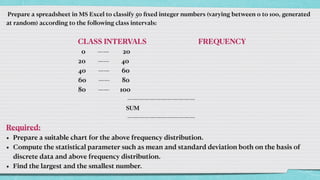

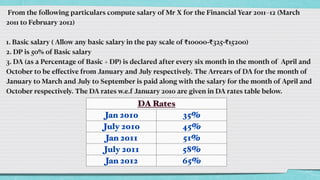

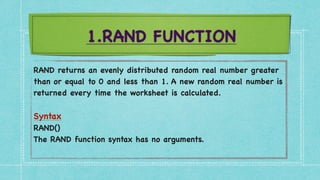

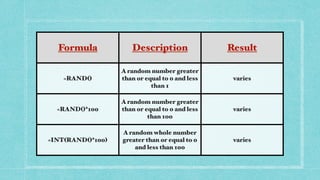

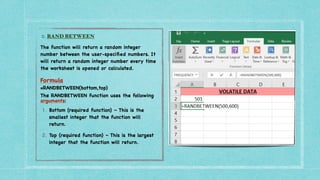

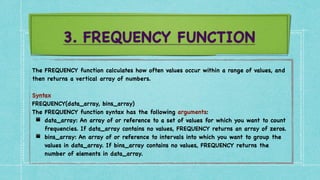

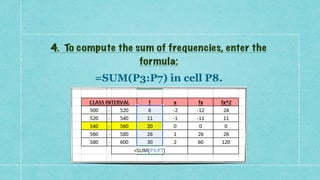

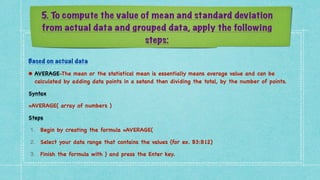

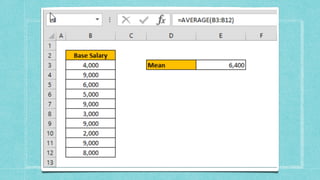

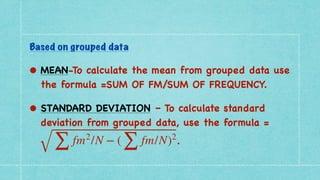

This document discusses frequency distribution and payroll accounting in Microsoft Excel. It provides examples of how to create a frequency distribution table and chart in Excel based on a data set of random numbers between 0-100 sorted into classes. It also demonstrates how to perform payroll accounting calculations in Excel, including computing salary, allowances, deductions and net salary over a financial year based on input parameters like basic salary, DA rates, HRA eligibility etc. Formulas and functions discussed include RAND, RANDBETWEEN, FREQUENCY, SUM, AVERAGE, STANDARD DEVIATION, IF, MAX and SUMIF.

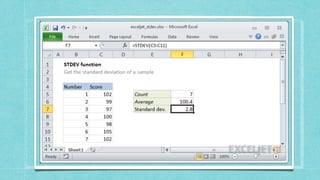

![• STANDARD DEVIATION- Standard deviation measures

how much variance there is in a set of numbers

compared to the average (mean) of the numbers.

Syntax

=STDEV.P(number1, [number2], ...

)

Arguments

• number1 - First number or reference in the sample

.

• number2 - [optional] Second number or reference.](https://image.slidesharecdn.com/caib-210511215152/85/Computer-Applications-in-Business-15-320.jpg)

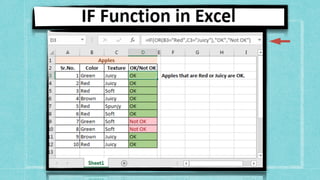

![6. IF FUNCTION

The IF function runs a logical test and returns one value for a TRUE result, and

another for a FALSE result

.

Syntax

=IF (logical_test, [value_if_true], [value_if_false]

)

Arguments

• logical_test - A value or logical expression that can be evaluated as TRUE or FALSE

.

• value_if_true - [optional] The value to return when logical_test evaluates to TRUE

.

• value_if_false - [optional] The value to return when logical_test evaluates to

FALSE.](https://image.slidesharecdn.com/caib-210511215152/85/Computer-Applications-in-Business-18-320.jpg)

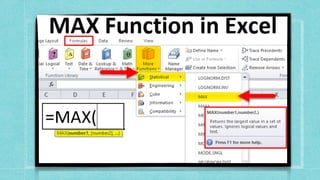

![2. MAX FUNCTION

The Excel MAX function returns the largest numeric value in a range of

values. The MAX function ignores empty cells, the logical values TRUE and

FALSE, and text values

.

Syntax

=MAX (number1, [number2], ...

)

Arguments

• number1 - Number, reference to numeric value, or range that contains

numeric values

.

• number2 - [optional] Number, reference to numeric value, or range that

contains numeric values.](https://image.slidesharecdn.com/caib-210511215152/85/Computer-Applications-in-Business-20-320.jpg)

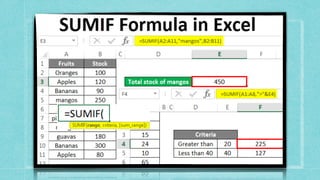

![1. SUMIF FUNCTION

You use the SUMIF function to sum the values in a range that meet criteria that you

specify

.

Syntax

The syntax for the SUMIF function in Microsoft Excel is

:

SUMIF( range, criteria, [sum_range]

)

Arguments

range: The range of cells that you want to apply the criteria against

.

criteria: The criteria used to determine which cells to add

.

sum_range: Optional. It is the range of cells to sum together. If this parameter is omitted, it uses

range as the sum_range.](https://image.slidesharecdn.com/caib-210511215152/85/Computer-Applications-in-Business-22-320.jpg)