Clsa asia themes 2011

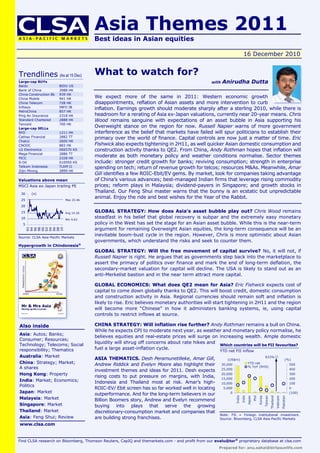

- 1. Asia Themes 2011 Best ideas in Asian equities 16 December 2010 Trendlines (As at 15 Dec) What to watch for? Large-cap BUYs with Anirudha Dutta Baidu BIDU US Bank of China 3988 HK China Construction Bk 939 HK China Mobile 941 HK We expect more of the same in 2011: Western economic growth China Telecom 728 HK disappointments, reflation of Asian assets and more intervention to curb Infosys INFO IB inflation. Earnings growth should moderate sharply after a sterling 2010, while there is PetroChina 857 HK Ping An Insurance 2318 HK headroom for a rerating of Asia ex-Japan valuations, currently near 20-year means. Chris Standard Chartered 2888 HK Wood remains sanguine with expectations of an asset bubble in Asia supporting his Tencent 700 HK Large-cap SELLs Overweight stance on the region for now. Russell Napier warns of more government BYD 1211 HK interference as the belief that markets have failed will spur politicians to establish their Cathay Financial 2882 TT primacy over the world of finance. Capital controls are now just a matter of time. Eric Chalco 2600 HK CNOOC 883 HK Fishwick also expects tightening in 2H11, as well quicker Asian domestic consumption and LG Electronics 066570 KS construction activity thanks to QE2. From China, Andy Rothman hopes that inflation will Mega Financial 2886 TT PICC 2328 HK moderate as both monetary policy and weather conditions normalise. Sector themes S-Oil 010950 KS include: stronger credit growth for banks; reviving consumption; strength in enterprise Telkom Indonesia TLKM IJ spending on tech; return of revenue growth for telcos; resources M&As. Meanwhile, Amar Zijin Mining 2899 HK Gill identifies a few ROIC-Ebit/EV gems. By market, look for companies taking advantage Valuations above mean of China’s various advances; best-managed Indian firms that leverage rising commodity MSCI Asia ex-Japan trailing PE prices; reform plays in Malaysia; dividend-payers in Singapore; and growth stocks in 30 (x) Thailand. Our Feng Shui master warns that the bunny is an ecstatic but unpredictable 25 Max 25.46 animal. Enjoy the ride and best wishes for the Year of the Rabbit. 20 15 Avg 14.26 GLOBAL STRATEGY: How does Asia's asset bubble play out? Chris Wood remains 10 Min 9.63 steadfast in his belief that global recovery is subpar and the extremely easy monetary 5 policy in the West has set the stage for an Asian asset bubble. While this is the near-term argument for remaining Overweight Asian equities, the long-term consequence will be an 93 94 96 98 00 02 04 06 08 10 Source: CLSA Asia-Pacific Markets inevitable boom-bust cycle in the region. However, Chris is more optimistic about Asian governments, which understand the risks and seek to counter them. Hypergrowth in Chindonesia® GLOBAL STRATEGY: Will the free movement of capital survive? No, it will not, if Russell Napier is right. He argues that as governments step back into the marketplace to assert the primacy of politics over finance and mark the end of long-term deflation, the secondary-market valuation for capital will decline. The USA is likely to stand out as an anti-Merkelist bastion and in the near term attract more capital. GLOBAL ECONOMICS: What does QE2 mean for Asia? Eric Fishwick expects cost of capital to come down globally thanks to QE2. This will boost credit, domestic consumption and construction activity in Asia. Regional currencies should remain soft and inflation is likely to rise. Eric believes monetary authorities will start tightening in 2H11 and the region will become more “Chinese” in how it administers banking systems, ie, using capital controls to restrict inflows at source. Also inside CHINA STRATEGY: Will inflation rise further? Andy Rothman remains a bull on China. While he expects CPI to moderate next year, as weather and monetary policy normalise, he Asia: Autos; Banks; believes equities and real-estate prices will surge on increasing wealth. Ample domestic Consumer; Resources; Technology; Telecoms; Social liquidity will shrug off concerns about rate hikes and Which countries will be FII favourites? responsibility; Thematics fuel a large asset-inflation cycle. YTD net FII inflow Australia: Market 833% ASIA THEMATICS. Desh Peramunetilleke, Amar Gill, (US$m) (%) China: Strategy; Market; Andrew Riddick and Evelyn Moore also highlight their 30,000 YTD net 500 A shares % YoY (RHS) investment themes and ideas for 2011. Desh expects 25,000 400 Hong Kong: Property 20,000 300 rising costs to put pressure on margins, with India, 15,000 200 India: Market; Economics; Indonesia and Thailand most at risk. Amar’s high- 10,000 100 Politics ROIC-EV/ Ebit screen has so far worked well in locating 5,000 0 Japan: Market 0 (100) outperformance. And for the long-term believers in our Malaysia: Market India Phil Thailand Taiwan Pakistan Indo Vietnam Japan Korea Billion Boomers story, Andrew and Evelyn recommend Singapore: Market buying into plays that serve the growing Thailand: Market discretionary-consumption market and companies that Note: FII = Foreign institutional investment. Asia: Feng Shui; Review are building strong franchises. Source: Bloomberg, CLSA Asia-Pacific Markets www.clsa.com Find CLSA research on Bloomberg, Thomson Reuters, CapIQ and themarkets.com - and profit from our evalu@tor® proprietary database at clsa.com

- 2. Asia Themes 2011 Contents What are the themes for 2011? Which stocks might get discovered? Introduction by Anirudha Dutta ........................... 3 Asia thematics by Amar Gill .............................. 18 How does Asia's asset bubble play out? Seeking Asian exposure without EM risk? Global strategy by Christopher Wood ................... 4 Australia market by Scott Ryall ......................... 18 Will the free movement of capital survive? How do you fight hot money? Global strategy by Russell Napier ........................ 5 China strategy by Francis Cheung ...................... 19 What does QE2 mean for Asia? How to play to become No.1? Global economics by Eric Fishwick ....................... 6 China market by Danie Schutte ......................... 20 Will inflation rise further? Will small still be beautiful? China strategy by Andy Rothman ........................ 7 China A shares by Manop Sangiambut ................ 21 What is the key earnings risk in 2011? Will HK property prices fall in 2011? Asia microstrategy by Desh Peramunetilleke ......... 9 Hong Kong property by Nicole Wong .................. 22 Where to invest in Asia? Commodity curse in 2011? Asia sales view by Evelyn Moore ......................... 9 India market by N Krishnan .............................. 23 Does consumer remain the way to go? Will the investment upturn lose steam? Asia sales view by Andrew Riddick ..................... 10 India economics by Rajeev Malik ....................... 24 Is the global sector in a sweet spot? Is politics a risk? Asia autos by Geoff Boyd ................................. 11 India politics by Anirudha Dutta......................... 25 Will the sector continue to outperform? Is there “good” and “bad” inflation? Asia banks by Daniel Tabbush........................... 12 Japan market by Andreas Schuster .................... 26 Will Asian Boomers ride high? Will the nation push meaningful reforms? Asia consumer by Aaron Fischer, Anirudha Dutta . 13 Malaysia market by Clare Chin .......................... 27 How will miners spend their capital? Does a strong currency hurt its status? Asia resources by Andrew Driscoll, Daniel Meng .. 14 Singapore market by Ashwin Sanketh ................ 28 Will 2011 be a “cleaner” year? Can the SET go up three years in a row? Asia technology by Bhavtosh Vajpayee .............. 15 Thailand market by Tim Taylor .......................... 29 Can data push revenue growth? Will the Rabbit leap into a wall? Asia telecoms by Elinor Leung........................... 16 Asia Feng Shui by Philip Chow ........................... 29 Is Asia becoming more responsible? How did our 2010 predictions fare? Asia social responsibility by Simon Powell ........... 17 Asia review by Amar Gill ................................... 30 Related reports to key themes 2 16 December 2010

