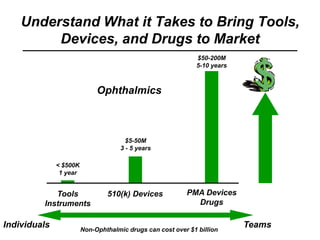

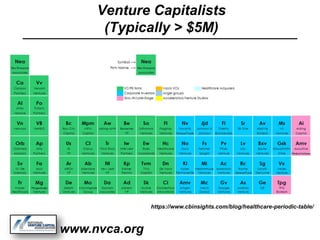

This document provides helpful tips for aspiring entrepreneurs from a venture capital perspective. It emphasizes the importance of protecting intellectual property, understanding regulatory requirements to bring products to market, choosing advisors carefully, and setting realistic expectations for fundraising and valuation. Additional tips include focusing presentations on business models and clinical data, seeking experienced investors, and having fun with the entrepreneurial process.