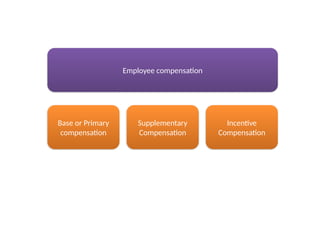

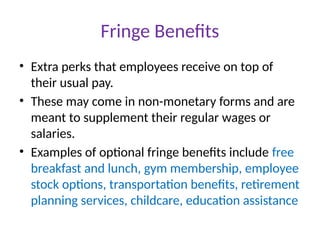

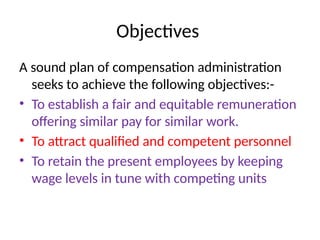

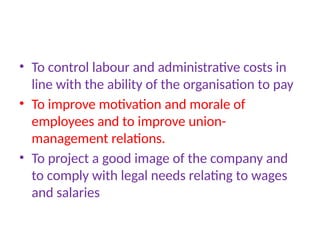

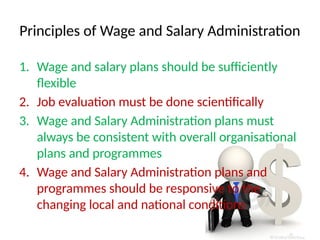

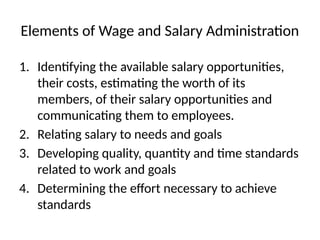

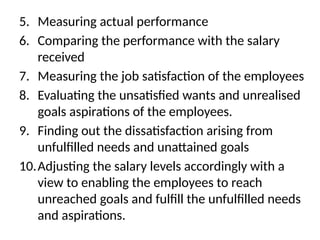

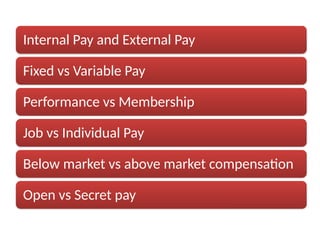

The document discusses the importance of employee compensation within human resource management, detailing its types such as base pay, supplementary compensation, and incentive compensation. It emphasizes the need for fair compensation to attract and retain talent, while also outlining the objectives, components, and principles of effective wage and salary administration. Additionally, it covers factors influencing compensation levels and the need for a compensation system that aligns with an organization's strategic goals.