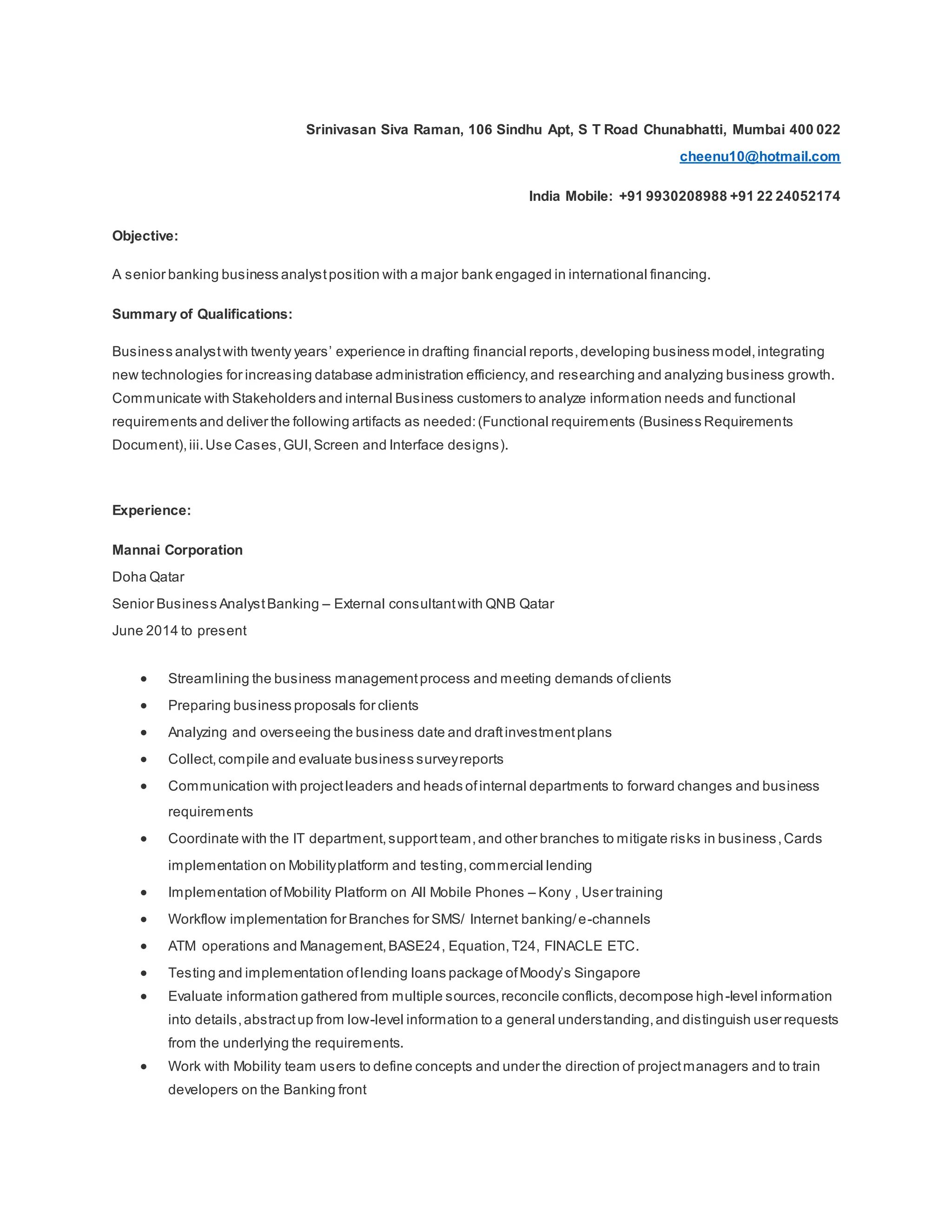

Srinivasan Siva Raman has over 20 years of experience as a senior business analyst in the banking sector in India and Qatar, with expertise in business requirements analysis, database management, and implementing new technologies. He is currently a senior business analyst consultant for QNB Qatar, where he works on projects such as mobility platform implementation, loan package testing, and branch workflow automation. He is seeking a senior banking business analyst position with a major international bank.