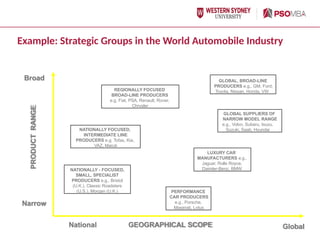

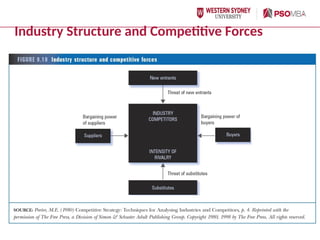

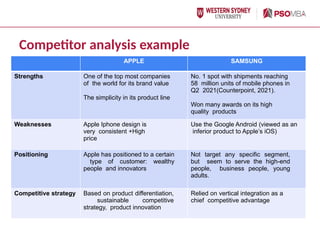

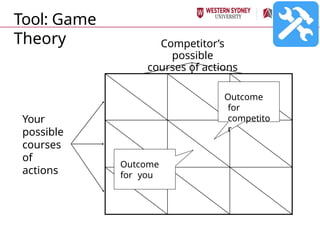

The document outlines a comprehensive framework for competitive analysis, highlighting the importance of understanding competitors' objectives, strategies, strengths, and weaknesses. It discusses various methods for identifying and analyzing competition, including market segmentation and strategic groups, while emphasizing the significance of the competitive landscape for effective strategic planning. Additionally, it presents tools and models, such as Porter's Five Forces, to assess competitive forces and make informed business decisions.