- 3. Asia Themes 2011 Asia - INTRODUCTION What are the themes for 2011? Remain Overweight Asia. Next year is likely to be similar in many ways to 2010, but watch for increased policy risks. The recovery in the West remains anaemic and the USA is still in a deflationary mode. Asian asset prices will continue to inflate as long as the region is coupled to US monetary policy. Hence, we are likely to see more government intervention in Asia even as inflation remains stubbornly high. For now, we are Overweight the region. We provide insights from our strategists Anirudha Dutta and research/sector heads in the following pages. (91) 2266505056 anirudha.dutta@clsa.com Macro and global - From Washington with love US recovery remains weak and the outlook on EU is pessimistic; monetary policy in the West will remain loose; secondary-market valuations will decline as governments step back into the marketplace. Ample liquidity in Asia should result in asset inflation, particularly in Still rising equities and property; China will be the epicentre of the Asian asset Asian inflation weighted for GDP bubble. 10 (% YoY) 9 With accelerating domestic consumption and construction in the region, 8 inflation will remain a key concern in 2011. 7 Increased government intervention, first in property and likely to follow 6 5 with capital controls; the renminbi should continue to appreciate, by 4 7% next year. 3 A key risk is margin pressure. 2 1 Sectors - A(utos) to T(echnology) 0 (1) Autos are in a sweet spot globally with developed-market capacity 98 99 00 01 02 03 04 05 06 07 08 09 10 addition muted and demand from the emerging world surprising on the Source: CEIC, CLSA Asia-Pacific Markets upside. A brilliant year awaits Asian banks, with healthy credit growth, widening margins and limited provision costs; focus on banks with high ROAs. Sharply up since the downturn Asian consumers remain upbeat and will benefit from the positive job US-dollar market performance since end-2008 outlook and wage inflation in 2011; buy affluence and companies that Indonesia are building strong sustainable franchises. Thailand Hong Kong residential-property prices will continue to rise; we prefer Phillipines Korea the landlords to the developers. India Resources companies are well placed with healthy cashflows and Taiwan Singapore therefore, capex and M&A will remain in focus. MSCI Asia A positive year ahead for technology: enterprise spending will remain Malaysia Hong strong after a decade of underinvestment; new products will keep China consumer demand high. Stop worrying about wage inflation. USA (%) Japan Telcos will witness revenue growth again on growth in data revenue, 0 100 200 300 cheaper smartphones and Asian telcos’ own application stores. Valuations are undemanding. Source: Bloomberg, CLSA Asia-Pacific Markets Markets of choice Australia offers exposure to the growth of Asia without emerging- Upgrades are moderating market risk. Consensus EPS forecasts 50 (%) With China emerging as the No.1 global consumer, there are multiple ways to play the theme. Negative sentiment for the policy-sensitive 2010E 45 stockmarket could reverse as weather and monetary policy normalise. 2011E 2012E Commodity-price hikes and governance issues plague the Indian 40 market. Inflation, high prices of resources and tight liquidity conditions are likely to be transient and we expect a revival in investment 35 demand. 30 Return of inflation is good news for Japan, an oversold market with undemanding valuations. We see upside potential. 25 Malaysia is likely to see progress in reforms notwithstanding the Feb 09 Sep 09 Apr 10 Nov 10 sceptics, which will drive a market rerating. Source: Datastream 16 December 2010 3

- 4. Asia Themes 2011 After two years of positive returns, Singapore is no longer cheap. Focus on dividend-related investment themes. A continuation of capex and credit growth alongside a return of the present government after the next election will boost earnings in Thailand. Markets will react positively. Valuations - Room for upside. We forecast Asia ex-Japan earnings growth to sharply moderate from 42.3% this year to 13.6% in 2011. The 12-month forward PE, at 12.1x, suggests valuations are not yet demanding in the aggregate. We estimate strong free-cashflow growth of 98% for next year. This, coupled with reasonable valuations, should provide upside to regional markets even as EPS growth slows. Our strategists remain Overweight Asia, while being cognisant of the risks, particularly from government action. Meanwhile, according to our new Feng Shui master, the year of the Metal Rabbit can be quite unpredictable, if history is any guide. Global - STRATEGY How does Asia's asset bubble play out? Asia to enter a bubble if US interest rates take a long time to normalise. The macroeconomic backdrop in America remains deflationary; hence the Federal Reserve’s willingness to embark on QE2. The US bond market continues to signal a subpar recovery. The more anaemic the Western recovery proves to be, the longer it will take for Western interest rates to normalise and so the more likely it will be that Asia enters into an asset bubble. Christopher Wood Unhealthy US recovery. By the first half of 2011, it should become (852) 26008516 christopher.wood@clsa.com apparent whether US consumption and employment are really normalising. The view here is that neither will recover healthily. This also seems to be the message from the US government-bond market, which has remained relatively well bid, despite the ongoing rally in the S&P500 amid rising optimism. Indeed the 10-year Treasury bond yield is still 117bps lower Bond yield still below April high than the 2010 high reached in April. In this sense, the US bond market S&P500 and US 10-year Treasury bond yield continues to send an entirely different message from the US stockmarket. 