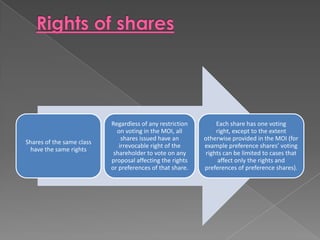

Shares represent a company's capital and are transferable property. Shares do not have a par value. Ordinary shares entitle holders to vote and receive dividends, while preference shares may have restricted voting rights but take priority in dividends and liquidation distributions. A company's authorized share capital and the rights of different share classes are set out in its Memorandum of Incorporation. Shares are issued through subscription contracts.