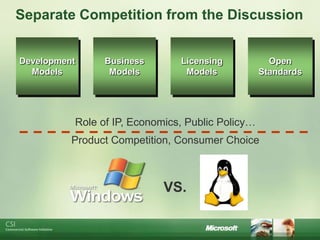

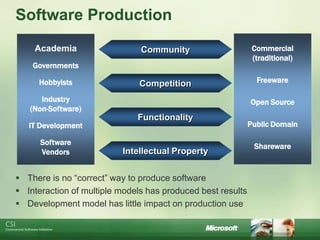

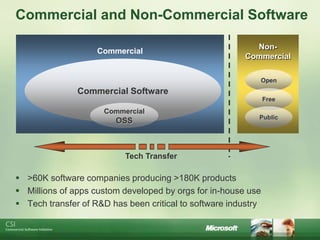

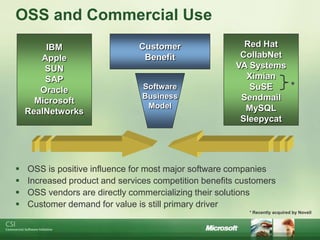

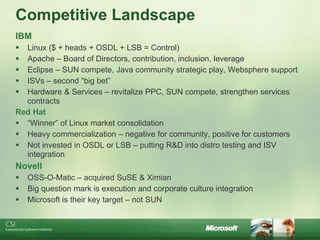

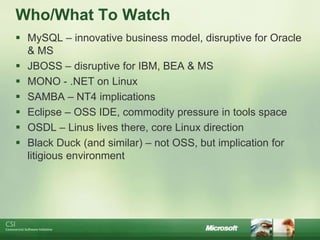

This document discusses commercial and open source software models and their interaction and impact. It notes that there is no single correct model for software development and that different models have produced best results through interaction. It provides an overview of major software companies and their approaches to open source software, including both participating in open source projects and commercializing open source solutions. It also identifies several open source projects and companies to watch that could disrupt existing software markets through open source competition and innovation.