1,500 S&P500 (LHS) (%) 4.5 Asian asset bubble . . . China is likely to be the epicentre of an Asian 1,400 US 10-year Treasury bond yield 4.0 bubble. The situation in the West is critical in terms of how the Asian cycle 1,300 evolves. Western policy is likely to remain super-easy because of the 1,200 3.5 lacklustre outlook for consumption and employment in an American 1,100 economy, where consumption still accounts for 70.4% of total nominal 1,000 3.0 GDP and 88.5% of nominal private-sector GDP. Another reason for policy 900 remaining super-easy in the West is the potentially systemic issue of 800 2.5 Euroland sovereign debt. 700 600 2.0 . . . and tightening policies. Asian governments and central banks are Jan 08 Dec 08 Dec 09 Dec 10 going to have to be very aggressive if they really want to head off the risk of an asset bubble in an environment where Western monetary policy Source: Datastream, Bloomberg stays so easy. Such an aggressive approach is theoretically possible in terms of much higher interest rates and allowing currencies to float freely. But the most likely outcome at present is that Asian tightening policies will Continue to Overweight Asia continue primarily to address symptoms of the bubble risk, such as higher MSCI AC Asia ex-Japan relative to MSCI AC World property prices, not the cause of it. 300 (Jan 1988=100) Renminbi appreciation. One important aspect of this potential Asian policy response remains Chinese currency policy. For now the view here 250 remains that China will allow only an incremental appreciation of 5-7% per year. Still, the political noise on the Chinese exchange-rate issue is likely 200 to escalate next year if the US labour market continues to be unhealthy. 150 Remain Overweight Asia. The extremely easy monetary policy in the West remains a perfect ingredient for an asset bubble in Asia, which is 100 an argument for now to remain Overweight on the region. From a 50 longer-term perspective, the other side of an asset bubble in Asia, with 1988 1995 2003 2010 China at its epicentre, is a deflationary bust. This is why it is correct to say that an extended period of near-zero rates in the USA has the Source: Datastream potential to destabilise Asia in the sense that the long-term healthy 4 16 December 2010

- 5. Asia Themes 2011 domestic demand story anticipated in the original Billion Boomers report (The Real Pacific Century - Asia’s Billion Boomers, September 2002) is fast-forwarded into a boom-bust cycle. Still, it is a positive that the Chinese leadership, as well as other Asian governments, understands this risk and will be seeking to counter it. Global - STRATEGY Will the free movement of capital survive? From mercantilism to Merkelism and the perils to capital. The Merkelists’ desire to assert the primary of politics over finance reverses the assertion of Thatcherism that ‘you can’t buck the market.’ Government retreat from the marketplace and a long disinflation dramatically lifted the secondary-market valuation of capital from 1982 to 2000. We need to realise that we are faced with governments stepping back into the marketplace and the end of that disinflation - a combination Russell Napier that should structurally reduce secondary-market valuations for capital. (44) 1316549830 russell.napier@clsa.com Merkelism is a convenient label. However, it is not confined to the ex- members of the Free German Youth Movement of the German Democratic Republic. Merkelism is a global movement forced upon politicians by perceived market failures. Of course, many of these failures stem from government intervention, most notoriously the refusal of China to permit exchange-rate revaluation, but this is irrelevant in the reactionary world, which is politics. Merkelism will have many manifestations; the key one for investors will be that politicians will seek ‘I won’t let up on this because otherwise solutions to Greenspan’s flaw. The flaw, as the Maestro outlined in that primacy of politics over finance can’t testimony before Congress, is that the ‘enlightened self-interest’ of the be enforced,’ Angela Merkel, Chancellor of private sector cannot correctly determine the appropriate level of credit Germany for an economy. This is now the job of the authorities. ‘Primacy of politics over finance’. Anyone serious in asserting this needs to make capital as sluggish and inflexible as labour and government. The superior speed of capital has allowed it to arbitrage labour and government and thus asserted the primacy of finance over politics. Capital controls, whether introduced proactively in a Merkelist conversion or reactively in a crisis, are now just a matter of time. Capital controls - A barrier to arbitrage. The emerging-market Merkelists Current account directs economic adjustment believe that they will be able to target interest rates, thus credit, and their Brazil’s financial and current accounts exchange rates simultaneously. The emerging-market authorities are 25 (US$bn) Financial account marching down this route to avoid the credit bubble they suffered in the mid- 20 Current account 1990s and the US endured for the past decade or more. Such controls are 15 likely to be insufficient to control credit and defeat inflation and this will inevitably lead the Merkelists to seek to more directly control bank credit. 10 Almost certainly one day they will have to follow Volcker rather than Merkel 5 and attack their endemic inflation problems with interest rates and abandon 0 the attempt to ‘whip inflation now’ with administrative measures. This approach is currently too radical, as it will inflict the political pain of higher (5) interest and exchange rates simultaneously. Political expediency is driving the (10) 09 97 99 01 03 05 07 75 77 79 81 83 85 87 89 91 93 95 emerging-market authorities to Merkelism rather than monetarism. As with the USA in the 1970s, monetarism is a medicine too strong for all but those Source: Datastream already weakened by a prolonged period of Merkelism. Merkelism will spread. Most investors will be surprised that the Merkelist drive to assert the ‘primacy of politics over finance’ will also inflict Asia. Forecasting its spread within Europe is much less contentious. When all else fails, Merkelism can save the euro but at the expense of the free movement of capital and by cajoling private-sector savings into public-sector debt. Many might see such a move as imminent as the fiscal glue to cement the euro as it melts in the heat of Spain. This might be true but ignores that fact that when the fiscal arbitrage that passes good credit to bad credits reaches its limit, there is another solution in reserve. The monetisation of European sovereign debt by the European Central Bank (ECB) will save the euro. 16 December 2010 5

