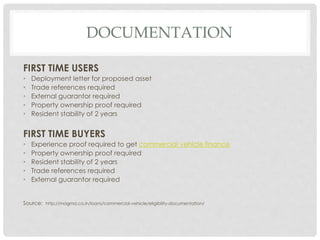

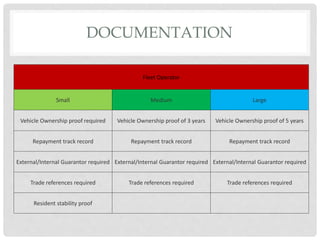

This document provides information about commercial vehicle loans. It defines commercial vehicles as goods and passenger carrying vehicles used for business purposes, such as transporting materials or people. It lists eligibility requirements for commercial vehicle loans, including individuals, companies, and fleet operators. The documentation section outlines the documents required for first-time users and buyers, as well as fleet operators of different sizes. Benefits of commercial vehicle loans are fast processing, flexibility, and financing up to 100% of the asset value. Interest rates can range from 12-18% depending on various customer and loan factors.