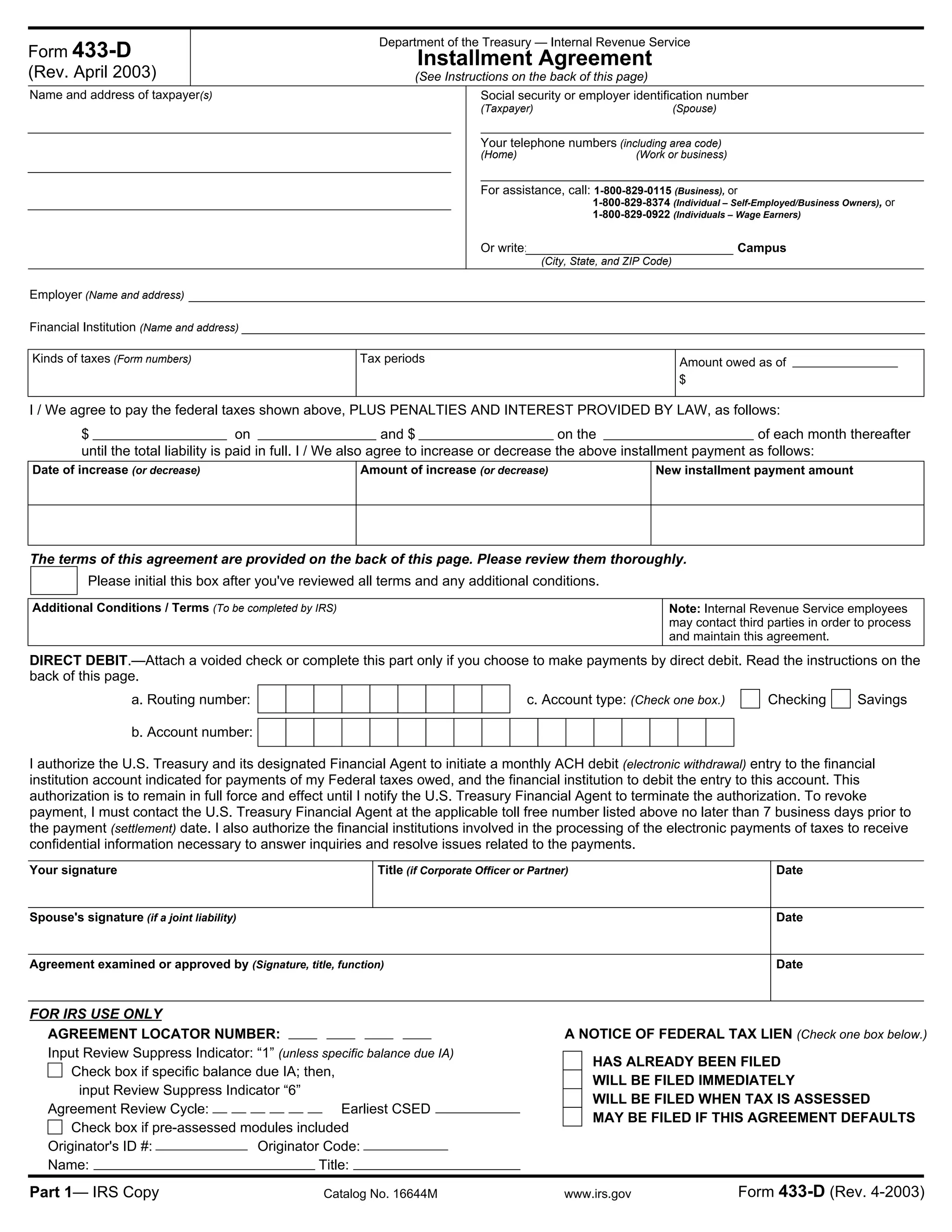

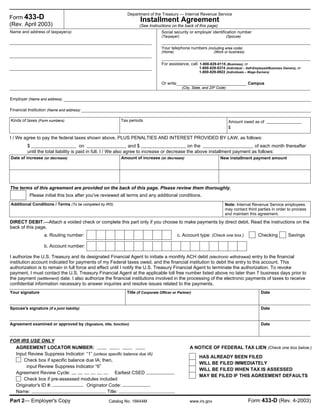

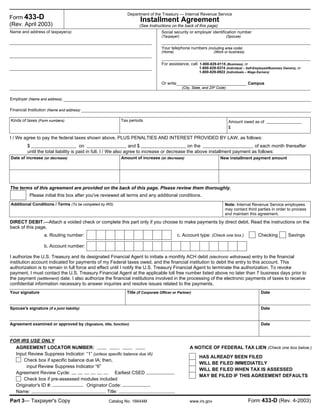

1. This document is an IRS installment agreement form for paying back taxes owed. It details the terms of the agreement between the IRS and taxpayer, including payment amounts and dates.

2. Key terms include that the taxpayer agrees to pay taxes owed plus penalties and interest, in scheduled monthly payments until the full amount is paid. The taxpayer must also continue filing and paying future taxes on time.

3. The IRS can terminate the agreement if the taxpayer misses payments, fails to provide financial updates, or the collection of taxes is deemed in jeopardy. The form instructs taxpayers how to complete and submit the agreement.