- 6. Asia Themes 2011 Markets versus central banks. Markets can take on and defeat USA as an anti-Merkelist bastion governments whose fire power is limited to the funds they can extract Gross Federal debt as a portion of GDP from their citizens. However, markets must bend to the central bankers 140 (%) whose fire power is unlimited as they conjure money out of thin air. Most 120 believe that the ECB would never pull this rabbit out of a hat because once 100 upon a time, in 1923, another European central bank tried a similar trick. However, with the failure of the commercial banking system of Europe 80 assured, if the euro fails then the ECB will have to follow the Fed and the 60 Bank of England to defeat the markets. If the ECB saves the euro then 40 Merkelism need not. However, it will not be held in abeyance for long. Once we thought Merkelism would appear to save the sovereign debt of 20 Portugal, Ireland, Greece and Spain. Of course, if the ECB saves them, 0 then one day Merkelism will appear but to save the sovereign debt of 1940 1952 1964 1976 1987 1999 2011E Germany itself. Source: whitehouse.gov Will the USA hold out? The USA is likely to stand out as an anti- Merkelist bastion. As the owner of the reserve currency, it must resist any movement towards the capital controls that would restrict the injection of foreign savings, which send it to work every morning. This resistance may even attract more capital as capital considers the balance between politics and finance to be in its favour in the USA. However, the primacy of finance in the USA is not some cunning legacy of Alexander Hamilton, but a result of a society addicted to the easiest money of all - the easy money called the reserve currency. Even the USA will question the primacy of finance when it realises that finance is not always cheap and readily available. That day for America will dawn when Volcker comes to Asia. When the emerging markets are forced to attack their endemic inflation with high interest rates and flexible exchange rates, then the USA will have to pay the real cost of finance. It is a price that it arguably has not paid for a century and at least not since the seventies. Emerging-market savings will no longer be on tap and US Treasury yields will soar. Then, and probably only then, will the USA be forced to impose capital controls, assert the primacy of politics over finance and bring Merkelism to America. Global - ECONOMICS What does QE2 mean for Asia? Asia to see credit growth and faster consumption and construction. QE2 will drive down the cost of capital globally and thus Asia is likely to see credit growth and accelerating domestic consumption and construction activity in 2011. But GDP growth will be slower amid weak world trade. Malinvestment resulting from emerging-market monetary policy internationalising QE2 will define the end-game for this cycle, but the party could last several years. The more immediate problem is consumer-price inflation. We expect Asian Eric Fishwick monetary authorities to start tightening in 2H11. (852) 26008033 eric.fishwick@clsa.com The “Bernanke put”. QE2 will drive down the cost of capital on a global scale. It will accelerate credit cycles in those countries in which, as a result of interest-rate and exchange-rate practices, import US liquidity. This includes most of Asia. Next year is likely to see credit growth and domestic Importing US liquidity construction activity accelerate. Most of Asia is export-driven, so in the Aggregate Asian forex reserves weak-world-trade environment that we expect for 2011 GDP growth will be slower than this. But consumption and investment will be stronger than 5.0 (US$tn) (US$tn) 2.0 previous export-GDP correlations would suggest. QE2 represents the 4.5 Rolling 12M change 1.8 4.0 1.6 “Greenspan put” supersized into the “Bernanke put” of 2011. Our bearish Level (LHS) 3.5 1.4 economic forecast makes it a certainty that the US will extend QE2 into 3.0 1.2 2H11 and potentially beyond. 2.5 1.0 Don’t overplay euro weakness. QE2 will generate liquidity flows into 2.0 0.8 risk assets far greater than the Fed’s direct purchases of Treasuries if it 1.5 0.6 1.0 0.4 makes the US dollar appear a risk-free short. At the moment, this is not 0.5 0.2 the case as the euro is contaminated by sovereign-risk concerns. Event 0.0 0.0 risk in the euro will dissipate only by Portugal and likely Spain following 2004 2005 2006 2007 2008 2009 2010 Ireland and Greece in accessing International Monetary Fund and European Union funding. So doing will require aggressive austerity Source: Datastream, CEIC, CLSA Asia-Pacific Markets 6 16 December 2010

- 7. Asia Themes 2011 measures vindicating a pessimistic outlook for EU growth. As the bailout Credit decoupling Asia pacts are progressively triggered for Portugal and finally for Spain, liquidity Real GDP forecasts risk overhanging the euro will dissipate. As this happens, the currency 2009 2010CL 2011CL 2012CL should again start to outperform the dollar. Australia 1.3 2.7 3.9 3.6 China 9.1 10.2 8.9 9.5 Asia a soft-currency region in 2011. With export growth already under Hong Kong (2.8) 7.0 5.4 4.3 pressure and China unwilling to allow anything more than a cosmetic India 7.4 8.8 8.3 9.0 appreciation of the yuan, Asia as a whole in 2011 will be a soft-currency Indonesia 4.5 5.9 5.7 6.0 region. Exchange rates will appreciate versus the US dollar but only Korea 0.2 6.4 5.1 5.4 because the latter is even weaker. Asian currencies will fall relative to Malaysia (1.7) 6.7 4.3 4.5 physical stores of value (gold and commodities in general), freely floating Philippines 1.1 7.0 4.8 5.3 commodity currencies (the Australian and New Zealand dollars) and, as Singapore (1.3) 15.0 4.0 5.0 sovereign risk dissipates, the euro. Taiwan (1.8) 10.2 5.1 4.1 Asia coupled to US monetary policy. In Asia, QE2 will appear as a Thailand (2.3) 7.7 4.0 4.7 reduced cost of capital as underleveraged banks try to raise loan/deposit ratios (LDRs). The return on savings will also fall (especially in real terms). Memo: USA (2.6) 2.8 1.8 1.1 With cyclical (export) sectors weak, liquidity will pool in property markets. Memo EU (3.6) 1.1 0.0 0.5 The combination of QE2 and Asian monetary policy will support both China is a small upward revision. Recent PMI data domestic credit growth and fixed capital formation. With exports under suggest that sequentially 4Q will be stronger than 3Q and this pushed the CY10 number up a little and the CY pressure, Asian economies will appear finally to have decoupled from world- number up about 0.5ppts. I'll characterise as 8-9% in the trade flows. Our forecasts for 2011 are slower than 2010 but far from text. Source: CLSA Asia-Pacific Markets pessimistic given our US and EU assumptions. Asia will have decoupled, but only by virtue of remaining intimately coupled to US monetary policy. Inflation will rise in Asia. On the street, liquidity is likely to be most visible as persistent upward pressure on property prices. Consumer-price inflation is already appearing in Asian inflation statistics today. Asia, like most emerging markets, is vulnerable to rising food prices because of the large weight of unprocessed food in Consumer Price Indices (CPIs). Inflation has started to rise across Asia and we expect headline rates to rise further as QE2 continues. Asia will become more “Chinese”. QE2 has the potential to make the Rerun of 2008 inflation, for longer most economic difference in economies like Indonesia and India, which Average CPI inflation (2009 GDP weights) historically have had high cost of capital and constrained bank balance 18 (% YoY) sheets. More and more aggressive interference in property markets and 16 Overall attempts to control banks’ ability to lend will characterise 2011. There is 14 Food Non-food also likely an increase in the use of capital controls to restrict inflows into 12 monetary systems at source, as is the case in China (which is therefore 10 8 one of the countries best able to handle them). And in 2011 we would 6 expect the rest of the region to become more “Chinese” in how it 4 administers banking systems. 