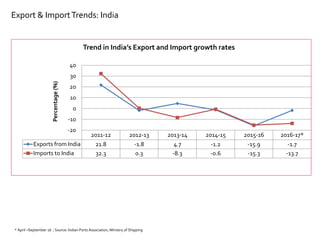

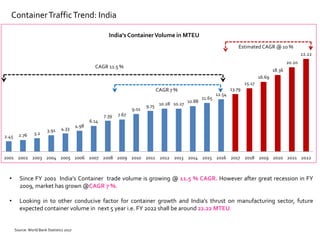

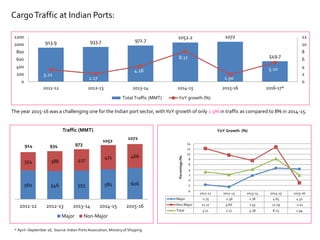

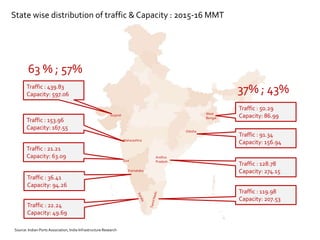

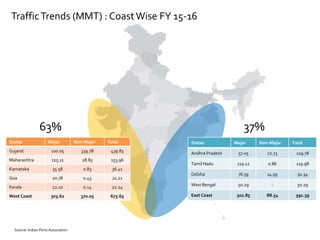

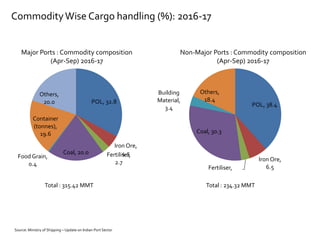

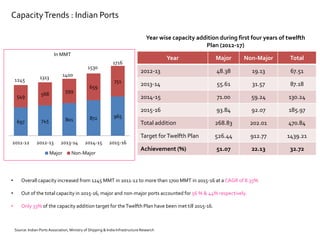

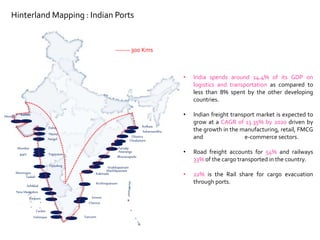

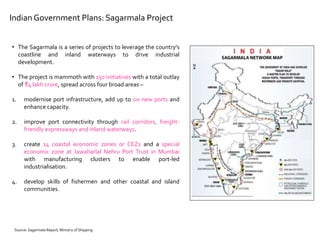

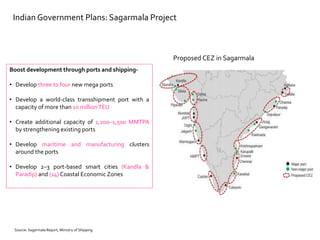

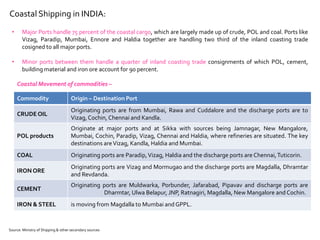

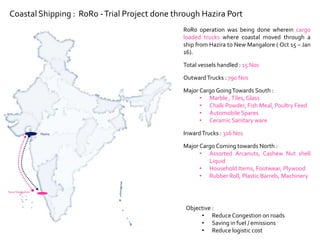

This document summarizes a presentation given by Capt. A.K. Singh, CEO of Adani Dahej & Hazira Port, on the topic of connecting India through shipping. It provides an overview of global and Indian trade trends in recent years, cargo traffic and capacity at Indian ports, key commodities handled, and various initiatives by the Indian government to boost port infrastructure and connectivity through projects like Sagarmala and development of coastal economic zones.