Embed presentation

Download to read offline

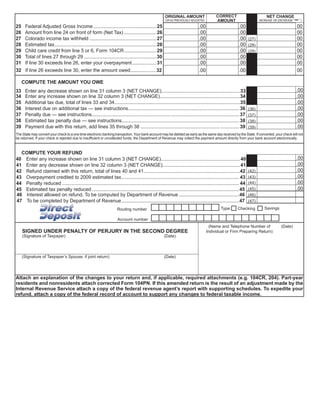

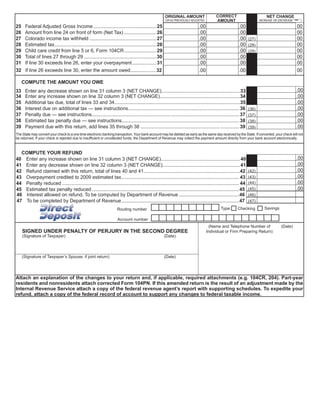

This Colorado income tax form provides instructions for filing an amended 2008 individual income tax return using Form 104X. Taxpayers should complete columns showing original, corrected, and net change amounts. Any refund increase will be shown as a positive number on line 31, and any additional tax due will be shown as a positive number on line 32. The taxpayer may owe additional tax, interest, and penalties or claim a larger refund depending on the net changes. Supporting documentation including federal adjustments must be attached as applicable.