2 Tightening will occur in second half. Eventually, Asian monetary 0 authorities will be forced to react. But historical precedent, both in how (2) 2003 2004 2005 2006 2007 2008 2009 2010 they respond to terms of trade shocks and their willingness to raise rates while US rates remain low, suggests that interest rates and exchange rates Source: CEIC, CLSA Asia-Pacific Markets will lag inflation. By end-2011, we expect interest rates to be raised and attitudes towards currency appreciation to be more open. But it will have taken inflation rates at or around 10% to have caused the shift. China - STRATEGY Will inflation rise further? CPI to moderate next year as climate and monetary policy normalise. Inflation in China is primarily a weather-driven phenomenon, with monetary policy playing a supporting role. As these factors normalise next year, the increase in CPI will not be dramatically higher than the 3.6% average annual rate of the five pre-stimulus years. Still, we expect high levels of liquidity and rising income to fuel price surges in the country’s two asset classes - equities and real estate. Andy Rothman (86) 2123066000 Largely bad weather. The primary driver of CPI inflation has been bad andy.rothman@clsa.com weather across the country, leading to a sharp fall in fresh vegetable and fruit supplies. Food accounted for 74% of the November CPI rise, while 16 December 2010 7

- 8. Asia Themes 2011 residence expenses contributed another 18%. Ninety-two percent of the headline CPI increase came from just those two categories. We are not arguing that the sharp rise in the growth rate of money supply has had no Sinology China Macro Strategy inflationary impact, but monetary conditions account for only a small share of the CPI surge. Fresh veggies and fruit the key driver It isn’t always money. Core CPI was only 1.5% in November. The sharp CPI-Food, CPI-Fresh veggie and CPI-Fresh fruit fall in money velocity has largely neutralised last year’s dramatic increase 135 (% YoY) CPI-Food in money supply. Monetary policy accounts for only a small share of the 130 CPI-Fresh vegetable CPI increase, and the growth rate of money supply is normalising. 125 CPI-Fresh fruit 120 Social unrest. Higher food prices are unlikely to result in social instability. 115 The key factor is that a decade of rapidly rising income has left Chinese far 110 better equipped than many of their emerging-market counterparts to 105 manage higher food prices. 100 Higher rates. Beijing is once again using administrative measures to cool Jan 10 Mar 10 Jun 10 Aug 10 Nov 10 off inflation. But as was the case in 2008, we don’t expect the Party to Source: CEIC freeze food prices. The Communist Party will keep raising interest rates until food prices cool off. This means two to three more 25bp increases are likely by mid-2011. Lending and one-year deposit rates should rise in Higher reserve requirement tandem. CPI-Food and RRR Higher RRR. Bank reserve-requirement ratios (RRRs) will also rise with 125 (%) 20 CPI, but as with interest rates, this is primarily a political signal that will 120 CPI-Food 18 have little impact on food prices or bank lending. Demand for credit will RRR (RHS) 16 115 remain strong, and supply is controlled by quota. With the system-wide 14 110 12 loan/deposit ratio still at about 66%, well below the 75% ceiling, very few 10 105 banks will find their lending constrained by a much higher RRR. 8 100 6 Not significant tightening. Higher real rates and RRR will have little 95 4 impact on the economy or on the housing market, and do not foreshadow Jan 04 Sep 05 Jun 07 Feb 09 Nov 10 significantly tighter monetary policy next year. New lending will be very Note: non-food inflation before 2005 is based on low in December as the Party sticks close to its full-year target, but in estimate. Source: CEIC 2011 loans outstanding is likely to rise by 14-15%, near the average annual rate of 15.7% during the five pre-stimulus years. FAI will stay strong. Nominal fixed-asset investment (FAI) growth, No significant tightening which drives commodities demand, will normalise at about 25% YoY this RRR, interest rate, M2 and loan growth year and next, roughly the same pace as in the six pre-stimulus years. 45 (%) (%) 10.0 40 Loan growth YoY (LHS) No change to currency policy. The Party does not consider the 35 Required reserve ratio (LHS) M2 growth YoY (LHS) 9.0 exchange rate as a tactical tool for managing short-term problems such as 30 Interest rate for one-year loans 8.0 high food prices. Rather, gradually moving the currency towards a market- 25 20 7.0 based equilibrium rate is considered a long-term structural adjustment. 15 The renminbi is appreciating at a 5-7% annualised pace against the dollar, 10 6.0 and we expect that to continue for the next couple of years. 5 5.0 Jan 04 Sep 05 Jun 07 Feb 09 Nov 10 Non-food inflation. There are two factors keeping non-food prices low. First, steady gains in productivity. Second, overcapacity in most Source: CEIC manufacturing sectors severely limits the ability of firms to raise final goods prices. Hot money. A second round of quantitative easing in the USA has sparked Asset-price, not CPI inflation expectations of a wave of “hot money” into emerging markets. In China, Shanghai composite index, interest rate and RRR however, the key will continue to be domestic liquidity. Capital-account Shanghai stock composite index (LHS) Benchmark interest rate for one-year loans controls make it difficult to move money into the country, and the absence Required reserve ratio 7,000 (%) 19 of a significant bond market will make other emerging markets more 6,000 17 attractive to many investors. 5,000 15 13 4,000 Asset-price, not CPI inflation. While we expect CPI to be moderate next 3,000 11 9 year, high levels of liquidity and rising income are very likely to fuel price 2,000 7 rises in China’s two asset classes, equities and real estate. We note that in 1,000 5 2007, when rates rose seven times and the RRR was increased 10 times, Jan 07 Jul 07 Dec 07 Jun 08 Dec 08 the Shanghai composite index rose from 2,800 to 5,300. If this time Source: CEIC investors also shrug off inflation and higher rates, there is ample domestic liquidity - household bank deposits equal to US$4.4tn, larger than the combined GDPs of Russia, India and Brazil - available to fuel a large asset- price inflation cycle. 8 16 December 2010

