This document summarizes an investment fund called the Trinity Accommodation Regional Hospitality Fund (TARHF). Some key points:

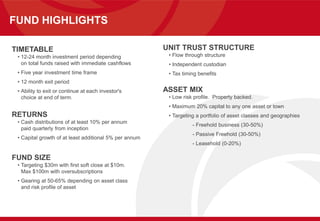

- TARHF will invest in regional Australian hospitality assets like motels over 5 years, targeting annual returns of 10% from distributions and 5% from capital growth.

- The fund will be structured as a unit trust with an independent custodian. Assets will include freehold passive, freehold business, and leasehold properties.

- The principals have over 25 years of experience in hospitality, property, and finance. They currently own and manage seven motel properties through the Trinity Accommodation Master Trust.

- The pipeline includes the Goulburn Heritage Motel