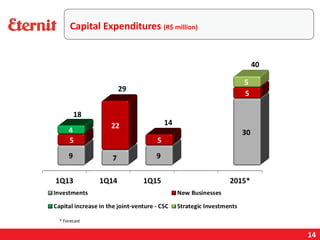

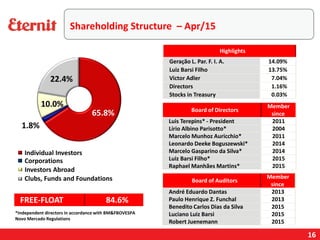

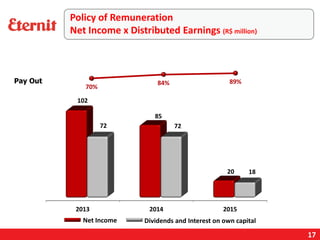

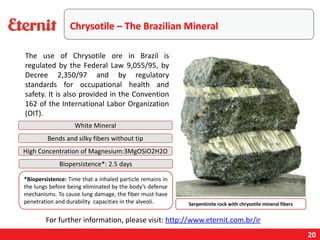

The document summarizes the key financial and operational highlights from Eternit's 1Q15 earnings call. It notes that while GDP and construction sector GDP in Brazil declined year-over-year, Eternit's net revenue grew 3.7% in 1Q15 driven by a 21.1% increase in foreign markets. Adjusted EBITDA was up 15.8% in 1Q15 compared to 1Q14. However, net income decreased 14.2% over the same period. The document also provides an overview of Eternit's business segments, debt levels, capital expenditures, shareholder base, and chrysotile mineral.