- 9. Asia Themes 2011 Asia - MICROSTRATEGY What is the key earnings risk in 2011? Rising costs and easing demand create widespread margin pressure. Margins remain a key EPS-growth driver at almost any point in the cycle. From a top-down perspective, there are some reasons to be concerned about margins. Costs are rising, particularly raw-material and energy prices. This, and easing demand, creates widespread margin pressure. Analysts underestimating these headwinds in their bottom-up forecasts could put earnings at risk in 2011. Our India, Indonesia and Thailand Desh Peramunetilleke analysts exhibit the most optimism in margin assumptions presently. (852) 26008293 desh.peramunetilleke@clsa.com Rising costs add to margin pressure. Producer prices have risen Margin squeeze ahead significantly in Asia, with the Producer Price Index (PPI) outpacing the PPI/CPI relationship with Ebitda margins Consumer Price Index (CPI). History shows that this will create major Avg PPI YoY (LHS) 12 (%) (%) 20 headwinds for Ebitda margins. We expect by 2011 gross margins to hit an Avg CPI YoY (LHS) Expected 10 19 all-time low as variable costs increase more than we forecast due to higher Ebitda margin 8 input prices and rising wages in the region. 18 6 17 Peaking operating leverage. Any decline in global growth impacts Asian 4 16 earnings due to the high levels of operating leverage in the region. Given 2 15 the focus on manufacturing, Asian firms tend to have high proportions of 0 (2) 14 fixed costs. This means that any increase in sales goes directly to the Highier PPI (4) hurts margins (5.0) 13 bottom line, so earnings growth can be spectacular when economic times 98A 99A 00A 01A 02A 03A 04A 05A 06A 07A 08A 09A 10F 11F 12F are good. The recovery of Asian markets in 2009 saw operating leverage peaking at 3.1. This should see a steady decline to 1.2x in 2011, Source: CLSA Asia-Pacific Markets highlighting the pressure on margins. EPS for our Asia ex-Japan (ex finance) universe is set to grow by 8.4% in 2011 but a 1ppt decline in margins would see growth become negative at -1.2%. Focus on sustainable growth. Asia has long been a paradise for growth- at-a-reasonable-price (Garp) investors. However, pricing growth based on ratios such as PE/G has always been a challenge given the volatility and low reliability of EPS forecasts, especially when margin optimism in analyst estimates remain a concern. One of our recent reports introduced sustainable growth as a reliable long-term measure and a key component behind through-the-cycle valuation analysis. Sustainable growth (SG), defined as ROE X (1 - payout ratio), is the core organic growth potential of a company, excluding M&A and any increase in gearing. Our backtests further highlight that price of sustainable growth (PSG), defined as (12- month forward PE/SG), is a better predictor of share-price performance than PE/G for Asia. We found J-curve-driven Chindonesia® to be cheap on a PSG basis. Asia - SALES VIEW Where to invest in Asia? Buy affluence, sell peasantry. Investors should structure their portfolio holdings to buy plays on affluence and sell those on peasantry in 2011, in order to profit from Asia’s serious wealth creation. Apart from higher wages, wealth will come from improved investment returns, availability of leverage, new investment and consumer credit products, and less savings for non-discretionary expenses. Labour is no longer docile, but aspirational and connected. Social networks and Evelyn Moore broadband have brought branded goods and luxury living to billions. (1) 2145288820 evelyn.moore@clsa.com Buy stocks that service emerging wealth. Margins, valuation expansion and shareholder profits will come from companies positioned to sell to and service emerging wealth. Two decades ago, profits in Asia stemmed from first-time buyers of government housing, taxi rides, eating out, and wardrobes beyond workplace uniforms. Today, the riches want to own the best-in-show products, to hide and insure assets, to be among their own kind, to give children superior educations and to feel and look 16 December 2010 9

- 10. Asia Themes 2011 good to infinity. Buy stocks representing the best brands in discretionary Be long the yellow metal items, land, travel, organic goods, online shopping, private transport, cool Gold price tech gadgetry, blue-chip financial services, insurance, education and 1200 (US$/oz) healthcare, and companies focusing on broadband buildout and internet 1000 mobility. Steer away from staples, utilities, bicycles and cigarette stocks. Think paintings, not paint. In sum, when choosing stocks in Asia, buy 800 affluence and sell peasantry. 600 Behavioural finance will rule gold and Japan trades. Therefore, be 400 long gold as investors and pundits re-anchor their price target from recent all-time high of US$1,423/oz to the inflation-adjusted high of US$2,387/oz. 200 When people think of something being at record highs, they are less likely 0 to buy, but when they reframe on a new anchor, their loss-aversion bias Dec 44 Dec 57 Dec 70 Dec 83 Dec 96 Dec 09 kicks in and they are driven to act in order to take advantage of this apparent “deal” before the “cheap” offering of gold disappears. Ready your Source: Bloomberg portfolio for the view that gold has another 68% to go before it simply matches its real money peak of 30 years ago. Recent performance of Japanese equities and the yen will lead equity investors to re-anchor from a view of multidecade decline to multiyear recovery. Asia - SALES VIEW Does consumer remain the way to go? Thought-provoking insights on companies with economic moats. A CLSA salesman caught singing the praise of non-CLSA research never endears himself to his research colleagues. At the risk of being hung out to dry, my recommendation is to get hold of some of the reports boutique investment-fund managers Arisaig & Partners produces, for some provoking thought process. As they say in their consumer-sector research, if consumers don’t eat it, drink it, clean with it, wear it or shop in it, they do Andrew Riddick not own it. These are the areas where cyclicality is most reduced and quality (852) 26008836 of earnings most increased. andrew.riddick@clsa.com Dominant Asian companies create value. Arisaig constructed a simple, Upside in Asian demand equally-weighted index of 54 Asian dominant consumer companies and Swiss-watch imports to GDP looked at what might have happened if they had had the wisdom and 150 Swiss-watch imports (US$/capita) foresight to buy and hold these since 1 January 1997 through to 31 Hong Kong December 2009. During a period in which the MSCI Asia ex-Japan returned 100 Singapore a net 4.2% Cagr with EPS growth of negative 0.1%, this index returned Saudi UAE 31.0% Cagr with a 23.2% EPS Cagr. Consumer-staple companies in Africa 50 China Thailand Arabia Taiwan France and Latin America achieved similar massive outperformance over the same UK USA period. But not only there: as it happens, the story in the USA back in the 0 Germany 1980s is just as impressive. Stocks with high "moats" (brand, distribution, 0 Russia 20,000 Spain 40,000 60,000 scale) generate high ROEs, create cash and permit growth, both organic Italy Japan GDP/capita (US$) and acquisitive. ¹ Assuming 50% of exports to HK are re-exported to China. This is a meaningful adjustment to achieve as Power of compounding. The conviction in the power of compounding conservative a result as Hong Kong is the largest importer underlies Arisaig’s research. To quote, ‘what matters more than short term of Swiss-made watches in the world (imports are 3x larger than China). The federation also bases its China valuations is that we own for the long haul the alpha generating per-capita calculation on an urban population of 594m businesses that have what it takes to compound earnings come rain or (not 1.3bn). The data are based on annual data, collected monthly. Source: Fed of Swiss Watch Industry shine (in short: scalability, high gross margins and low capital intensity). In other words, it makes a great deal more sense to let the best businesses do the heavy lifting for us than to make the mistake of trying Power of compounding to time or finesse markets and sectors.’ Whether you agree with Arisaig or Compounded returns versus MSCI AxJ not, their research underpins such a provocative and persuasive conclusion. 450 (%) 400 15% compounded A 15% compounded is what you need. ‘Sometimes people forget the 350 simple maths: US$1m invested in a business that compounds its 300 250 earnings at 15% would be worth US$16m in 20 years. This would be 200 US$12m if the valuation compressed from say 25x to 18x in a straight 150 6% compounded MSCI AxJ line over that period. However, US$1m invested in a fund rotating across 100 50 sectors within a universe growing its earnings at say 6% (which is what 0 history suggests is likely) would be worth US$3m in 20 years; and, no Dec 99 May 03 Aug 06 Dec 09 doubt, less taking account of transaction costs and the inevitable Source: Bloomberg, CLSA Asia-Pacific Markets misjudgements along the way.’ 10 16 December 2010

