This document summarizes key concepts from a financial management lecture, including:

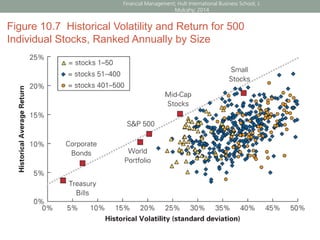

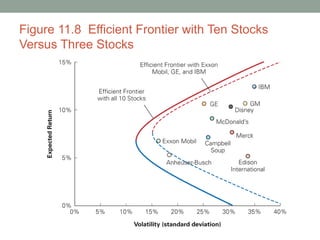

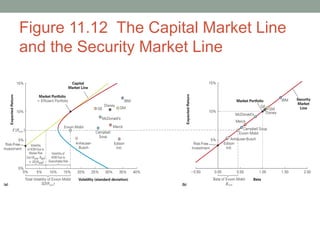

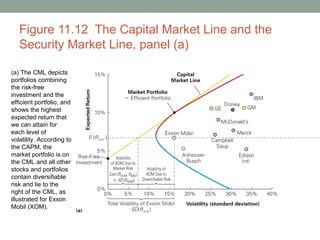

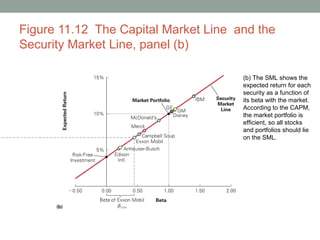

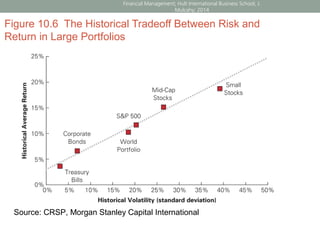

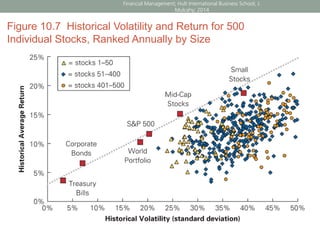

1) Diversification reduces non-systematic risk but not market risk. Beta measures a stock's systematic risk relative to the market.

2) While individual stock volatility does not predict return, the market return premium compensates for systematic risk.

3) The capital asset pricing model uses beta to estimate a stock's expected return based on the risk-free rate and market risk premium.

![10.8 Beta and the Cost of Capital

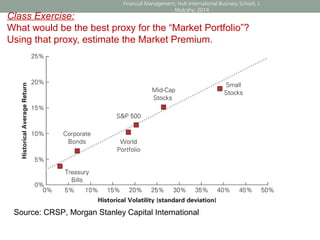

• Estimating the Risk Premium

• Market risk premium

• The market risk premium is the reward investors expect to earn for

holding a portfolio with a beta of 1.

[ ]Market Risk Premium = −Mkt fE R r

Financial Management; Hult International Business School; J.

Mulcahy; 2014](https://image.slidesharecdn.com/class16finmgmntslidesjmm2014p-140617234735-phpapp02/85/Class-16-fin_mgmnt_slides_jmm2014p-27-320.jpg)

![10.8 Beta and Cost of Capital

(cont'd)

• Adjusting for Beta

• Estimating a Traded Security’s Cost of Capital of an investment

from Its Beta

[ ]

[ ]

Risk-Free Interest Rate Risk Premium

( )

= +

= + β × −f Mkt f

E R

r E R r

Financial Management; Hult International Business School; J.

Mulcahy; 2014

This is the Capital Asset Pricing

Model, equation 10.11 in the text.](https://image.slidesharecdn.com/class16finmgmntslidesjmm2014p-140617234735-phpapp02/85/Class-16-fin_mgmnt_slides_jmm2014p-29-320.jpg)

![Alternative Example 10.9 (cont’d)

• Solution

• E[RMkt] = (60% × 15%) + (40% × 5%) = 11%

• E[R] = rf + β ×(E[RMkt] − rf )

• E[R] = 6% + 1.18 × (11% − 6%)

• E[R] = 6% + 5.9% = 11.9%

Financial Management; Hult International Business School; J.

Mulcahy; 2014](https://image.slidesharecdn.com/class16finmgmntslidesjmm2014p-140617234735-phpapp02/85/Class-16-fin_mgmnt_slides_jmm2014p-31-320.jpg)