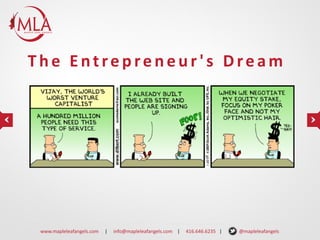

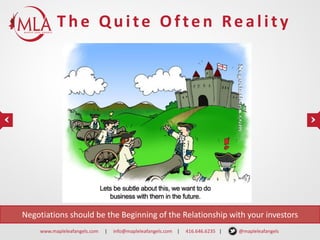

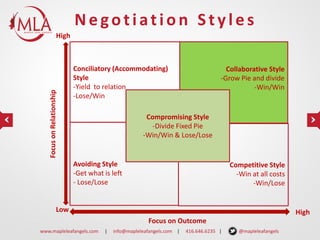

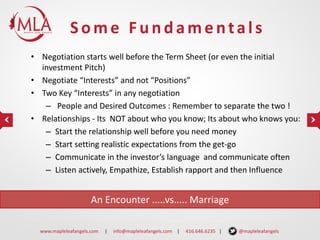

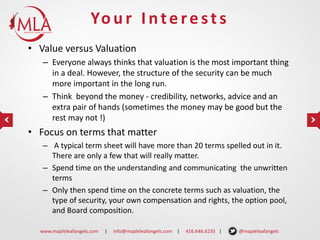

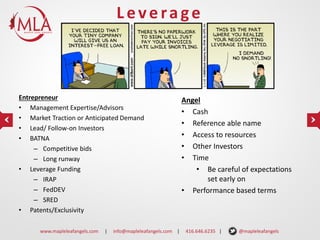

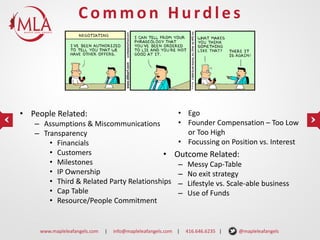

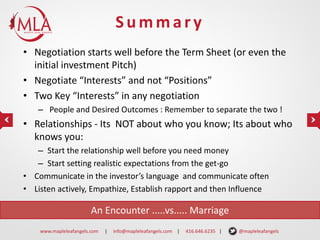

The document provides guidance on negotiating investment deals with angel investors. It discusses focusing on interests over positions in negotiation, understanding the interests of both the entrepreneur and investor, identifying key value drivers and leverage, and addressing potential hurdles like assumptions, financial transparency, and ego. The goal is a collaborative negotiation process to create a mutually beneficial outcome and long-term business relationship.