- 11. Asia Themes 2011 Masterly inaction. With a portfolio on 25x forward earnings, a period of consolidation probably beckons, while some of their research is clearly also designed to be self-serving. But it offers a rock whereby to try to look at various investment opportunities. Increasingly I accept that the lack of patience and unwillingness when investing in good businesses to give them time to do their work is one of the greatest errors of many investors. For the time being that is not something Arisaig can be criticised for. Nor Warren Buffet. There is a message in this. Asia - AUTOS Is the global sector in a sweet spot? A healthy world supply/demand picture after the GM restructure. The global auto sector should remain in a sweet spot after the restructuring of General Motors. This is due to lacklustre capacity expansion in developed markets and surprisingly strong addition in the emerging world. Healthy free-cashflow generation in Asia raises the question on deployment. We continue to like Kia Motors, Guangzhou Automobile, Great Wall and Toyota in Japan. Maruti Suzuki is a top long-term pick in India, though we are hesitant about it near term. Geoff Boyd Post GM restructuring. During 2000-08, General Motors famously (65) 64167853 “pushed” production into its US inventory system, forcing large incentives geoff.boyd@clsa.com to move vehicles to customers. It was trapped in a vicious circle of high fixed costs and declining market share but rising debt-service obligations. Suggests a healthier USA The bankruptcy that followed has shed its debt and the company is acting Ford operating margin more rationally now to allow demand to “pull” its production schedule. 8 (%) Widening margins. As a result of GM’s more rational tone, the market 6 has turned more positive on the sector and consensus is forecasting 2010- 4 12 operating margin of 7.4% for companies like Ford. This compares with 2 0 the negative 4.1% and negative 1.5% the US automakers reported for the (2) five and 10 years to 2009. We believe this indicates a better pricing (4) environment in the USA, despite the generally weaker demand this year. (6) Avg 2004-09 Avg 1999-09 Avg 2010-12F US demand is ticking up. The overall US auto market was up 17% YoY in November to a 12.3m run rate, beating our 13% expectation. Industry Source: Bloomberg executives talk about dealers seeing people who “want” to buy a car, rather than “need” to buy one. Some forecast 13m units of sales in 2011, while JD Powers expects 15m vehicles in 2012, both ahead of our current forecasts of Indicative of global margin trend 12.5m and 13.5m. On the supply side, we see Volkswagen adding capacity Volkswagen operating margin but not a dramatic rampup overall to disrupt the enjoyable returns. 7 (%) 6 Europe also improves. Renault and Fiat represent the mass-market 5 European manufacturers and we note that 2010-12 consensus margin 4 estimates have improved versus history: 3.1% for Renault versus the 3 2 1.1% it achieved over 2004-09; 4.6% for Fiat versus 3.8%; and 8.0% for 1 Daimler versus 3.3% and 9.0% for BMW versus 6.4% in recent years. An 0 improved Chinese business partly explains this, but also a generally Avg 2004-09 Avg 1999-09 Avg 2010-12F healthy premium segment. Giant Volkswagen should also reach 5.8% Source: Bloomberg operating margin versus the 4% it achieved over the past decade. Some disparities. The Japanese companies are suffering the most relative to the past decade, due mostly to the strong yen. We forecast operating margins of 1.2%, 6.0% and 6.0% for Toyota Motor (7203 JP - ¥3,260 - BUY), Honda Motor (7267 JP - ¥3,170 - U-PF), and Nissan Motor (7201 JP - ¥809 - U-PF) in 2011. This compares to a decade average of 8.1%, 7.7% and 7.8%. We also expect demand from Europe to be down YoY, post stimuli in key markets like Germany. China still going strong. Latest data suggest China might finish 2010 up 30% YoY versus our forecast of 26% YoY from a couple months ago, and 19% at the start of the year. Demand growth is outstripping capacity additions, and this will remain the case for 2011, so we expect industry margins to remain at healthy levels. Top picks. We like Toyota in Japan, Kia Motors (000270 KS - 51,300 won - O-PF) in Korea, as well as Guangzhou Automobile (2238 HK - HK$10.58 - BUY), SAIC Motor (600104 CH - Rmb17.21 - BUY) and Great Wall Motor (2333 HK - HK$24.80 - BUY) in China. Abhijeet Naik still likes Maruti Suzuki (MSIL IB - Rs1,413.5 - O-PF) as a long-term pick but expects it to languish on price wars with Toyota’s new models in India near term. 16 December 2010 11

- 12. Asia Themes 2011 Asia - BANKS Will the sector continue to outperform? Healthy credit growth, widening margins and limited provision costs. A brilliant year awaits Asian banks, with healthy credit growth, widening margins and limited provision costs. What’s more, Tier I ratios are high and remain liquid - which is good in the new world of Basel III. Positive structural factors are plentiful, including limited consumer-loan penetration and young population. We remain Overweight Asian banks, focusing on high-ROA, high-growth markets. Our top picks are Bank of China, Bank Daniel Tabbush Central Asia, HDFC Bank and Standard Chartered. (66) 22574631 daniel.tabbush@clsa.com Credit growth. For the highest-growth countries, credit growth is 15-25% per annum and more countries are likely to enter this range during 2011. Focus on high growth With increased investments in India, growth will rise and increased LDR versus Loan growth corporate facilities in Thailand will drive growth in the country. Where 10CL LDR (%) Loan growth (% YoY) India 78 25 Indonesia’s banks become more aggressive at raising loan/deposit ratios Indonesia 77 22 (LDR), loan growth will accelerate. China has seen its loan growth step HK 67 20 China 61 18 down already, where study of our China Reality Research (CRR) team Singapore 72 17 suggests it will rise marginally. But for more developed regions, including StanChart 88 12 Australia, Korea and Japan, expect subpar loan volume to continue. Malaysia 83 12 Philippines 66 10 Credit quality. The global financial crisis was not global, as it never really Thailand Korea 85 127 10 5 hit Asia. Nonperforming loans