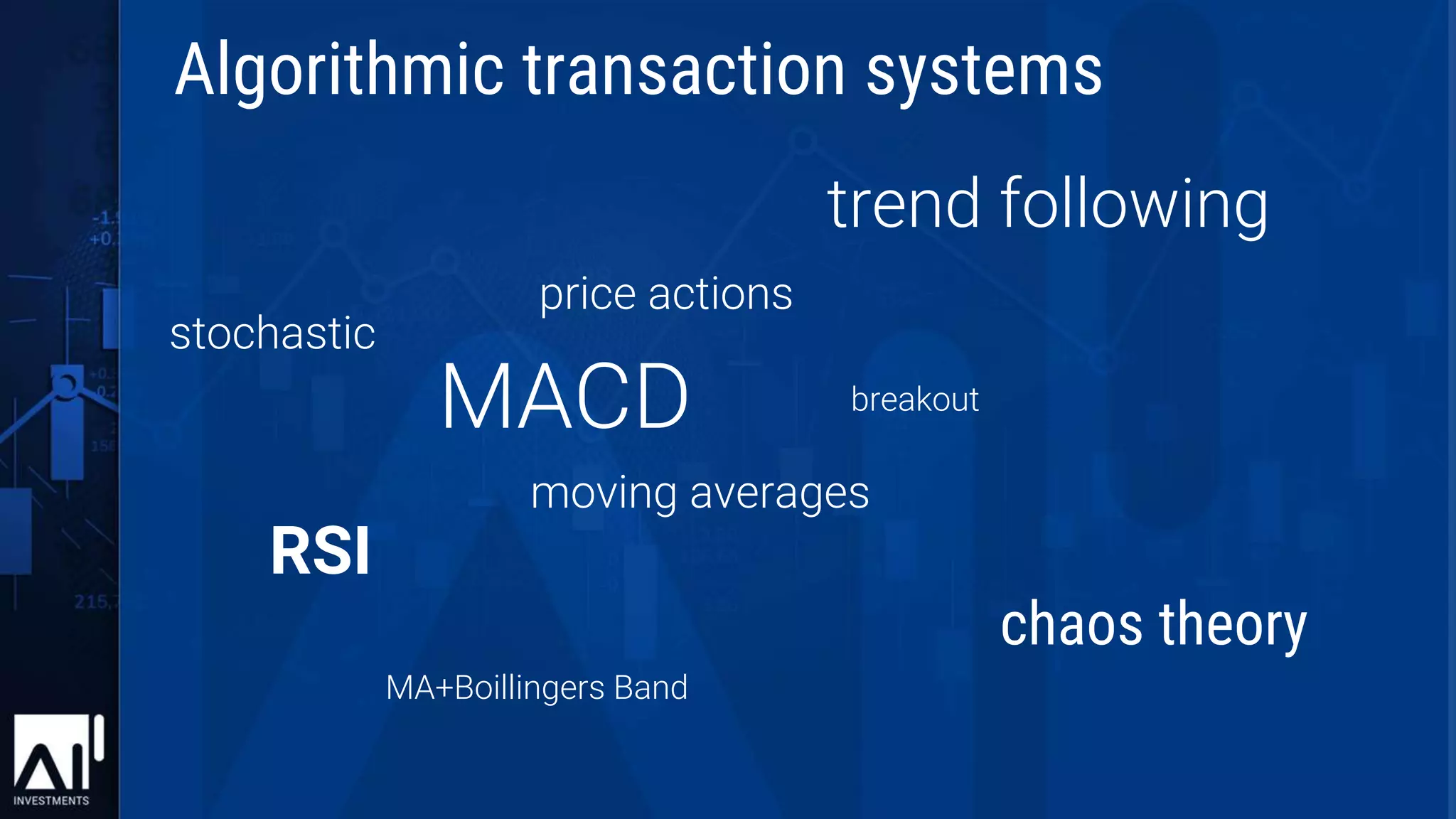

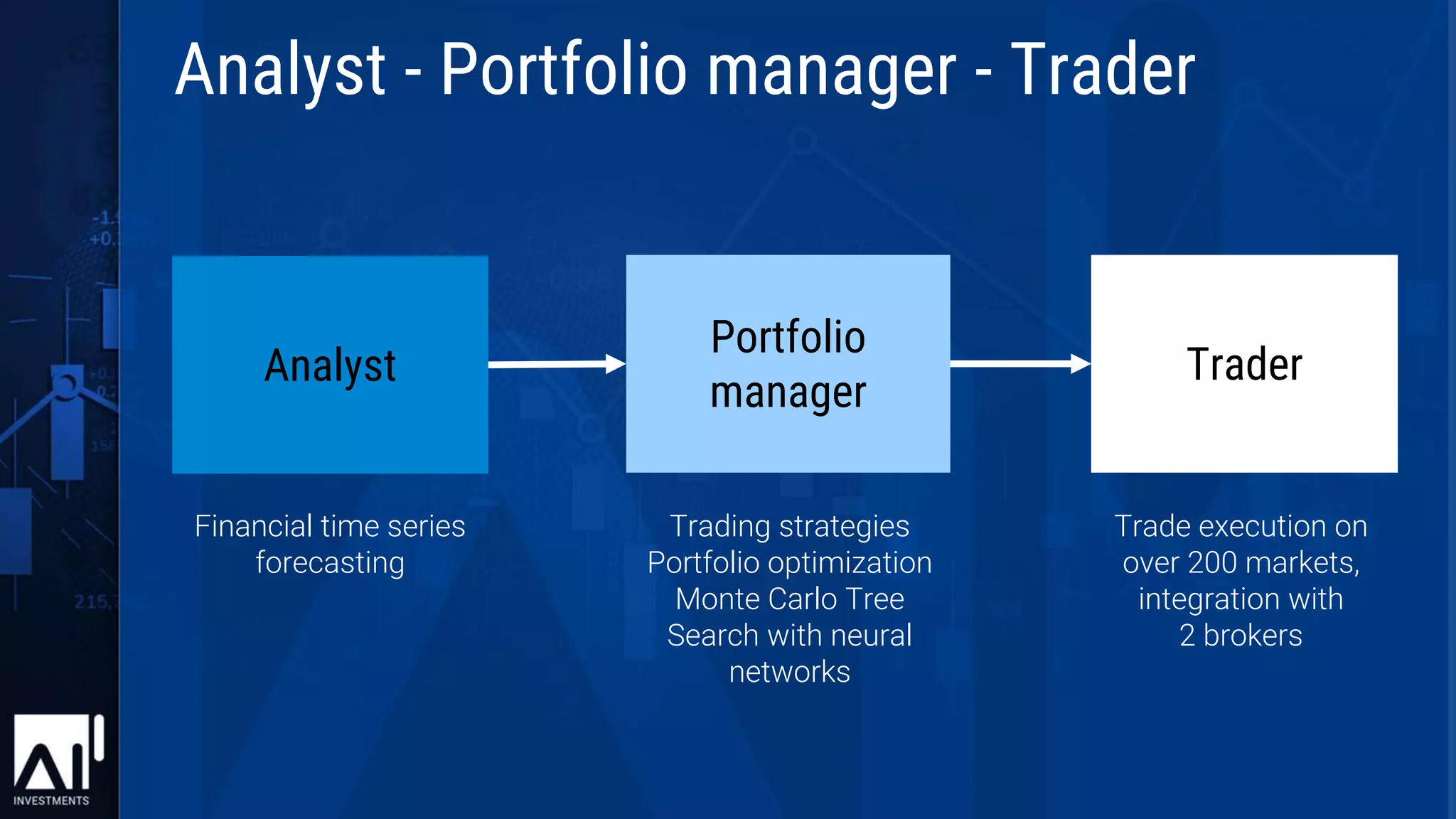

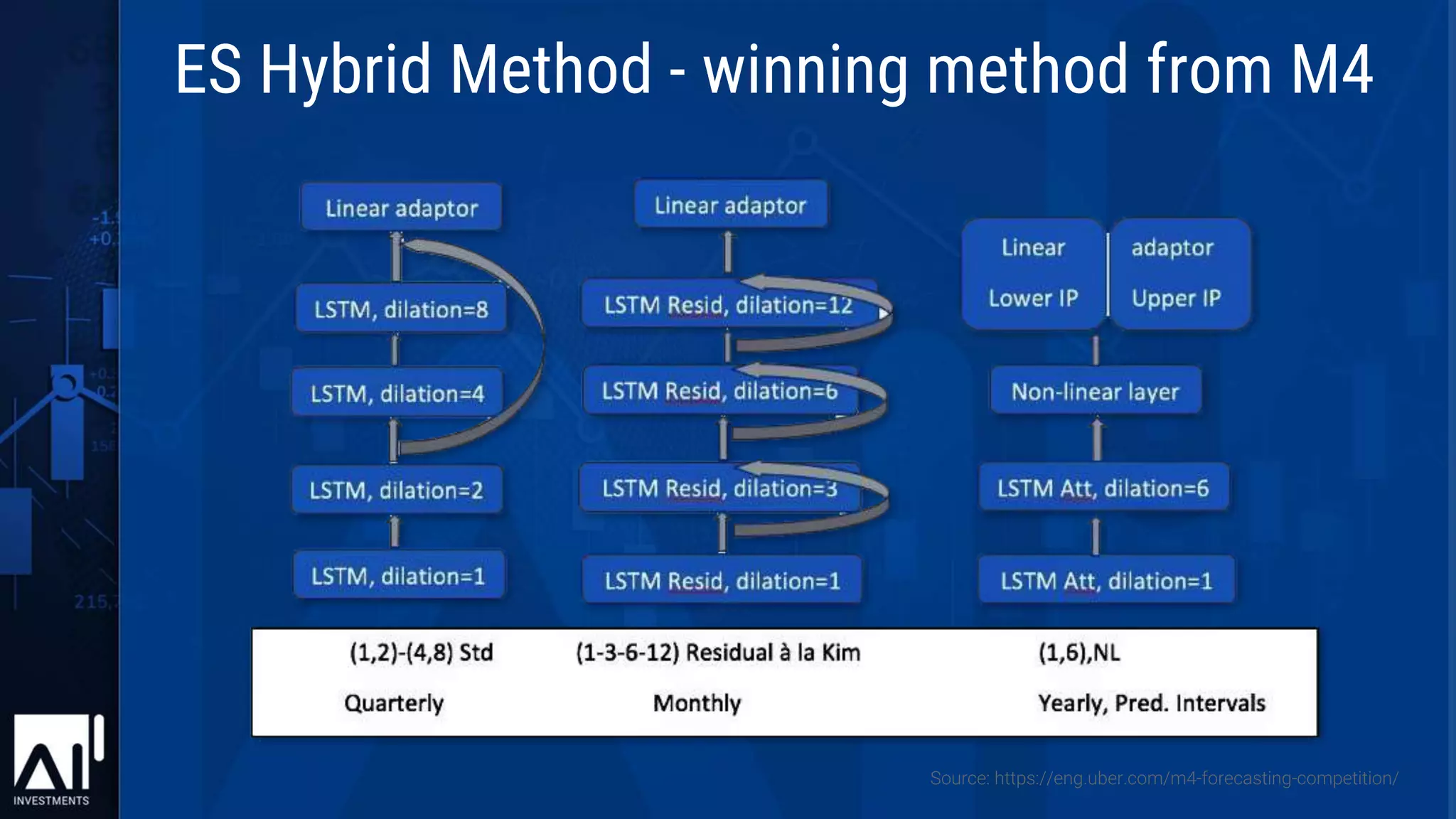

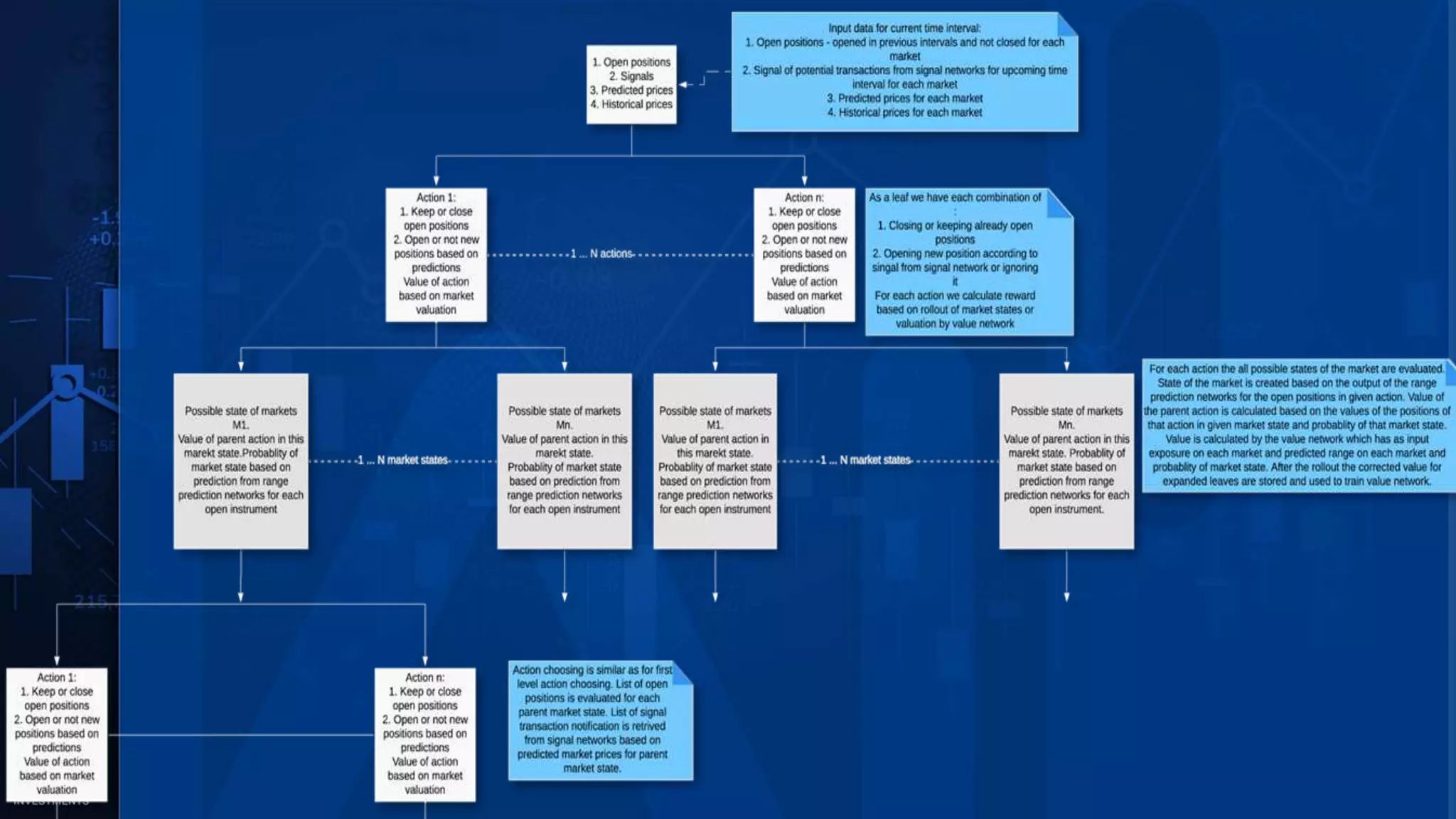

The document discusses the use of AI in investment portfolio optimization, highlighting advancements in AI technologies such as deep learning and reinforcement learning. It presents methodologies for financial time series forecasting, including hybrid methods that combine machine learning and statistical approaches, and reviews successful AI applications in trading strategies. The conclusion emphasizes the potential of AI tools in transforming the future of financial markets, supported by live performance results from AI Investments Ltd.