did not rise during 2009-10, even though Taiwan 73 4 Asian banks prepared for the worst, with higher provision costs. Going into Australia 131 4 HSBC 89 1 2011, the region’s NPLs/loans should be below pre-Asian Crisis (1997) Japan 65 (4) lows, at 2.5% versus 3.9% in 1996. Where many banks have seen 50- Average 83 11 80% lower provision costs during 2010, persistently low loan-loss Source: Company reports, CLSA Asia-Pacific Markets provisions (LLP) will characterise 2011. With average NPL-coverage rates Key driver for China at 131% on 11CL, this is in a different league to pre-Asian financial crisis, China - Non-interest income to assets, 10CL at 72%. Indonesia and the Philippines stand out, where LLP/loans remain Thailand high at 1.5-1.8% this year. Phils Indonesia StanChar HSBC China’s banks. A simple chart showing share-price performance of Malaysia Avg India Indonesian, Indian, Thai, Malaysian and Philippine banks during 2010 Japan Sing shows no discrimination, with a 55% increase. Adding China to the chart Taiwan Australia HK (%) leads to anomaly in performance, up 10% during the year. And yet, there China Korea are many similarly positive structural features, no NPL formation, 17-20% 0.0 0.5 1.0 1.5 2.0 2.5 ROE and 1.2-1.5% ROA. Performance has been frustrating in 2010, but with far less in the way of regulatory risk, good NPL trends and still good Source: Company reports, CLSA Asia-Pacific Markets profit growth, China’s banks will shine in 2011. Continue to improve StanChart and HSBC. The big shock in 2011 for Standard Chartered StanChart CB - Fee income vs loan growth (2888 HK - HK$217.60 - BUY) will be its consumer-banking (CB) Fee growth (LHS) 50 (%) (%) 120 transformation, where the income delta has been negative for two years. Loan growth 100 40 While wholesale banking remains strong, credit costs low, meaningful 80 30 growth in CB will drive 14% EPS growth. HSBC’s (5 HK - HK$81.95 - O-PF) 60 20 40 ROA should see the best improvement among major Asian banks, from 20 25bps in 2009 to 85bps in 11CL, and 2010 should mark the first year of 10 0 more normal credit costs. An improved focus on commercial banking in 0 (20) 01A 02A 03A 04A 05A 06A 07A 08A 09A 10CL Asia and Hong Kong will support revenue, allowing for total EPS growth of 29% in 11CL. Source: Company reports, CLSA Asia-Pacific Markets ROA and recommendations. Countries with higher ROAs typically O-WT on higher returns perform better and we doubt that will change in 2011. This is a key reason Change in ROA, 11CL versus 10CL for our Overweight stance on markets with higher returns. When we Korea HSBC looked at actual stock performance over the past 15 years, the bank Taiwan StanChar Thailand basket of high-ROA countries only underperformed in just one year. This Asia avg Sing compares with five years of underperformance for high-ROE countries. We Japan Malaysia Phils are Overweight China, Indonesia, India, Hong Kong, Thailand, Malaysia China Australia India and the Philippines, and Underweight Japan, Australia, Korea, Singapore HK Indonesia (%) and Taiwan. Our top stock picks are Bank of China (3988 HK - HK$4.22 - 0 10 20 30 40 50 BUY), Bank Central Asia (BBCA IJ - RP6500 - O-PF), HDFC Bank (HDFCB IB - RS2236.1 - BUY) and StanChart. Source: CLSA Asia-Pacific Markets 12 16 December 2010

- 13. Asia Themes 2011 Asia - CONSUMER Will Asian Boomers ride high? Chindonesian consumers remain upbeat amid wage inflation. China, India and Indonesia’s (Chindonesia®) consumer sectors should exhibit J-curve hypergrowth over the next five to 10 years on rising incomes and propensity to consume and take risks. Even in the face of slower global growth, their consumers remain upbeat and will benefit from strong liquidity inflows and wage inflation in 2011. Our top picks are Air China, Baidu, Bank of China, Cathay Pacific, HDFC Bank, Evergreen, Aaron Fischer Want Want, Parkson Retail, Sands China, Wynn Macau and SAIC. (852) 26008256 aaron.fischer@clsa.com Rise of the middle class. We estimate that the middle class makes up 19% of Asia ex-Japan’s population, and that should rise to 30% in five years, or an 11% Cagr. The aggregate number of those in the region’s middle class will increase from 570m currently to 945m by 2015. China will account for two-thirds of the new members, while Chindonesia® will represent 90% of the 375m increment. We expect the social cluster’s consumption spending to increase from US$2.9tn to US$5.1tn over this period. For more of our analysis, see our spring report, Mr & Mrs Asia - Moving up the J-curves. High aspirations, though grounded in reality. This autumn, we Anirudha Dutta revisited the Chinese, Indian and Korean respondents in our 20 20 20 (91) 2266505056 project in 2005. Now 25 years old, our 20 20 20s have certainly moved anirudha.dutta@clsa.com ahead: most are now working, many of them outside their home countries - and also spending. Despite the financial crisis, they remain optimistic overall and confident about the future - not only for themselves, but their countries. That said, they clearly have a more mature and balanced view than they did in 2005. Responsible hedonists. Now that most of our 20 20 20s are finally earning a wage, they spend a good deal of it. This is clearly a generation of “baby” consumer Boomers. But whereas brand awareness is high (particularly for electronics), brand loyalty is not (especially when it comes to clothing and sports goods). Pragmatism rules and the brands must be seen to offer value. Our 20 20 20s may be consumer Boomers, but they’re not spendthrifts. Most manage to save a significant amount of their earnings, typically with the aim of buying big-ticket items such as cars and travel, and eventually a home of their own (except in Korea, where renting is the norm). Moving up the J-curves. Some key trends of this generation: low loyalty to brands; high savings rate but not financially savvy; increasingly purchasing everything online; and priority areas of spend are travel, house and car. Key sectors to benefit from the growing consumption would be online travel companies, airlines, hotels, real estate, retail financial services, automotive plays and companies earning the loyalty of this generation by building strong franchisees. Global brands that have a strong resonance with this generation are Apple (i-Whatever), Canon (7751 JP - ¥4,080 - BUY), Nokia, Samsung Electronics (005930 KS - 929,000 won - O-PF) and Sony (6758 JP - ¥2,988 - BUY). Top picks and risks. We project hypergrowth in discretionary spending on autos, transport and tech, while telecoms should see a more moderate increase. Travel and buying a house are among the top priorities for the Asian Boomers. Our top consumer plays include Air China (753 HK - HK$8.88 - BUY), Baidu (BIDU US - US$106.62 - BUY), Cathay Pacific (293 HK - HK$23.70 - O-PF), HDFC Bank (HDFCB IB - RS2236.1 - BUY), Evergreen (238 HK - HK$5.45 - BUY), Want Want China (151 HK - HK$6.76 - BUY), Parkson Retail (3368 HK - HK$12.86 - BUY), Sands China (1928 HK - HK$16.58 - BUY), Wynn Macau (1128 HK - HK$17.06 - BUY) and SAIC Motor (600104 CH - RMB17.21 - BUY). However, rising interest rates and policy intervention could impact high-value discretionary spending in 2H11. 16 December 2010 13